Welcome to the weekly SPI Report

Each Sunday, @spinvest uploads an earnings and holdings report to keep investors up to date with fund performance and news. You can subscribe to these weekly reports in the comments.

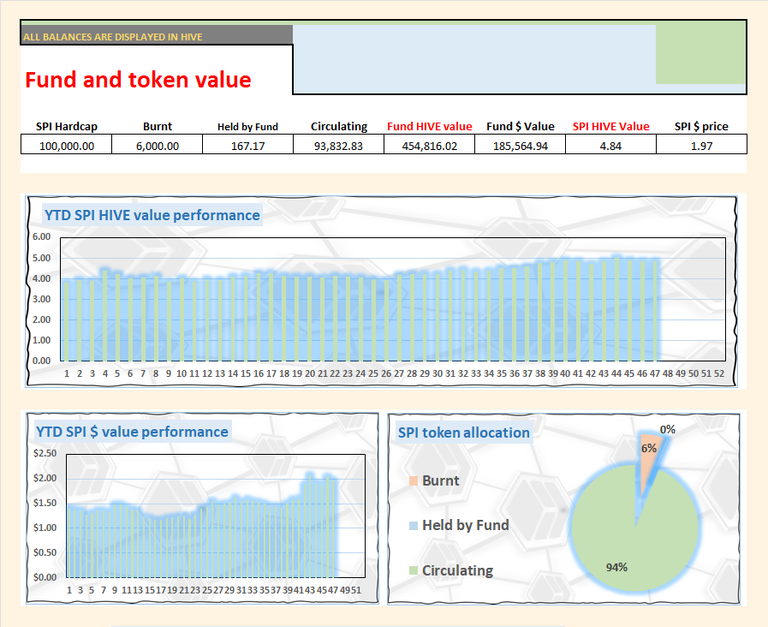

SPI is the flagship growth token for the SPinvest fund. Launched in June 2019. SPI tokens act as both a token of ownership and a governance token. Since launch, we've been able to 7x the HIVE value (including revaluations and token split) and 12x the dollar value of the fund.

We are now in our 5th year of operation and still going strong as we stick to our plan of investing the bulk of our holdings into time-served investments and HODL.

Our motto is = Getting Rich Slow

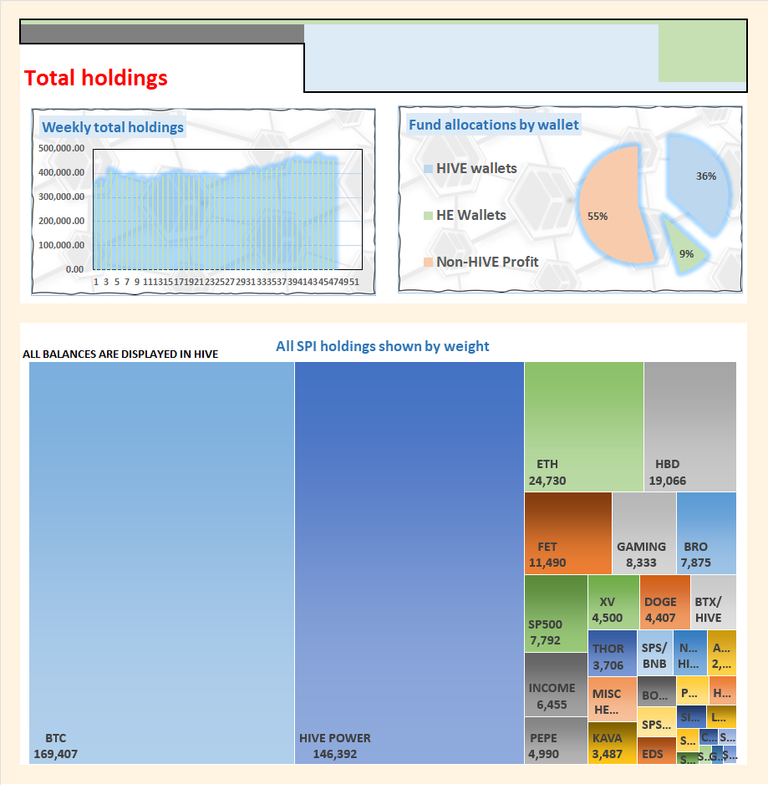

In our expansive portfolio, we are involved in over 30 investments, with a significant portion dedicated to HIVE, BTC, and ETH. We firmly believe in avoiding impulsive actions driven by the fear of missing out or chasing unattainable aspirations. Instead, we rely on tried and tested strategies that have proven to be the most effective and secure.

