MYEG Services Berhad (“MYEG”) is a concessionaire for Malaysian Electronic-Government (“E-Government) MSC Flagship Application. They builds, operates and owns the electronic channel to deliver services from various Governmental agencies to Malaysia citizens and businesses.

MyEG has now opened registrations for their first DeFi product, Lock-and-Earn Wallet to users of Digital Asset Exchanges (DAXs), who are licensed as Recognised Market Operators in Malaysia and abroad.

As reported by The Edge Markets (2021), the DeFi product will allow cryptocurrency holders to utilise the smart contracts for the purpose of borrowing cryptocurrencies or lending against their cryptocurrency assets with return in kind and up to 5% BFR.

MyEG has further outlined how participants could earn the BFR by choosing their preferred tenure to lock their digital assets.

The base BFR is 2.5% and users can increase the spot BFR offered by:

- An additional 0.25% for every user (up to 8) referred to the DAX within the last 30 days before opting in to a Lock-Earn.

- An additional 0.5% if the user has traded more than 0.5 BTC in the last 30 days on the DAX, for BTC Lock-Earn.

- An additional 0.5% if the user has traded more than 8 ETH in the last 30 days on the DAX, for ETH Lock-Earn.

How is it compared to other available DeFi on the web?

Disclaimer

The material in this article is not financial advice in any way or form and is only solely meant for educational purposes, readers are required to do their own research before participating in any investment products.

We are assessing the DeFi based on the following criteria.

- Security and safety

- Entry barrier

- Rate of return

- Security and safety

When assessing any DeFi products, security and safety is always our top priority. With the recent news on the DeFi hack and flashloan attack, bugs within smart contracts are still a potential risk for depositors to deposit their funds into it. However, there are DeFi insurance platforms providing insurance for users on DeFi platforms from hacks and smart contract failures. The more coverage, the more expensive the insurance premium.

For the MyEG Lock-and-Earn that is built on top of blockchain technology and utilising smart contracts in facilitating the cryptocurrency services, it too would have similar risks as other DeFi protocols. There are no insurance coverage for this, but we believe that MyEG has an excellent track record and experience in building and operating electronic channels and would be able to mitigate the risks.

Entry barrier

Users must own a recognised Digital Asset Exchange(DAX) wallet to be eligible to sign up for the Beta programme, locking your digital assets to your Lock-and-Earn wallet within your DAX’s exchange wallet.

The entry barrier starts with the minimum amount you are required to deposit at 0.01 BTC(19,5621.56 MYR) or 1 ETH(13,412.34 MYR) at the time of writing this article. With the majority of Malaysia’s population being B40 and M40, with household income below RM4,850 for B40 and RM4,851 — RM10,970 for M40 group, we may find it difficult for most Malaysians to participate.

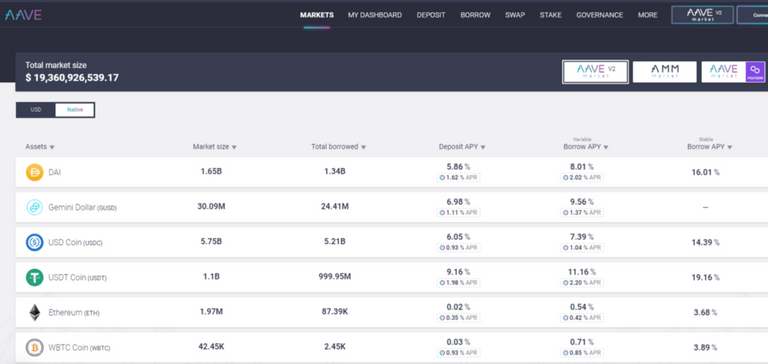

With the extreme competition outside, people would prefer other DeFi lending protocol with lower entry barrier that yields almost similar returns and with other income options besides lending such as staking and supplying assets into liquidity pools. You may find these in Aave DeFi Protocol, Uniswap, pancakeswap, Raydium, and more (not financial advice).

Rate of return

As mentioned earlier, MyEG Lock-and-Earn offers up to 5% BFR with a base BFR of 2.5%. In some of the more popular DeFi lending protocols, depositors would have multiple cryptocurrencies to select from and deposit to earn; some yielding higher APY than others.

As enticing as the returns may seem on other platforms, do not jump aboard the bandwagon without thorough research. A regulated platform has its advantages being recognised by the authorities with the proof of legitimacy of the operator within the industry; we are also looking forward to have more regulated DeFi platforms to create a more competitive environment.

How Malaysia authorities look at digital assets?

The capital market regulator said the guidelines would facilitate the SC’s objectives in promoting responsible innovation in the digital asset space, while managing emerging risks and safeguarding the interests of issuers and investors. — by The Star

Under the Securities Commission(SC) digital initiative, SC has categorised the digital asset operator into the following roles:

- Digital Asset Exchange(DAX) — An electronic platform that facilitates the trading of permitted digital assets.

- Initial Exchange Offerings (IEOs) — An alternative channel to raise funds for innovative businesses through an offering of digital tokens.

- Digital Asset Custodians (DAC) — Allow companies to be custodians for digital assets to ensure the protection of investors’ funds from being stolen or misappropriated during a fundraising exercise.

At the time of writing this article, there are four(4) recognised DAX by SC to be operated in Malaysia while there are no IEO at the moment. Here is the list of registered DAX:

- Luno Malaysia Sdn. Bhd.

- MX Global Sdn. Bhd.

- SINEGY Technologies (M) Sdn. Bhd.

- Tokenize Technology (M) Sdn. Bhd.

The release of Digital Assets Guidelines on 28 October 2020 provides a clearer guidance to digital asset operators within their jurisdiction. As the world is transitioning towards a regulated digital asset industry, SC is continuing to further its reputation as an advocate for Fintech innovations.

Although cryptocurrency is not the Wild West as it once was, the growing regulatory on it shouldn't be looked as a negative impact on the industry. We believe that some degree of regulation is required to establish a reliable DAX or IEO for investors to participate with peace of mind, but not to an extend where it limits the technology growth.