Located on the northern part of Borneo island in the South China Sea, North Borneo or currently commonly known as Sabah is one of the 13 states of Malaysia, home to 394 official islands; where Sipadan Island together with Mount Kinabalu and Kinabalu Park are all UNESCO heritage sites.

Sabah is blessed with beautiful nature that attracted approximately 4.2 million tourists in 2019[1], with an average increment of tourist arrivals from 6% — 8% annually and generating an estimated RM9.01 billion in revenue[2]. As stated by the Sabah Tourism Board, tourism is Sabah’s largest and one of the most important economic pillars that supports more than 80,000 jobs [3].

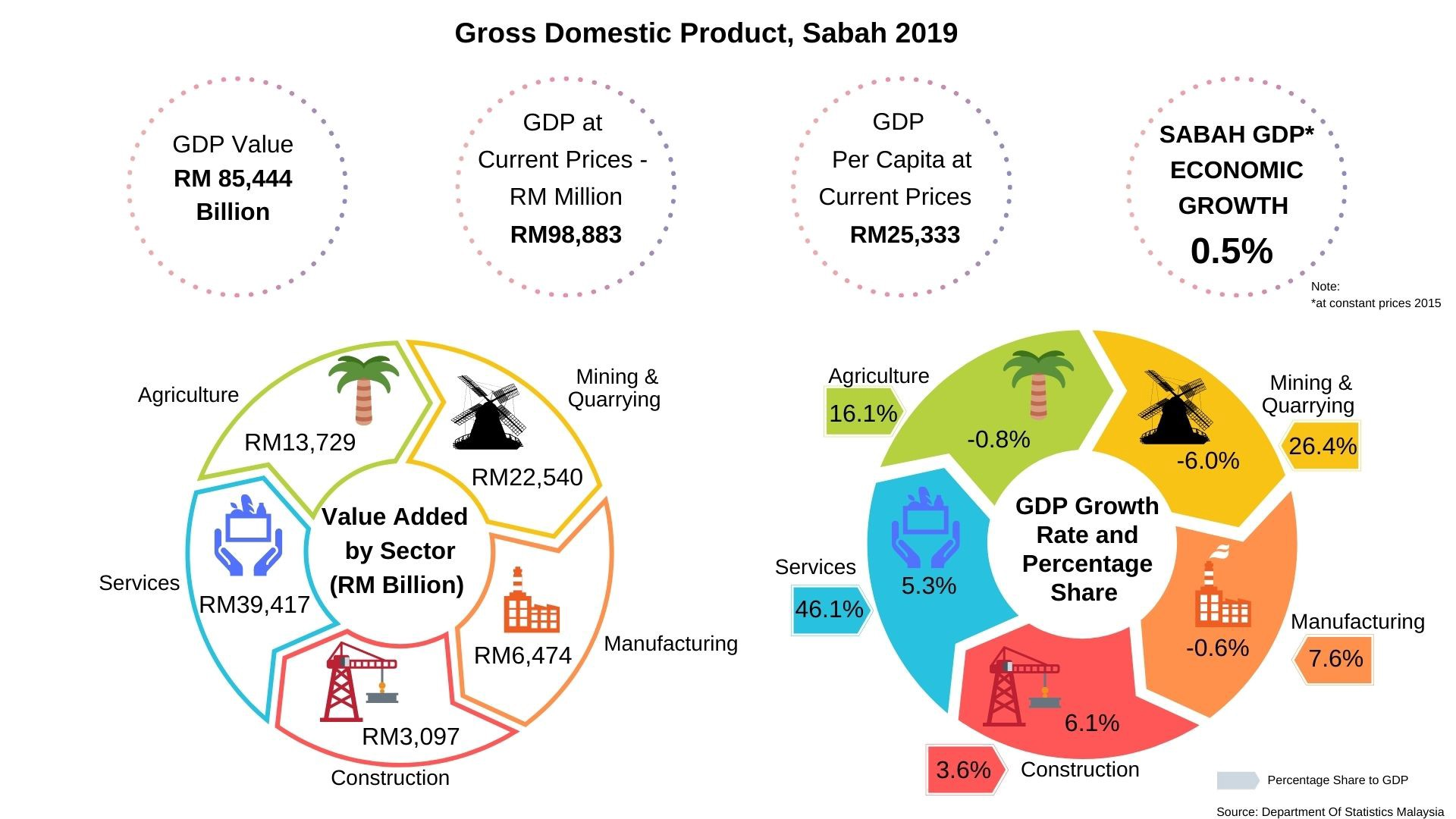

In 2019, Sabah recorded a 5.3% increase in Gross Domestic Product (GDP) in the service sector with an approximate RM39 billion or 46.1% of the total Sabah GDP. As this sector’s revenue benefits the most from the high influx of tourists, it has been growing gradually over the years while there is a decline in other industries such as agriculture, manufacturing, mining and quarrying [4].

