Welcome to this weeks LBI token earnings and holding post

What is LBI?

The LeoBacked Investment (LBI) token is the first of its kind, the 1st token to be valued completely in LEO. Each LBI token represents a percentage ownership in the overall fund including all LEO, HIVE, off-chain and wallets operated by @lbi-token. The goal is to provide a community based and ran investment vehicle focused primarily on the LeoFinance community and LEO token. We provide a weekly LEO dividend payment to all token holders whilst also increasing the value of the LBI token slowly but consistently over the long term by only investing into things that will stand the test of time.

LBI is a long term HODL token based on SPI's model. Because these tokens are backed and valued in their primary assets, the value only increases. Think of it as putting $1000 in the bank and earning interest. In theory, you should never have fewer dollars. The $1000 is the LEO you give us to buy your LBI token and the interest is the earnings we produce with that LEO.

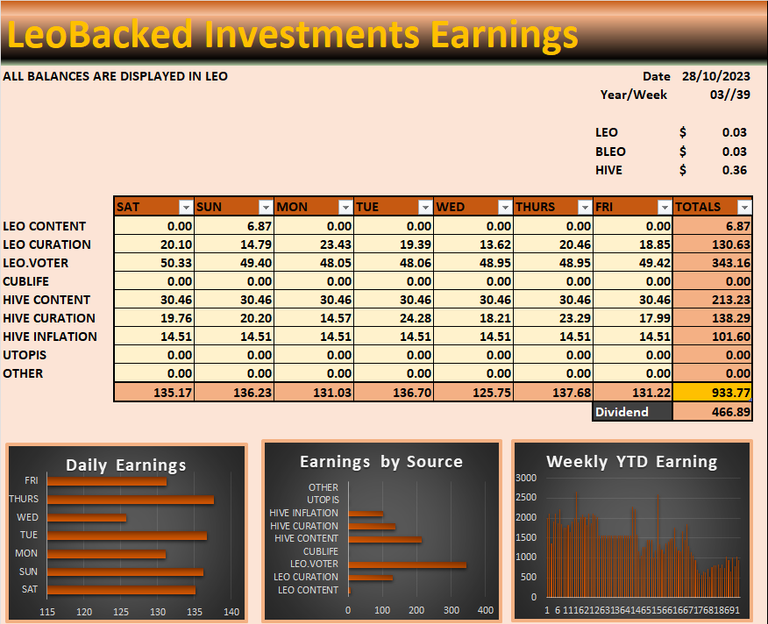

Earning this week were ok with 933 in total. Top earner this week was leo.voter, 2nd was HIVE content and 3rd was HIVE curation. Its worth noting that LEO curation has not come top 3 this week when it used to be so dominant. Our HP delegation to leo.voter is yielding at least twice as much as LEO curation. Running some quick numbers show that LEO curation is under 5% which is massively under its current inflation rate so it is hard to justify staking our LEO for it to lose value over time because curation rewards do not keep up with LEO token mintage.

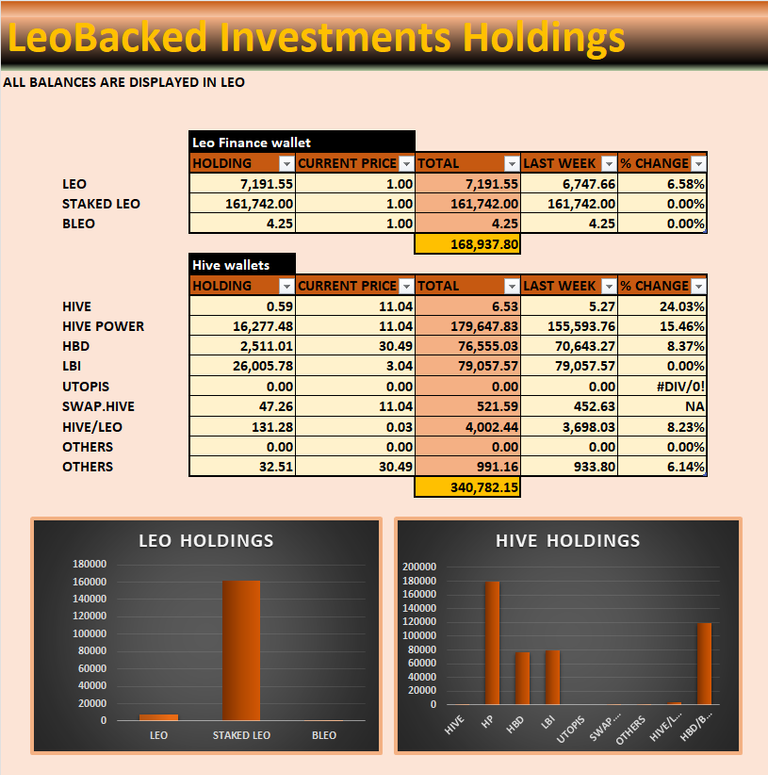

Our LEO and HIVE wallets are sitting around the same as last week but HIVE increased by around 5% from last week and this has increased the LEO value of our HP balance. Currently, our HP balance is worth more than our staked LEO. It is important to note that the LEO balance was once worth over $250k and now the HP we have got for free from posting content is worth more, infact less because half of the content rewards are paid in HBD.

