image credit

Be prepared that if you continue to make investment decisions based off internet personalities telling you something will 30x in some time period, you will find yourself learning this same lesson repeatedly in the crypto space.

For example if you ended up going 60x, so I suppose you dodged a bullet making a gamble like that, but it wont always work out so well for you. Making risky bets to get rich off online investment advice typically leads to followers buying the top and becoming bag holders. Where do you think the millions in investment advisors pockets come from? Their free money machine, or the people they are advising?

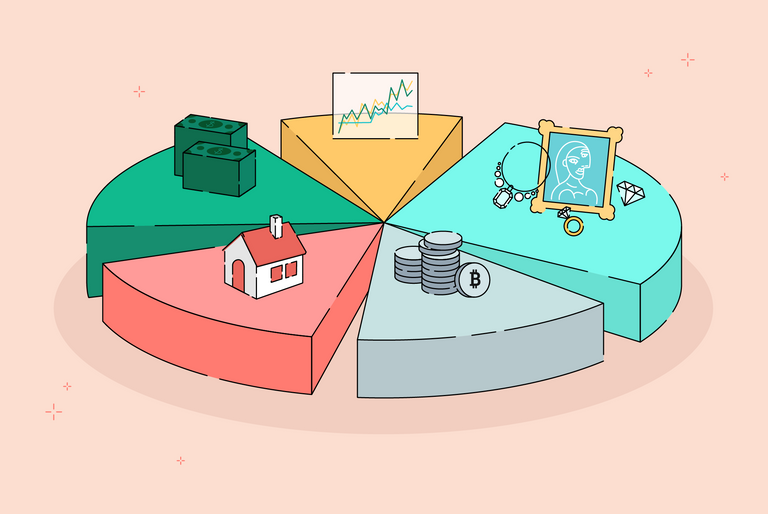

Diversifying means you will be closer to the average of the gains and losses of the market. If you centralize into fewer, you will be more subject to the volatility. Get it right and you make more, get it wrong you lose more. More risk = more reward. Diversifying is removing risk, which also removes reward. Try picking which of those coins go green on CMC on paper first and see how you do. Some people are good at trading volatile markets. Mostly it is highly manipulated and designed to siphon your money to the whales through emotion based markets.

Congratulations @sm-traveller! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s):

Your next target is to reach 3750 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPSupport the HiveBuzz project. Vote for our proposal!