I am not always early with stuff, but sometimes wonderful things happen in the Cryptoverse. Somehow I was eligible for the Celestia airdrop, and received a fair amount of $TIA. The Celesita hype started with a total of 576,653 addresses meeting the criteria for claiming, mostly for the Cosmos ecosystem OGs.

Developers were eligible, leading Ethereum rollup users, early adopters, and those who have staked over $75 worth of $ATOM and $OSMO. I didn't thought I was any of the above ... but I got my spot on the list thanks to my mainnet and layer-2 activity.

The "Celestia Genesis Drop" allocated 7.4% of the $TIA total supply, and another interesting thing is hidden in the paperwork! Their documentation suggests that another 12.6% will be set aside for "Future Initiatives", which sounds like airdrop 2.0 to me!

Celestia is a newly launched modular data availability network that securely scales with the number of users, making it easy for anyone to launch their own blockchain. Therefore, Celestia is a network of chains not a blockchain.

But why this hype around Celestia? The network is built on the Cosmos SDK and stands as the pioneer modular blockchain network that enhances verifiability in proportion to the number of users. The main focus is to allow the users to effortlessly launch their own blockchain with minimal setup requirements.

The Celestia mainnet will consist of rollups that use the network as data availability and consensus layer. The capability of the network nodes to download transaction information and store the information will scale to the needs of the users.

Celestia operates as a public chain, recording transaction history and ensuring data accessibility, with the ability to deploy your own blockchain in minutes. The dynamic scaling is unlocked by data availability sampling, and the number of user will not impact the speed of transaction. Developers can use Celestia to build sovereign rollups, the type of self-governing blockchain with minimal platform risk.

I done my research and I discovered that my eligibility was due to being an Early Adopter of Ethereum Rollups. The top 50% active users of the top 10 rollups by TVL on L2s where snapshotted on Ethereum block 16308181. Another criteria was to have a minimum balance of $50, which was a bit random. To be honest... 90% of the airdrops are random!

The eligibility was determined across three levels of activity score, with eligibility on-chain activity and weighing outlined in the Genesis docs. Not only I was eligible as an early adopter, but I was on a higher tier as well. My on-chain activity and presence on rollups ranked me on the top 20% users.

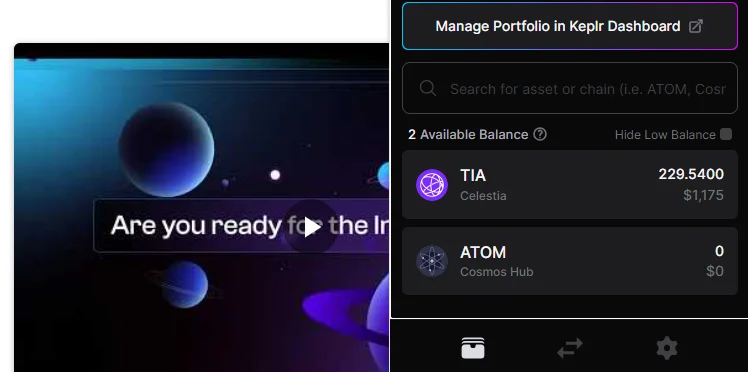

Went to the next step and installed Keplr wallet, waiting that estimated minimum allocation will be 71 $TIA. It was even better, as I received 229 tokens, valued on the day at 1,175 USD. I was a bit lucky I checked late, as the price per token surged from two... to over five dollars in a week! Though choice now ... to sell or HODL?

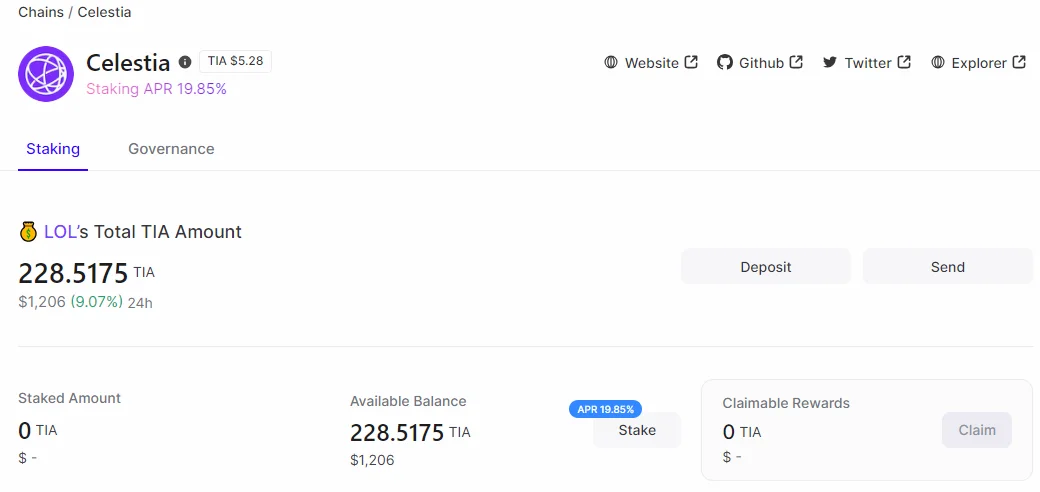

Earning opportunities were available, with $TIA staking at 19.85% APY on various validators. The token price stayed over $5 for several hours and I was fearing a dump in price. Decided to go split, cash some profit and lock some for rewards. Was this the best choice? Time will tell!