Our guiding principle is to accumulate wealth steadily, adhering to the philosophy of "Get rich slowly." We employ the power of compounding by consistently reinvesting in sound opportunities to amplify our returns over time.

When considering SPI tokens, it is essential to adopt a long-term perspective, aiming to hold them for a minimum of 3-5 years. Our rationale behind this recommendation lies in the belief that substantial returns require patience and allowing investments to mature organically. By committing to an extended investment horizon, you significantly increase the probability of maximizing your potential gains. This aligns perfectly with our overall investment philosophy and strategy, ensuring sustainable growth and profitability in the long run.

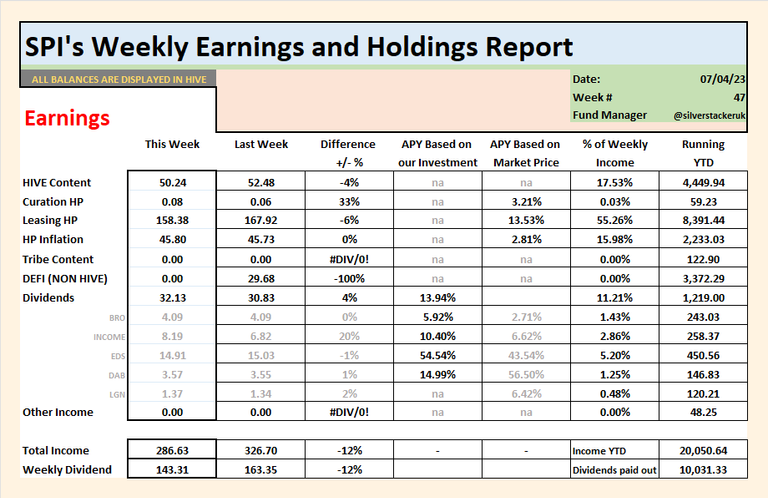

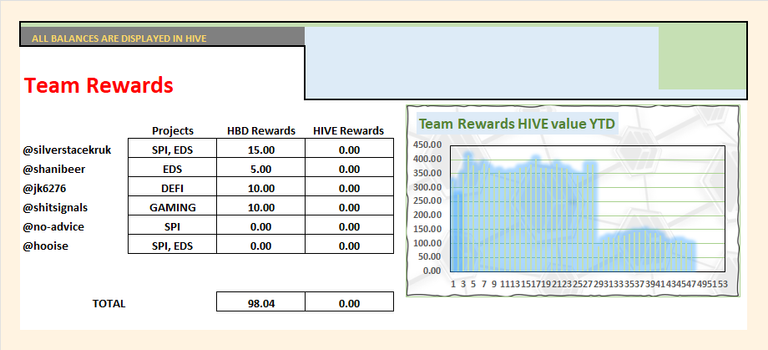

Earnings continue to be low and there is not much we can do about it. The APY we get from our HP is good but we're limited to content rewards and getting good worthwhile dividends from other token projects like INCOME or BRO costs too much money. Im not comfortable with having $5k+ in a single HE token simply for liquidity reasons. With that said, we did increase our INCOME position by 25% with a purchase of another 100 tokens. haha.

