My high school brief was about financial liberty.

In the first place, we should define what financial liberty is. Financial liberty is the state of someone's portfolio, while enough money comes in without any effort for him/her to live the life he/she wants.

Passive sources of income are needed. Some examples are :

-Interests

-Market investment

-Real estate

-Business

-Partnership

-Research and patents

-Creation (Music, books, arts...)

All these revenues come directly into your portfolio without any further effort. It only requires an initial investment in time or money, or both, and some knowledge in few specific domains.

Everyone can achieve this financial liberty. However, it requires time (5 to 20 years on average), and a lot of discipline.

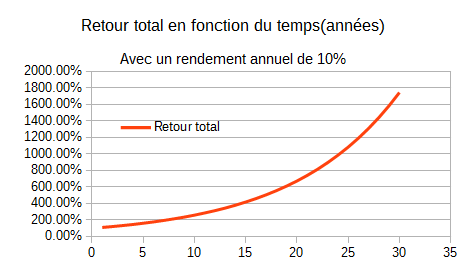

Compound growth returns are key to earn a lot.

Here you can see the final return after 30 years when having a 10% annual growth rate

It is quite a lot, right ? The sooner, the better. Investment returns are tremendously gigantic when time comes with.

Can you achieve your financial liberty ? Start wondering today !

new coin 2017 >?