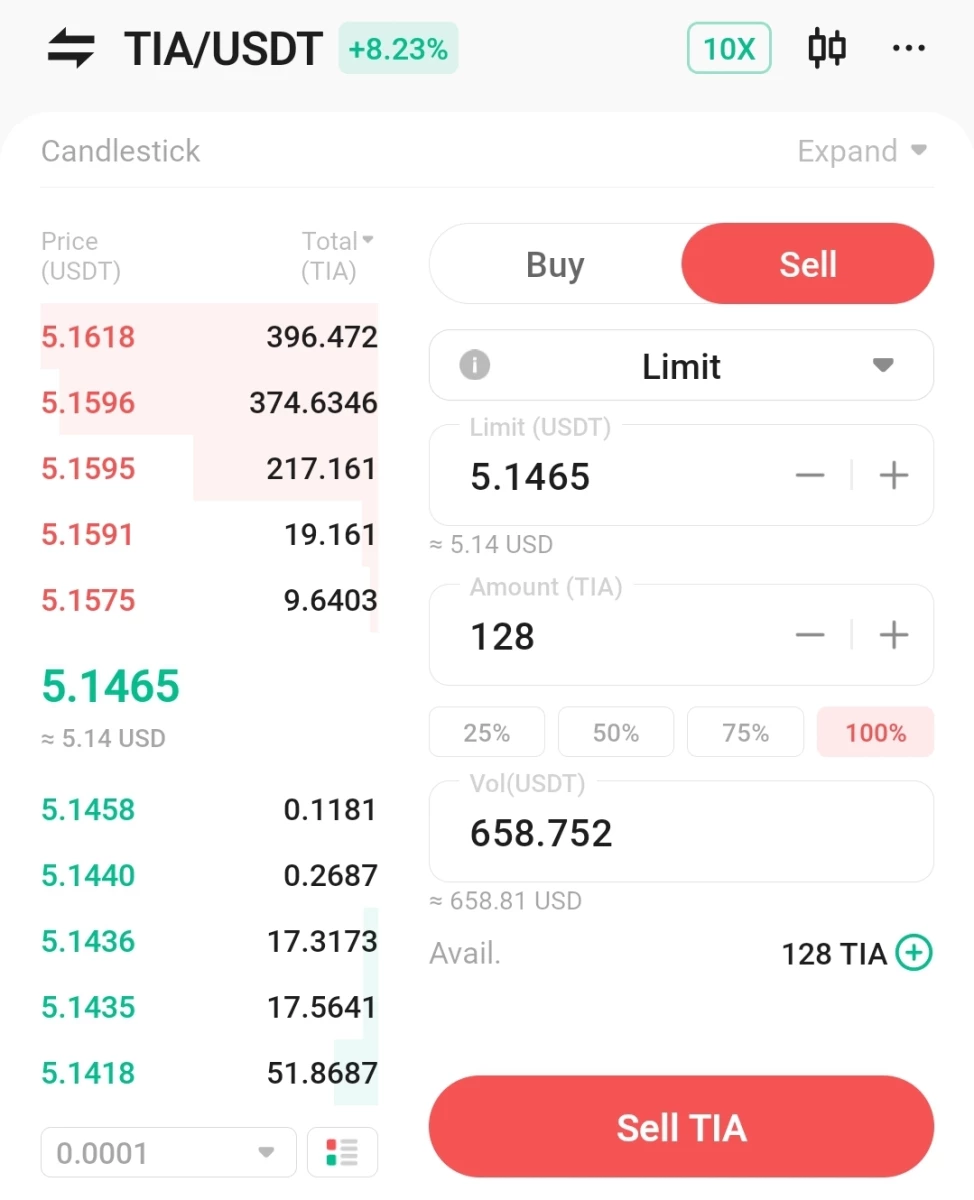

Kept 100 tokens and sent the rest to Kucoin, where I swapped at $5.14 per $TIA. I cashed out $658 USDT and let me tell you I have no regrets! This airdrop was unexpected and without any effort... so this is just a Christmas bonus!

Yes bro ... $TIA now doubled in value, reaching $10.40 on the 6th of December. Who cares... it could been the opposite and go to $2 or less. Crypto is all about opportunities, and you are not in profit until you cash out!