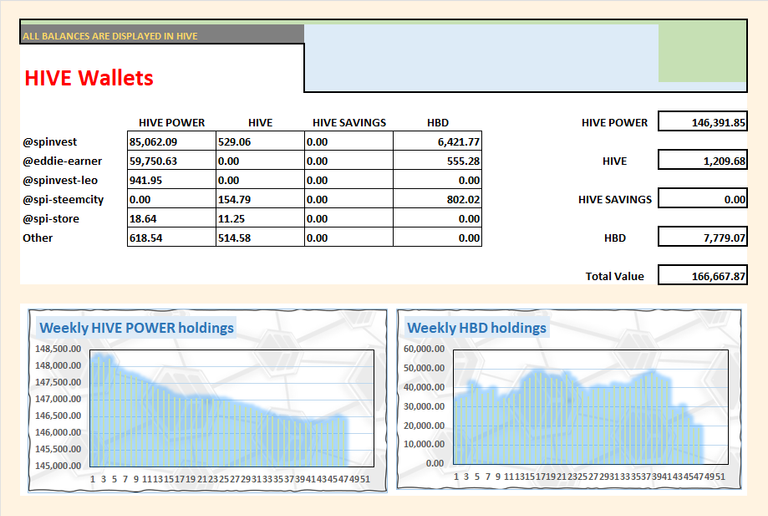

No big changes this week in our HIVE wallets. Our HBD balance is the same as last week cause the price of HIVE is the same as last week as well. We used 400 HIVE this week from last week's SPI raffle ticket sales and sent it to get HBI units for SPI and EDS. Fingers crossed, we're be back to an increasing chart next week.

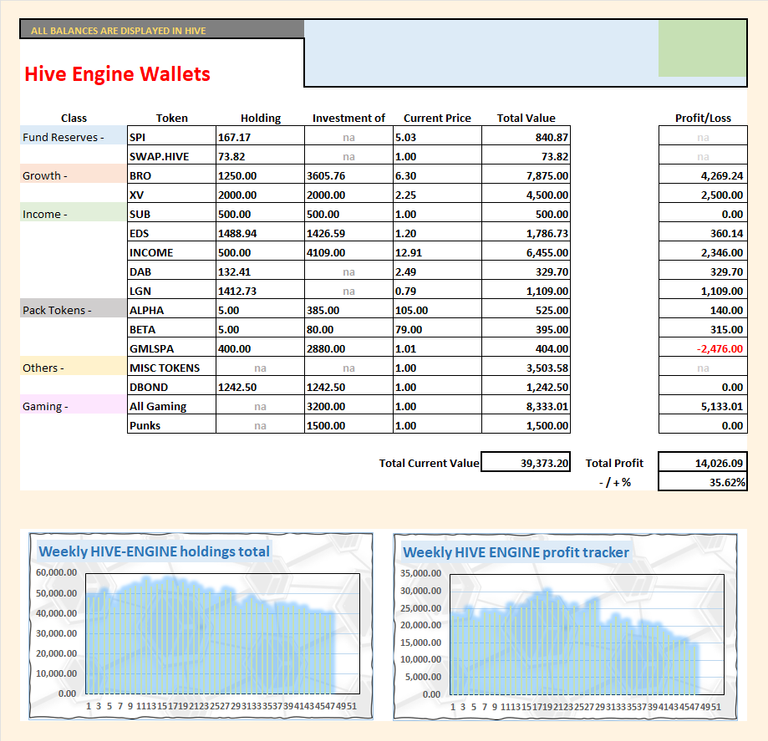

Not much action this week, the biggest change this week in our HE wallet is our holding in GMLSPA pack tokens. These are turning into a bad investment and the price has only dropped since we bought in. I dont see this ever getting into profit and if the price continues to decline for the next few months, we'll move them into the spi-null account and write them off as a loss. If they make a comeback, we'll still own them but im lazy to track them each week of they are worth nothing.

I added 500 SUB tokens for us last week. SUB tokens are sold to fund marketing for a music album. If its successful and its generates income through marketing royalties or streaming fees, we'll get a cut. It's a very risk investment but it might pay off.

