Hello, SPIer's. Today is Sunday and we end the SPI week with our weekly dividend payment this evening and every Sunday at 21.00 GMT.

What is SPI?

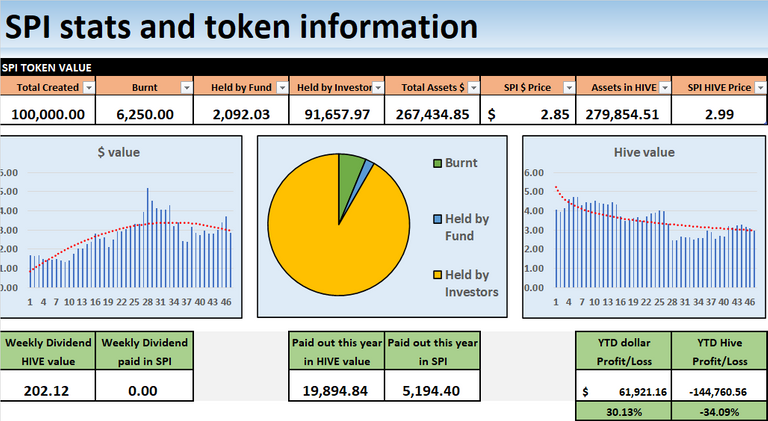

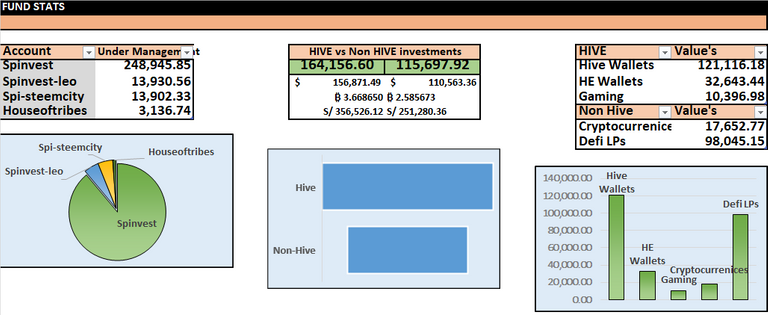

SPI tokens are growth investment tokens that pay a weekly dividend. They have been circulating for over 2 years, on STEEMHIVE. Mostly sold for 1 HIVE, each token today is worth over 4 times its HIVE issue value and 12x its dollar value. On top of that, token holders receive roughly 8% more SPI's every year from weekly dividends. We raised $13k from issuing SPI tokens for the first year which has been used to grow a diverse portfolio of investments, many of which provide streams of passive incomes. SPI tokens are part ownership of all SPinvest tokens/accounts, assets and income. The price of each SPI token is its liquidation value as SPI tokens are 100% backed by holdings. Handcapped to roughly 94,000, no more can be minted are issued. Adding, hold and compounding has us on the road to major growth and these tokens are still growing in value.

