Facebook finally releases the whitepaper of their hugely anticipated cryptocurrency, Libra. At the same time, they also create a website, Libra.org, with other information related to the project. In this post, I will first provide a summary of the whitepaper with my thoughts embedded and subsequently some of my predictions.

What is Libra?

According to the whitepaper, the mission for Libra is a simple global currency and financial infrastructure that empowers billions of people. Libra is planned to be a decentralized blockchain, a low-volatility cryptocurrency, and a smart contract platform.

The mission statement is quite typical of most cryptocurrencies that aim to solve the remittance issue. Though Libra is also poised to be a smart contract platform, there are not much information on that as of now. However, we can clearly see that this project is aimed to compete with the likes of Stellar Lumens for the remittance market and Ethereum for the smart contract platforms. Overall the mission statement somewhat reminded me of Initiative Q, if any of you still remembers.

Libra "Blockchain"

The Libra Blockchain has the following requirements,

- Able to scale to billions of accounts, which requires high transaction throughput, low latency, and an efficient, high-capacity storage system.

- Highly secure, to ensure safety of funds and financial data.

- Flexible, so it can power the Libra ecosystem’s governance as well as future innovation in financial services.

It is designed from ground up and it is even built on a new programming language called "Move". "Move" is claimed to be designed with safety and security as the highest priorities. In terms of achieving consensus, the Libra Blockchain adopts the BFT (Byzantine Fault Tolerant) approach by using the LibraBFT consensus protocol. It is designed to function correctly even if up to one-third of the network are compromised or fail. It is also faster and more energy-efficient compare to “proof of work”.

Next comes the interesting part. the Libra Blockchain implements Merkle trees, a data structure which is also used by Bitcoin. However, unlike previous blockchains, which view the blockchain as a collection of blocks of transactions, the Libra Blockchain is a single data structure that records the history of transactions and states over time. Curious, I went on to look at the technical paper. In the paper, it says that the all data in the Libra Blockchain is stored in a single versioned database. To me, this means that it is a distributed database. Unlike most other blockchains, changing the data in the Libra Blockchain probably does not require a hard fork. This means that it is not truly immutable? Do correct me if I am wrong.

Finally, the Libra Blockchain is pseudonymous and allows users to hold one or more addresses that are not linked to their real-world identity. So you do not need to do a KYC to own some Libra. However, since Libra is likely going to be implemented on the suite of Facebook products, perhaps KYC is not needed for them to track who owns a particular address. So is that still anonymous? Might have to think twice.

The Libra Currency

The Libra currency is not pegged to any of the fiat currency. This is probably one of the biggest surprise to me as most rumors pointed to Libra being pegged to USD as a stablecoin. According to the whitepaper,

Libra is designed to be a stable cryptocurrency that will be fully backed by a reserve of real assets — the Libra Reserve — and supported by a competitive network of exchanges buying and selling Libra. That means anyone with Libra has a high degree of assurance they can convert their digital currency into local fiat currency based on an exchange rate, just like exchanging one currency for another when traveling.

Essentially, Libra is pegged to the value of the underlying assets that forms the Libra Reserve. So the currency will fluctuate as the value of the assets changes. Low volatility assets were chosen to make sure that Libra can preserve its value over time. It is also important to note that interest on the reserve assets will be used to cover the costs of the system and ensure low transaction fees.

Libra Association

After understanding the technology and the currency, it is perhaps important to also know how is this currency governed. Facebook is smart to create a not-for-profit organization based in Switzerland to govern Libra. The organization, known as the Libra Association, is designed to facilitate the operation of the Libra Blockchain and to coordinate the agreement among its stakeholders. Initially, this group consists of the founding members from businesses, nonprofit and multilateral organizations, and academic institutions from around the world.

Here are the founding members,

These members are also going to run the validator nodes which forms the blockchain network. Facebook is really smart to get potential competitors like Visa, Mastercard and PayPal to be part of the association. This not only reduces the chance for competition, it also provides a "sense of decentralization".

Opportunity or Threat?

I think one of the key questions you have in mind is whether Libra is an opportunity or threat to the other cryptocurrencies in the market. Before we answer that question, lets do a quick comparison between Bitcoin and Libra.

| Bitcoin | Libra | |

|---|---|---|

| Decentralization (governance) | Yes | Quite centralized even if there are 100 members in the association as planned |

| Decentralization (infrastructure) | Arguably Yes | Centralized at start but promised to be decentralized later |

| Open and Permissionless | Yes | Open-sourced and will eventually be permissionless |

| Anonymity | Pseudo-anonymous | Pseudo-anonymous (but might be challenged considering Facebook own so much personal data) |

| Security | Proof of work is probably the most secure | Reasonably secure as I see it |

| Immutability | Yes | Largely immutable |

| Speed | Slow but improving with layer-2 solutions | Promised to be fast |

| Value preservation | Of its 10 years of history, Bitcoin has proven to be an appreciating asset | Promised to be able to preserve value well |

| Censorship Resistance | Largely yes | Unlikely. Since Libra aims to be compliant with regulations, it is likely that it can be censored |

| Adoption | Small but growing | Likely to be able to gain mass adoption considering the companies involved in the project |