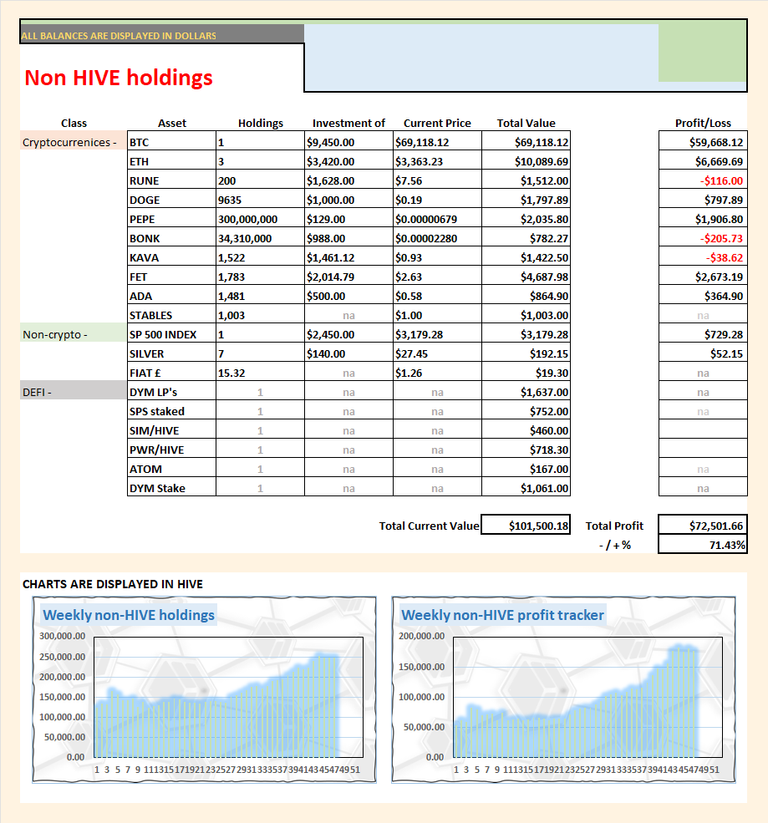

The market is down this week, everything is down a few percent. BTC which is our biggest holdings is the least affected is down only 1% so it not been that bad for us. The rest of our non-HIVE holdings are down between 5 and 15%.

Last week when the whole market dropped 5-10%, I noticed that ETH was down 20% from when it reached $4k a few weeks back and thought it would be a good time to get us into a leverage position. We have $1000 sitting in stables tokens so I put $500 into an x5 ETH leverage trade. This means if ETH drops by around 20%, we lose our $500 but whatever it goes up, we get 5x that amount. We're not trading futures and have borrowed the money to do that trade. We put up $500 and borrow $2000 to buy $2500 worth of ETH. We need to pay a little interest on the borrowed amount but we're trading actual ETH mainly if ETH were to double in value, we can take profit to pay off the loan and keep the remaining ETH. I'll write a more detailed post about this within the next few weeks, we've only been in this trade for 5-6 days so far and we're sitting on about break even. Also, lastly, the remaining $500 stable token is sitting in the trading account and I've set up the trade to auto-top up with USDT if a liquidation event goes up. Sort of protection against flash crashes or ETH dropping 20% from today's price.

Not much change in the BTC to HIVE ratio this week with 1 BTC getting 169k HIVE. We need it to hit that magic 200k number before we commit our precious BTC. It seems like a big risk but the ratio for over 18 months between 2022 and 2023 was under 100k HIVE to 1 BTC. When we look at things over years and not weeks/months, we see the bigger picture and understand that trading 1 BTC for 200k HIVE is easy money long term.