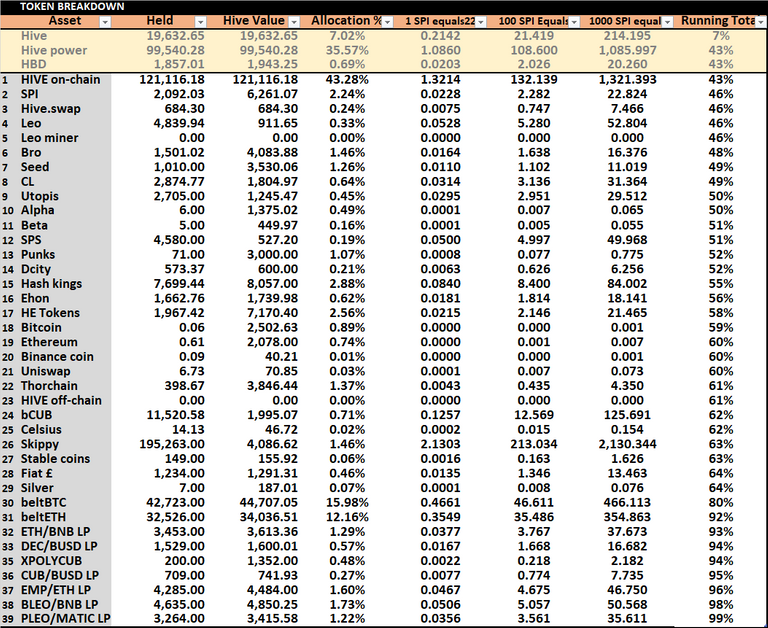

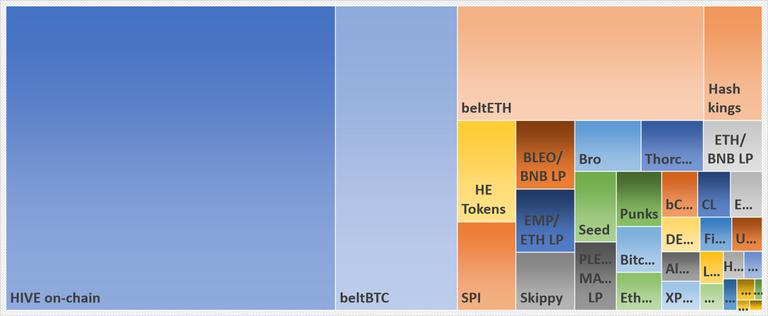

SPI tokens are part ownership in an actively managed fund. We have our hands in over 20 investments with the lion share being HIVE, BTC & ETH. We dont FOMO are chase pipe dreams. Tried and tested works best and is safest. Our motto is "Get rich slowly" and compounding down on sound investments is our game. You should invest in SPI tokens with the mindset of not selling for 3-5 years minimum. Let's have a look at this week's on-chain HIVE earnings.

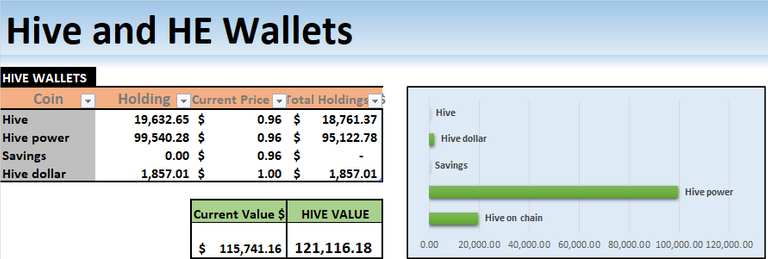

Earning are up a tiny bit on last week so not bad. Overall, HIVE earnings have been down and declining for some time. Alot of our earnings are being reinvested into growth through gaming. When it starts o payout, I believe it could be a few hundred a week easy but we're planting seeds in the hope they pay off later. Shitsignals has us into 5-6 new presale projects and if 1 is successful, we'll earn a few HIVE. For now, for the short term, I still think the crypto market is going to go full bull again and im not looking to use liquid HIVE holding for investing into something for a 20% APY when we can flip HIVE over a 12-36 month period and maybe 10x our HIVE instead.

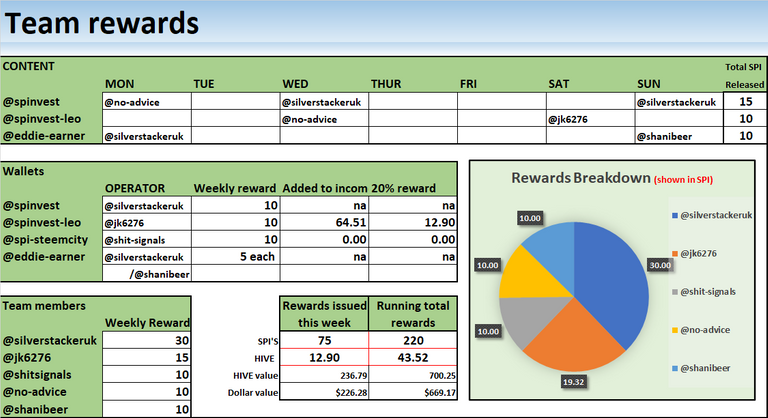

Team rewards are pretty much the same as last week. No chances there.

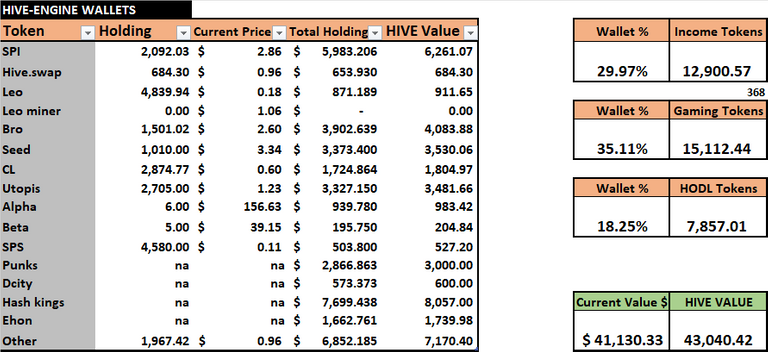

We lost alot fo value in our HIVE-engine wallet this week as the price of HIVE declined through the week. Because HE has smaller volumes, it takes hours to a few days to correct and stabilize.

