When a country declares to its nation a simple interest rate or a base rate, it plays an important role in affecting its local economy, currency value and exchange rates.

For today’s article, we will solely focus on interest rates in the local economy. In the event of an economy crisis, such as the recent crisis caused by the pandemic, the news of interest rates are no longer estranged to us as we often heard from the news, mass media, debated by politicians and the banks. In the United States, the effective Federal Interest Rate to-date is almost near zero at 0.25%, Japan’s interest rates as of writing today has fallen to -0.1% and Malaysia at 1.75%.

So what is the big deal with interest rates in the local economy?

When a central bank lowers the interest rate, it is intended to encourage individuals, businesses, or even government to borrow money and also encourage spending which makes the money flow again in market.

However, when lower rates are imposed, the interest earned for depositors who deposited in savings accounts or earning based on Interest Rates on Time Deposits by Maturity or instruments alike will also follow suit. These deposited funds will generally be lent to banking institutions to earn from short-term low-risk investments.

Can DeFi offer better rates than conventional banks?

Disclaimer

Due to countries may offer different interest rates and the time deposits by maturity, therefore the comparison outcome are not meant to represent all the interest rates being offered. The study does not take into account a country’s monetary and fiscal policy, and other rules and regulations involved with Cryptocurrencies.

This is merely to discuss the financial impact of DeFi and the associated risks, and not to be taken as financial advice.

The study below will utilise Malaysia’s interest rates for comparison due to the author’s in-depth knowledge of the system and the interest rates are slightly lower or similar to some of the DeFi rates.

1. Malaysia’s Interest Rate

As stated above, to date Malaysia’s base interest rate has been maintaining at a lower rate at 1.75%, with the current retail banking rates being offered, you are still able to earn approximately 0.25% -1% interest in savings account or 1%-2% [1] in a Fixed Deposit (FD) where your earning rate is based on the tenure (1 month, 3 months, 1 year, etc.), any early withdrawals from FD, you may forfeit any interests earned.

Pros

- Return is guaranteed.

- Deposited funds in savings account; FD is insured by PIDM where it protects your bank deposits and will promptly reimburse you on your insured deposits should a bank member fail[2].

- The protection is provided by PIDM automatically — no application is required[2].

- Use FD as collateral to secure a loan.

Cons

- Depositing funds into FD requires large sums of fund

- Earning on interest will be rewarded after maturity. Any early withdrawals will forfeit any interests earned.

2. DeFi Interest Rates

As of writing today, the Total Value Locked (TVL) in all DeFi networks amounted to USD 209.79 billion and is reaching All Time High (ATH) again.

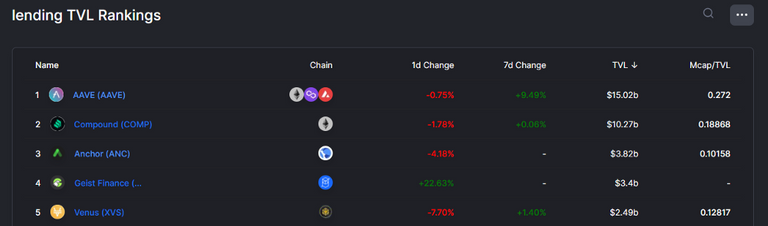

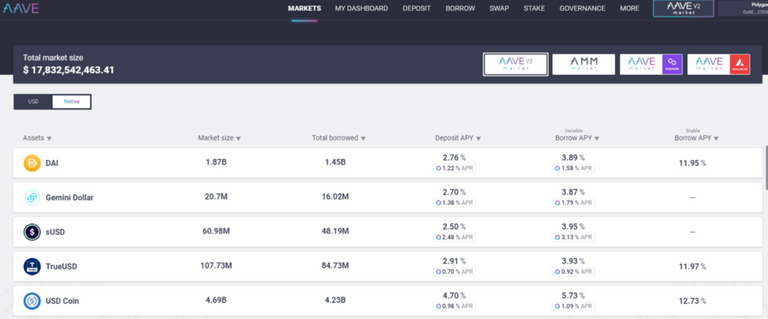

In DeFi Peer To Peer Lending protocol, AAVE is at the top of their game with a TVL of USD 15.02 billion and an APY ranging from 2.5% — 4.7% by depositing stable coins. Earnings begin as soon as users make a deposit and any early withdrawals will not forfeit your earned interests.