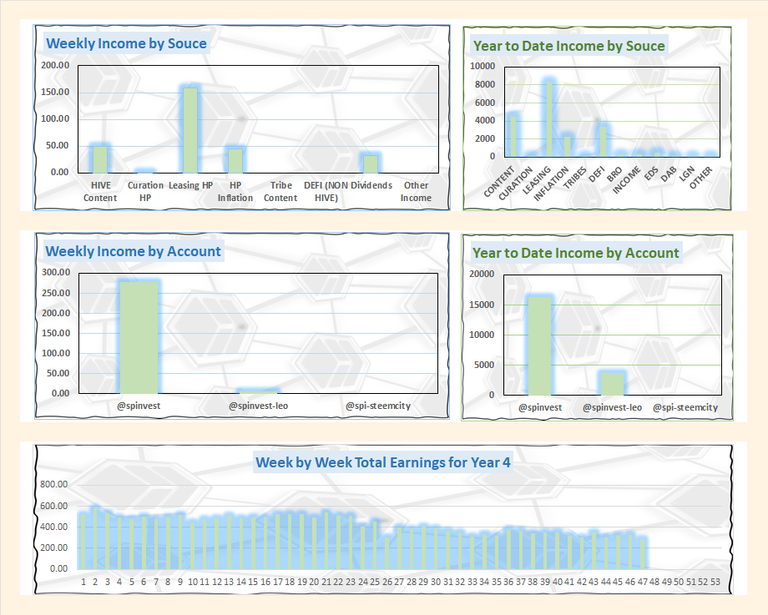

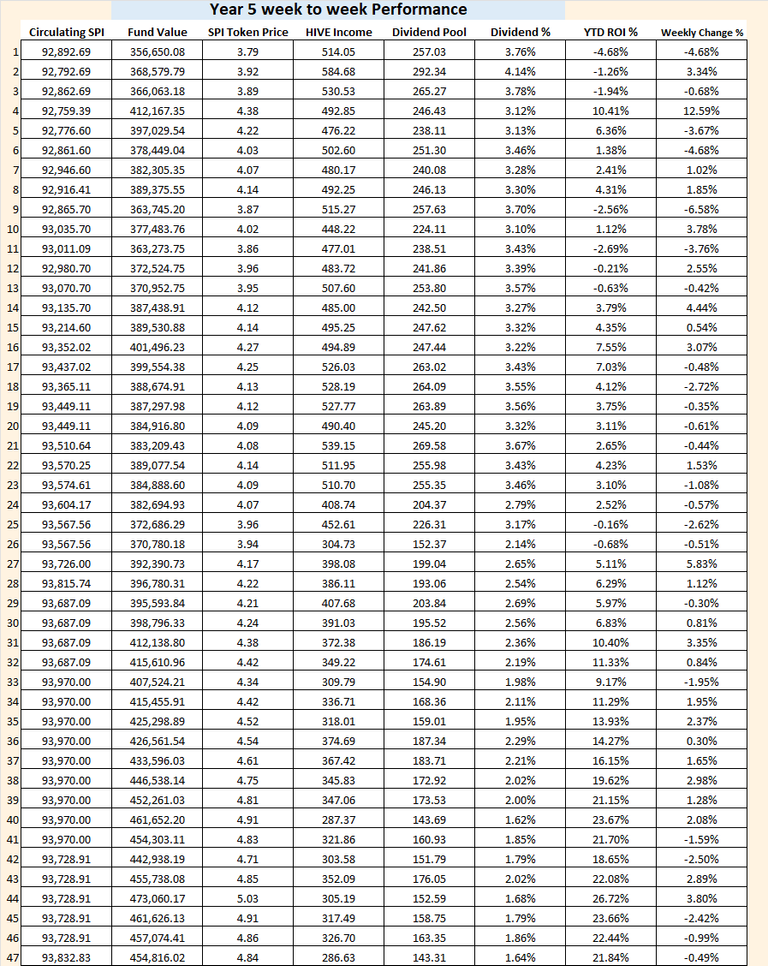

We took another small hit to the fund value again this week with a decline of 0.5%. We are still sitting at 22% to the plus YTD and with only 5 more weeks left in the year, im hoping we can finish closer to 25%. We'll have to see what happens, it's up to the crypto gods.

Its been a strange week with the markets going up and down, moving sideways and not much happening. I would guess it'll be like this for a few months and people will soon start to feel the crypto hype wind down again before things go crazy again.