Bought some $KCS and sent the remaining USDT to Crypto.com, where I could use them for Christmas shopping. The remaining 100 $TIA were locked and came back after one week to check the status.

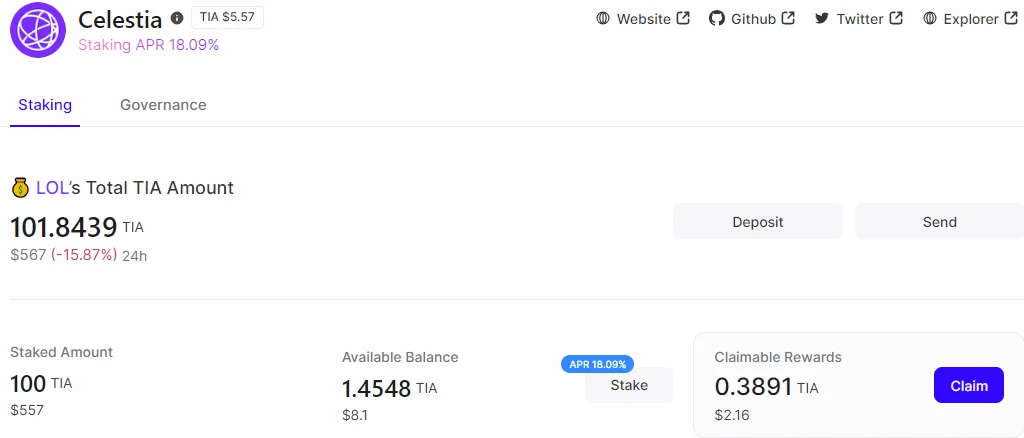

I had 1.45 $TIA balance, no idea from where, and farmed 0.38 tokens in less then a week. Maybe the balance was a little drip from somewhere, or a one of staking rebase. No idea! The 100 tokens farmed at 18.09% APR, and I must think about when to claim and re-stake.

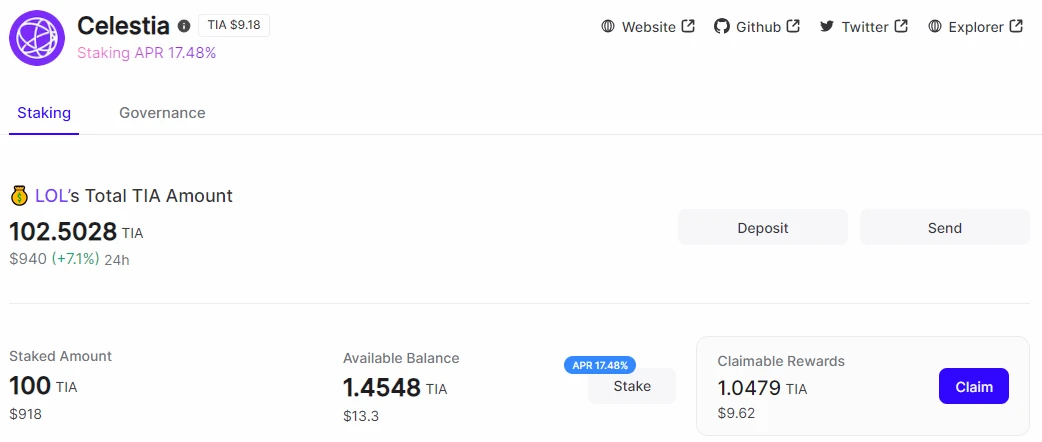

The $TIA value surged over the last days, and checked my staking dashboard again. The APR reduced slightly but still at optimal rates, reaching 1.04 $TIA in claimable rewards. I decided to leave it until the end of the month, and then start a routine on the 1st of January.

Will claim and add the rewards in the pool on the first day of each month, leaving my assets in there until the APR will be to small to count. Happy airdrop season and may LayerZero or zkSync bring even better gifts!

Residual Income:

Play2Earn: Upland / Splinterlands / ++Doctor Who Worlds Apart++

Get Plutus Card - 3% cashback on everything + Perks

CEXs and DEXs: OKX / Biswap / Binance / Crypto.com /

The fountains: PipeFlare ZCash, GlobalHive ZCash & Get.ZEN

Publishing bundle: Publish0x, Hive/Leo, readcash, LBRY & Presearch

Koinos is the first to do what Celestia is trying to do. It is a project from the developers who built STEEM before Justin Sun bought Steemit Inc. If you like Celestia, you must take a look at Koinos.

https://inleo.io/@vimukthi/koinos-can-be-bigger-than-cardano-solana-polkadot-or-even-ethereum-or-imagine-getting-in-at-launch

https://inleo.io/threads/pvmihalache/re-pvmihalache-jafupzta

The rewards earned on this comment will go directly to the people ( pvmihalache ) sharing the post on LeoThreads,LikeTu,dBuzz.