3. CeFi Interest Rates

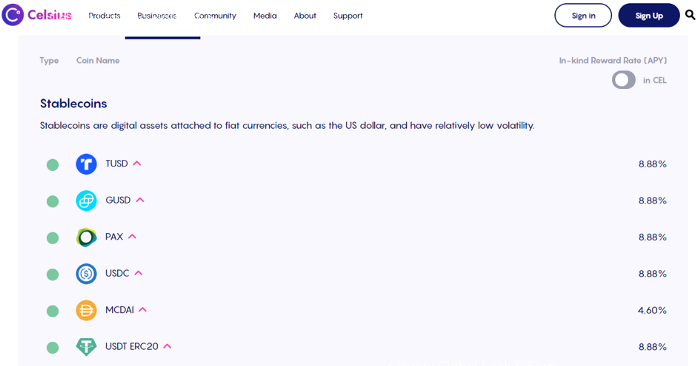

As targeted clients for borrowing funds from CeFi are gauged more towards corporate entities instead of P2P protocol, the deposit rates are usually higher. Celsius, BlockFi and Nexo are a few examples of many in lending-based CeFi. The could offer up to 8% APY.

Without risk, there are no rewards. The greater the risk, the higher the returns.

All investments involves some degree of risk. In finance, risk refers to the degree of uncertainty and/or potential financial loss inherent in an investment decision. — by U.S SEC

The involved risks besides liquidation from borrowing against crypto or with high-leverage trading can be categorised into technical risk, regulatory intervention and currency conversion.

Technical risk

- Smart Contract causing permanent loss

- DeFi dApps hacked, and till October 2021. 75% hacks in cryptocurrency are in DeFi

- Liquidity risk in DeFi, you may be holding an asset that has no liquidity

“Not your key, not your coin” with CeFi platform

Deposited Fund Insurance

Unlike conventional banking where funds are mostly insured by a country’s central bank, CeFi and DeFi users may have to purchase external insurance to cover their losses unless CeFi have Secure Asset Fund for Users (SAFU) which will give users a peace of mind.

Regulatory intervention

As DeFi boomed in the middle of 2020, regulators have been actively scrutinised DeFi and CeFi for illegally operating in their countries and the lack of “investor protection” in their platform. By ordering to shut down operations, it is limiting users’ option to gain those handsome returns or require VPN to access blocked platforms.

Currency conversion

Users who would not like to be exposed to extreme volatility cryptocurrencies, they would prefer to deposit stable coins in earning yield from lending or stable coin pools such as Curve.Fi, Saber, etc.,.

However, majority of the stable coins are 1:1 pegged to USD. Users outside the United States are required to purchase stable coins, exposing users to risk of currency conversion.

If a country X’s interest rates are projected to be adjusted and be higher than the US; countries, banks, and corporations could sell USD in their holdings and migrate their assets to country X currency to earn their interest. Thus increased USD supply and reduced supply in currency X could drive its price higher than USD.

If being the case above, users may have difficulty to sell their stable coins back since their country’s currency value had increased and users may sell it at a loss unless their earnings in interest have grown to cover the conversion loss.

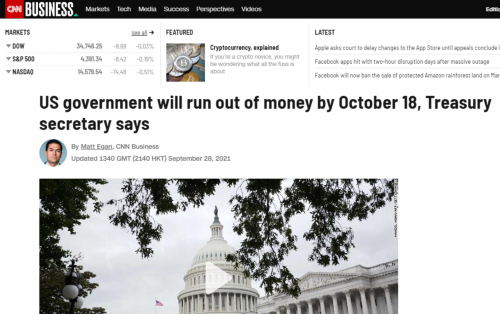

Besides interest rate fluctuations, holding USD stable coin is also holding our trust to US. Well….

US government will run out of money by October 18, Treasury secretary says

-by Matt Egan, CNN Business

Cryptocurrency & dApps are partially recognised and regulated globally. Therefore, Investors have to participate with caution and do their own research thoroughly. Nevertheless, banking institutions are aware of the money shifting towards crypto space with a $2.15-trillion market capitalisation that is “too large to ignore” [3].

“Despite rapid growth and market values on par with some of the largest public companies in the world, we believe the digital asset ecosystem is only getting started,” the Bank of Ameria’s (BOA)report notes.

So, are you migrating your money? Let us know your thought in the comment below.

Reference

Congratulations @nbbmag! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

Your next target is to reach 100 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPthanks @hivebuzz for the award, will produce more valuable content to the community.

You're welcome @nbbmag.

BTW, it would be much appreciated if you support our proposal so we can continue our work!

https://peakd.com/me/proposals/147

Thank you!