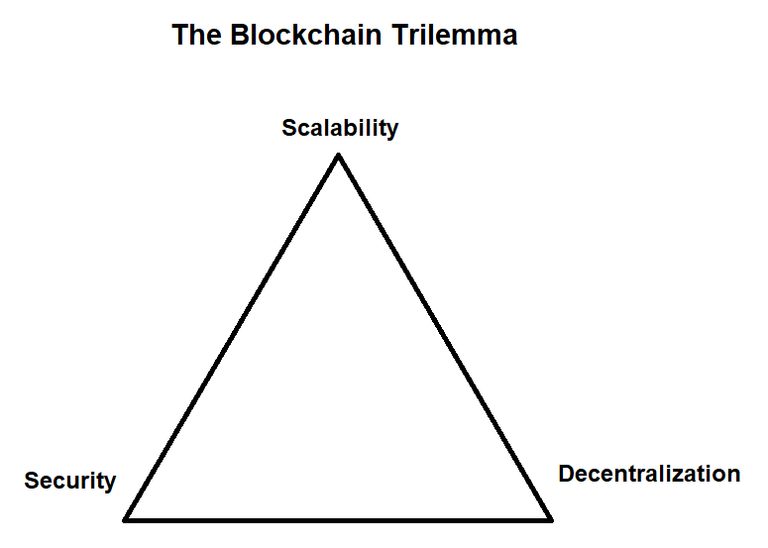

Based on the comparison, Libra is sacrificing decentralization for speed and security. Is that a huge sacrifice? Perhaps for some of us it is. However, I think for most people, it doesn't really matter if it is decentralized or not. Facebook has billions of users across the globe and it is not going to be difficult for them to achieve mass adoption. Hence, existing cryptocurrencies will have to have their own niche in order to survive the challenge by Libra.

In the near term, I see Libra as an opportunity to the overall cryptocurrency market as it allows the existing cryptocurrency market to gain some media attention. However, when Libra goes live many projects are probably going to lose out. Bitcoin is probably going to be around as most people sees it as a store of value rather than a currency. Ethereum and other smart contract platforms might be challenged by the smart contract feature on Libra.

In addition, Steem might also be threatened as I see a possibility for Facebook to integrate micro-payments or micro-tipping into its extensive social networks. This in turn allows their users to earn while using their platforms, which is the very reason why people are here on Steem.

Interestingly, the existing crypto projects are not the only ones that should be getting worried. The banks and other financial institutions should start to feel the threat. Like what many other tech companies (like Alibaba and Tencent) are doing, Facebook is clearly stepping into the financial sector. When money supplies are being held by these tech companies, the consumer banking sector is likely going to be affected. I will not be surprised if more tech companies start to follow suit.

Thanks for reading and do share your thoughts!

The "Raise to 50" Initiative

Under 50 SP and finding it hard to do much on this platform? I might just be able to raise your SP to 50. Check this post to find out more!

This article is created on the Steem blockchain. Check this series of posts to learn more about writing on an immutable and censorship-resistant content platform:

How far this Libra thingy goes, I guess time will tell. But it would be good if it could give the other cryptocurrencies some competition, so that they will simplified the process in the using and opening of wallet accounts.

Indeed. However, with Facebook's market dominance and deep pockets, I highly suspect the competition is going to be rather one sided. On the flip side, FB is sure to face a lot of political resistance. Will be interesting to see how this unfolds

Posted using Partiko Android

In general I see a positive move towards crypto. It will make crypto main stream and people will know how a wallet works etc. However, many alts will die as convenience triumphs over everything so "joe" will just use Libra over any crypto. Now it will be interesting to see what happens, The first attept at this was Facebook Credits, and they failed due to high cost and no one cared (you had to pay 30% to Facebook as fees). If facebook doesnt get too greedy I see a massive adoption, there are already many store groups in facebook where small businesses sell stuff.

Now, Facebook has the potential to become a "bank" and we are seeing the birth of a private currency. Either banks line up with Facebook and we get a new "BigTech global bank" or it gets destroyed by regulations like e-gold in the 90s. Most likely the former will occur, so I see a future where we will look at BTC/Libra instead of BTC/USD for out charts.

Thanks for sharing. Indeed. I think the greatest challenge FB is going to face will be from regulators. Their stance seems to be to comply with regulations as much as possible.

With Libra, the association of companies are beginning to play the role of a central bank. They can mint and burn a currency which they created. I reckon that regulators will start drafting new regulations to govern such activities. Along the way, there might be many altcoins becoming part of the collateral damage. It's going to be interesting how this will evolve

Posted using Partiko Android

Very interesting article. I think in many ways Libra will serve as competition for other cryptocurrencies, causing them to become easier to work with and use. With all the companies behind Libra, I imagine they'll make Libra very easy to use and buy things with.

If Facebook does integrate tipping and other Libra incentives into their various platforms that would at least give people the ability to share in some of the profits the platform is making from their use of it. They might even release an API allowing other platforms to integrate Libra as well.

Thanks. I am pretty sure they will have APIs for various parties to integrate. This will build up the network effect in order to succeed

Posted using Partiko Android

Thank you so much for participating in the Partiko Delegation Plan Round 1! We really appreciate your support! As part of the delegation benefits, we just gave you a 3.00% upvote! Together, let’s change the world!

Hi @culgin!

Your post was upvoted by @steem-ua, new Steem dApp, using UserAuthority for algorithmic post curation!

Your UA account score is currently 3.842 which ranks you at #4252 across all Steem accounts.

Your rank has improved 12 places in the last three days (old rank 4264).

In our last Algorithmic Curation Round, consisting of 200 contributions, your post is ranked at #25.

Evaluation of your UA score:

Feel free to join our @steem-ua Discord server