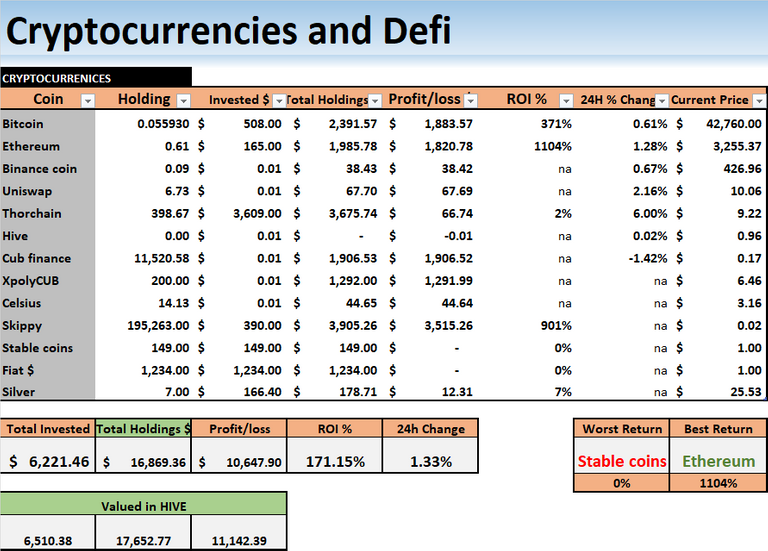

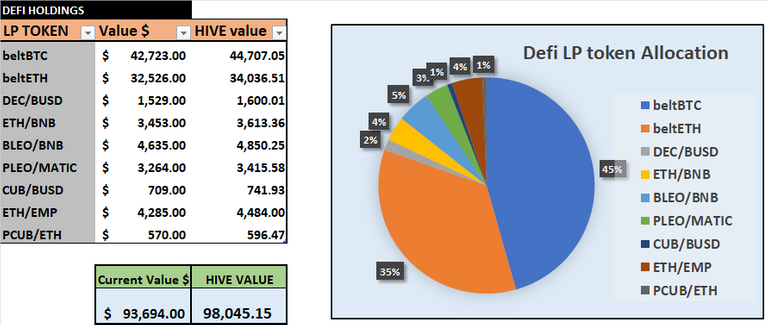

I moved our polyCUB holding back over to BSC CUB. You'll see our defi holding are much different than last week. We got our BTC back and we have a 1 BTC belt kingdom holding. I converted alot of our polyCUB profits into ETH tokens so we now have 10 ETH locked up in the belt ETH kingdom. I added 10 BNB worth in the autocompunding EMP/ETH LP on yieldwolf and then i added the rest to the ETH/BNB kingdom. The market is down a little from last week and our total defi holding have dropped below $100k. (insert sad pleb face)

All in all, the reallocation puts most of our holdings in solid cryptos like BTC and ETH.

SPI token price is down some but everything is down and SPI is into anything so this is what happens. We've only a couple of weeks left in the year and we are showing a massive HIVE loss for the HIVE. Today, we're down 140k HIVE from year start which is a bummer and i don see that turning round in 4-5 weeks. HIVE is up over 50% this year easy and that means our non HIVE holdings are worth less in terms of HIVE. Overall in terms of dollars, we're up 30% so we take the rough with the smooth. I guess when we are full swing bear market and the price of HIVE is under 20 cent again, the SPI token price will be worth 10 plus HIVE each and worth less in dollars. SPI is a crypto fund and going into the next bear market, we have to expect to lose alot of dollar value in our holdings. This is the game we play when we invest long term.

Anyways, onwards and upwards is always the goal. We've been kicking ass for almost 3 years, sure HIVE earning or down but growth is coming from non HIVE investments which use to pump our HIVE bags when the market is way down in 18-24 months and everyone dumping at bargain prices. We have to believe the bull market has not been completed yet and keep compounding.

Thank you for taking the time to read through this weeks SPI earnings and holding report. We post every Sunday to keep our investors up to date so please follow the account if you would like to track our progress.

140k HIVE less is a huge sum, but given that overall value is 30% over, I think we can bite the bullet.

Posted Using LeoFinance Beta

Yep sure is. I think SPI is down around over 400k HIVE from it's HIVE peak price 16 months back.

The total fund was worth $92k back then so we lose in 1 hand again in the other. I'd bet alot of money that SPI will go to over 10 HIVE each at the peak of the next bear market.

Bull market - HIVE price down, dollar price up

Bear market - HIVE price up, dollar price down

Will probably go, if not, it is a bargain worth buying.

Posted Using LeoFinance Beta

Thank you for your witness vote!

Have a !BEER on me!

To Opt-Out of my witness beer program just comment !STOP below

View or trade

BEER.BEERHey @alexvan, here is a little bit of from @isnochys for you. Enjoy it!Learn how to earn FREE BEER each day by staking your

BEER.HBD at now sitting at 20% should help the price of hive as well We shall get there jsut steady as we go

Been saving HBD from content rewards for the past 6 months. Getting there slowly

wonder if there will be interest in bear bonds now the interest rate on HBD has increased?

It actually makes more sense now for us to just earn the 20% of saving HBD instead of providing loans, lol. We'll chalk this as a fail, i never would be predicated HBD would pay out 20%.

Yeah, I just worked out the sums using HIVE, LEO and SPI ... over six months it's about $2.60 more than if everything stayed were it was, plus the risk element and the additional time bot towers would have to spend keeping an eye on what's happening.

it all looks good hoping to join this investment sooner thank you for the update

Posted Using LeoFinance Beta