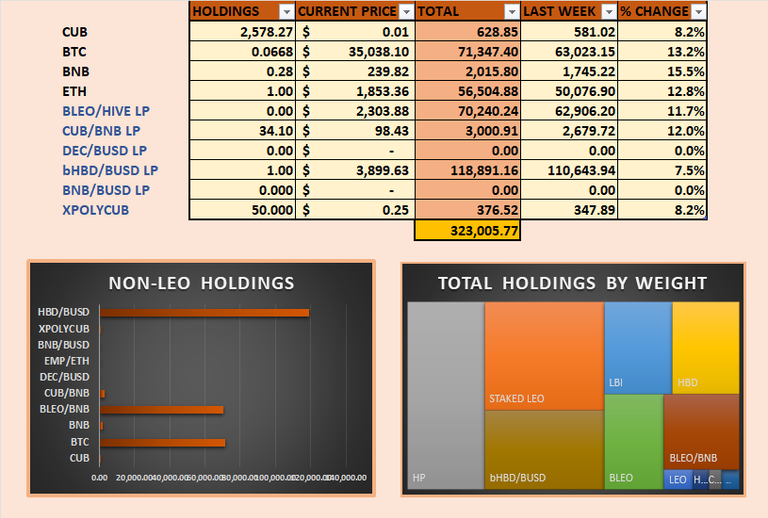

For non-HIVE wallets, I converted CUB harvests into BTC as I do each week. We currently hold 0.0668 BTC worth 71k LEO. The whole market is up this week and LEO is flat so we see gains across the board.

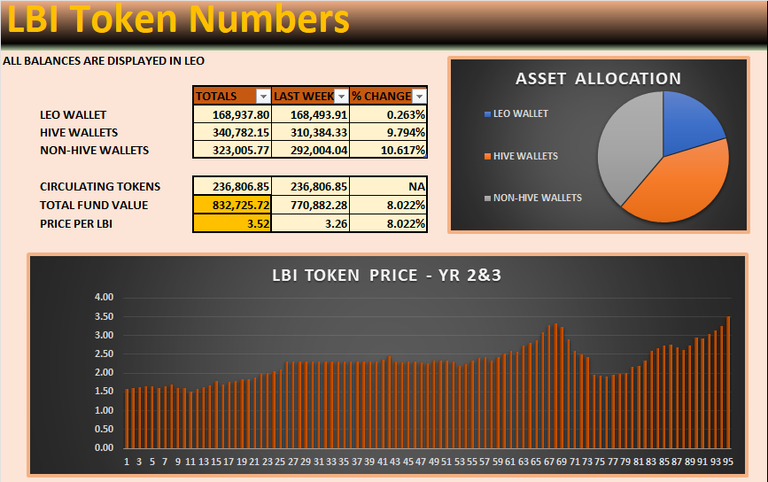

Massive jump in the LBI token price this week, it went to an all-time high at 3.52 LEO each giving the fund a total LEO value of 830k. Can it hit 1 million? I hope not, I'd rather LEO did something other than drop and regain a few cents. LEO's allocation in the fund is shrinking and I dont feel I can pull the trigger to convert other holdings into LEO until I think LEO has hit its bottom.

I'll be completely honest and say LBI is not exactly going the way it was planned to go. We launched a few months before LEO peaked and it's been all downhill from there. When we factor in the LEO tokens huge inflation over the past 3 years, we dont end in a good place. At this rate, the LBI token will be a mainly HIVE-backed token.

I have spent hours and hours thinking and researching about ways for LBI to be profitable on LEO and I always come up short with good ideas which is frustrating.

What are your thoughts?

Get LBI on LeoDex - https://leodex.io/market/LBI

Get LBI on Hive-engine - https://hive-engine.com/?p=market&t=LBI

Dang and with LEO pumping again, this is huge! 3.5!!!

I am wondering - are you open to do another LBI buyback at some time in the future?

The only hope is that LEO team development has finally hit its stride, moving into a bull market. Will be interesting to watch either way - with HIVE pumps incoming and continuous development - how the price moves.

One of the reasons I jumped into LBI is because underlying LEO Team, they keep relentlessly trying stuff. If they have strided through the bear market that is great news. Let's keep pushing

Thanks for the accurate weekly info. I think it is ok, the fund is a decent LEO whale, we earn LEO every day and we are distributing some earnings to other blue chips.

We hold 160K LEO, 16K Hive, 0.06 BTC, 1 ETH, 2500 HBD , and the money keeps compounding.

I think that is the way we need to go, keep growing LEO stash to stay relevant as whale and voting influencer in the LEO ecosystem, and keep divesting some to other compounding projects. I see LBI as a conglomerate of companies. We can start a position in both BRO and SPS staking on splinterlands, basically compound themselves fine. Open to other ideas ofc, but this 24 months have been slow and that can quickly change, as you well know.

Cheers