I see alot of reports claiming this cycle will be different because BTC has hit a new-time high pre-halving, we have BTC EFT and more people than ever are involved but I feel it'll just play almost the same as every other cycle to date. Every cycle, we have game changers, there are always more people each cycle, and there's always some sort of advancement toward mass adoption. BTCs top will come in May/June 2025 and ALTs Oct/Nov 2025. If BTC runs on a 16-year cycle made up of a 4 x 4 years cycle with the last of these having an extended bullrun, SPI is screwed and we will 100% sell everything too early. You might not have heard of the 16-year BTC cycle, could be BS but good to be aware of it.

We grind on and wait for the halving and then the aftermath that follows. I think I saw a NFT sell for $8-9 million this week so we're getting there, haha.

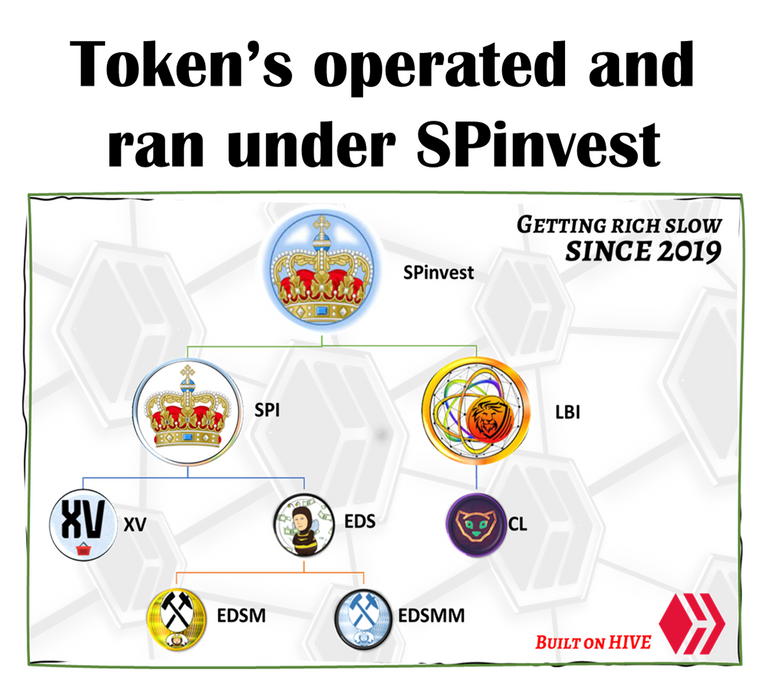

Links to all projects under SPinvest

| Token Name | Main Account | Link to hive-engine |

|---|---|---|

| SPI token | @spinvest | SPI |

| LBI token | @lbi-token | LBI |

| Top XV token | @spinvest | XV |

| Eddie Earners | @eddie-earner | EDS |

| EDS mini miners | @eddie-earner | EDSM |

| EDS micro miners | @eddie-earner | EDSMM |

| DAB | @dailydab | DAB |

| DBOND | @dailydab | DBOND |

Stay up to date with investments, fund stats and find out more about SPinvest in our discord server

Tag @spinvest to a comment below saying "I wanna Subscribe" and I will tag you in future SPI weekly reports.

Sub List:-

@ericburgoyne, @mikezillo, @shanibeer, @oldmans, @roger5120, @lilolns19, @riandeuk

!giphy great

!PIZZA

Via Tenor

yep

$PIZZA slices delivered:

@bhattg(4/10) tipped @spinvest

Yeehaw! This blog post is full of grit and determination, just like a cowboy on the range. Keep the faith, partner, slow and steady wins the race in the world of investments. Stay strong and keep on riding towards that sunset of success!

Thanks guh-reatly for checkin' out thuh post maah partner. We'll keep awn guh-rindin' as allers

Ride on, partner! Your positivity shines like the mornin' sun on the prairie. Keep pushin' forward, one step at a time. Together, we'll make this rodeo a success!