In 2020, the COVID-19 pandemic has disrupted all economic sectors, with the tourism industry being affected the most. Sabah recorded a 76.7% decline in tourist arrivals in 2020 and a further 94.6% decline from January 2021 to February 2021[1]. There is no doubt that tourism will still be the main economic pillar of Sabah. As reported by FMT(2021), in a meeting between Sabah chief minister Hajiji Noor and Malaysian Association of Tour and Travel Agents(Matta) committee, Sabah will reopen tourism again after 60% of locals are vaccinated and it is targeted to be completed by the end of August 2021[5].

Undeniably, tourism is a great revenue stream that could be participated by everyone, but it is also a fragile industry which can be easily devastated by internal or external factors such as political instability, economic crises, pandemics, raging wars and so on.

Adding A New Revenue To Sabah’s Economic Pillar

We are a group of Sabahans who love technology and innovation developments, exposing ourselves to the blockchain industry and cryptocurrency market so that we can take the risk and share our experience.

The recent news on blockchain technology have given us a vision to provide a comprehensive educational materials to better equip our readers with factual knowledge and the full potential of blockchain in our daily lives and not dwelling in get-rich-quick schemes. You may get rich quick as an early adopter with one coin, however without proper research, it would be like finding a needle in a haystack.

Sharing a similar vision and mission with Sabah Creative Economy and Innovation Centre (SCEIC), we want to establish a thriving world-class technology and innovations industry as a key economy for Sabah. We are dedicating our effort in consolidating the latest updates and providing quality news on blockchain, cryptocurrency as well as technology and innovations opportunities in Sabah into reliable sources to encourage Sabahan to diversify their interests into this industry and add a new revenue into Sabah’s existing economic pillars. Instead require raw materials for fabrication and manufacturing in a production line, technology and innovation in blockchain would uncovered a new industry opportunities in Sabah.

On 20 July 2021, a majority claimed that the cryptocurrency market is in a bear market and Bitcoin had lost 54% of its value since it hit an All Time High(ATH) at the price of USD64,888.99. Apart from Bitcoin, the overall cryptocurrency market capital has been in a consistent decline for the last 2 months (refer to the chart below). There are multiple driven forces that drove the market down where we would be discussing in an upcoming post. After see all the negative news, would you continue to participate in this speculative market?

On 4 August 2021, the total cryptocurrency market capital have been rallied up to 1.537 Trillion USD, growing approximately 30% from 20 July 2021 for subsequent days. It could resemble the return of a bull market, but how are we sure that it is not just another fake bull run before heading towards a down trend?

Thus, we believe blockchain technology’s value is not just creating virtual currencies for us to trade, but in establishing functional and valuable applications for our daily activities with the adoption of the trust protocol[6] (blockchain). Due to its advantages, we would be seeing more financial institutions’ involvement in adopting blockchain in year 2021[7] and introducing tokenised security products such as digital bonds launched by Singapore’s DBS bank on 31 May 2021 for retail and financial institutions to participate in as well as launching its own Digital Exchange that allows their customers to trade and hold cryptocurrencies[8].

Furthermore to adoption of blockchain in private institutions, we would also be following closely with the news of central banks all round the world in establishing their own digital currency namely Central Bank Digital Currency(CBDC) which would be a prominent topic for year 2021[9].

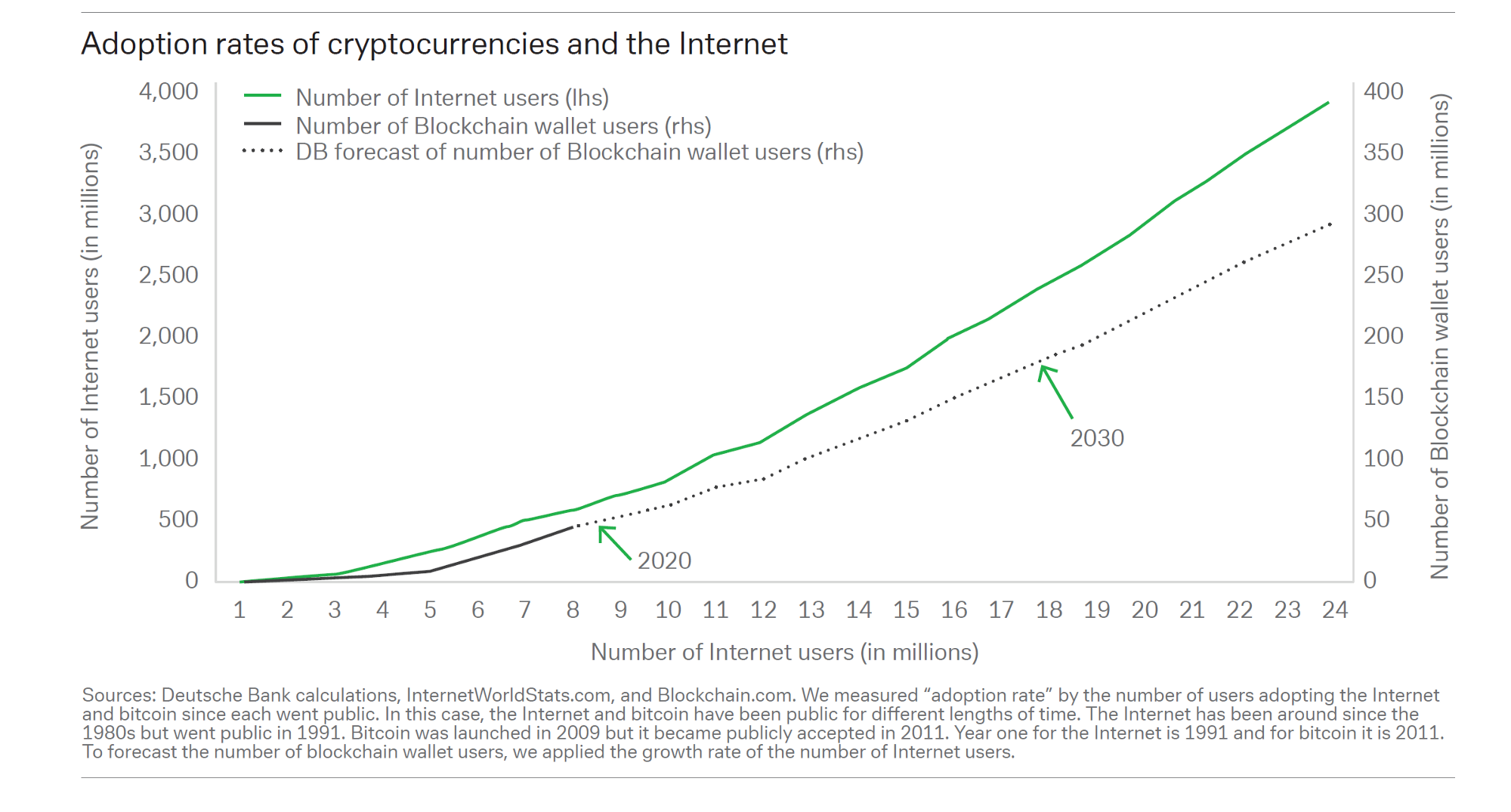

As illustrated in Deutsche Bank’s chart, the internet saw around 500 million users after eight years since its inception, yet cryptocurrency adoption number is approximately 50 million which is ten times less within a same timeframe. According to Deutsche Bank’s research, the differences will remain steady for the foreseeable future[10].

In brief, the relation between adoption of blockchain and internet users are interconnected. Combining blockchain advantages of securities and transparency and the ability to access the internet globally, the current development for Internet Of Things (IOT) would evolve especially in tracking supply chain, leasing/renting, oil operation and field service[11].

Technology and innovation are evolving faster than ever and we may have just only discovered the tip of the iceberg. We foresee blockchain and cryptocurrency will not be limited to individuals but Malaysia institutions will soon be heavily involved in it. At the current stage, Bank Negara Malaysia does not recognise any cryptocurrency as a legal tender in Malaysia, but Securities Commission Malaysia (SC) recognised cryptocurrency as a form of securities under the Capital Markets and Services Order 2019 and is required to be listed in an Initial Exchange Offering Platform (IEO), however there are currently no IEO in Malaysia. This could be an opportunity for our future development in Sabah, establishing an IEO in Malaysia.

CBDC, IOT, IEO, digital securities, bonds are the slow permutations of the blockchain technology over a period of time, however it still at its infant stage.

For our readers who are just starting to learn about what is blockchain and cryptocurrency and what is the correlation between them, we sincerely hope that our content would provide substantial information and insights for you in blockchain literacy.

Reference

[1] Sabah Tourism Board: Sabah Tourism Arrivals. Available at: Link (Accessed: 10 June 2021).

[2] The Borneo Post (2020): Sabah Tourism Promotion a great Success. Available at: Link (Accessed: 11 June 2021).

[3] Sabah Tourism Board(STB): General Information- About Us. Available at: Link (Accessed: 11 June 2021).

[4] Institute For Development Study(Sabah) : Facts & Figures. Available at: Link (Accessed: 11 June 2021).

[5] FMT(2021): Sabah to open up tourism after 60% are vaccinated, says Hajiji. Available at: Link (Accessed: 11 June 2021).

[6] Tapscott.D & Tapscott. A (2016): Blockchain Revolution. Penguin

[7] Naparwa. C (2021) : Trends in Blockchain: Why big banks are adopting this technology. Forbes. Available at: Link (Accessed: 12 June 2021).

[8] Haig. S (2021): Singapore’s DBS Bank launches digital bond security token. Coin Telegraph. Available at: Link (Accessed: 12 June 2021).

[9] Gansbeke. F.V (2021): Why Central Bank Digital Currencies (CBDC) Now And What They Could Mean For Climate Change? (1/2). Forbes. Available at: Link (Accessed: 12 June 2021).

[10] Deutsche Bank Research (2020): The Future of Payment-Part 3. Available at: Link (Accessed: 12 June 2021).

[11] Horwitz.L & Rosencrance.L (2021): How Blockchain Technology Can Benefit the Internet of Things. Informa. Available at: Link (Accessed: 12 June 2021).

Appendix

Securities Commission Malaysia: Digital Assets