Hello friends,

Today I’ll tell you all about BitMEX website, which is a unique type of trading platform and very popular in between traders

BitMEX is fully owned by HDR Global Trading Limited. HDR Global Trading Limited was incorporated under the International Business Companies Act of 1994 of the Republic of Seychelles and it is operates from Hong Kong.

What Is BitMEX?

BitMEX (Bitcoin Mercantile Exchange), is a peer-to-peer trading platform that offers leveraged contracts that are bought and sold in Bitcoin.

BitMEX is a derivative market for crypto mechanisms. Derivative market is another form of trading market. It is also known as Margin treading or leverage treading in crypto market. It’s a combination of margin trading and derivate of crypto assets for cryptocurrency traders.

Derivative market:

A derivative is an instrument the value of which is derived from the value of one or more underlying, which can be commodities, precious metals, currency, bonds, stocks, stocks indices, etc. Four most common examples of derivative instruments are Forwards, Futures, Options, and Swaps. Source

Margin trading:

I’ll tell you margin trading in simple words: Let’s assume, you want to make an investment of $100 in BTC, but you only have $50. Now to bring in the extra $50, you borrow that through the margin of 2:1 (it means for every dollar you have, you will get extra one dollar to invest. This is leverage or extra margin).i.e. “Borrowing additional cryptocurrency by leveraging the number of cryptocurrencies that you already own to buying additional cryptocurrencies.”

Hope you understand clearly if you not understand please go to BitMEX website and read how to get started. Source

BitMEX Team

BitMEX team is very strong, they have experienced developers, good economists, and algorithm traders and many more, which makes BitMEX is using to the easy and reliable website for traders.

Available Contracts

1- Futures Contracts

A Futures Contract is a derivative product and is an agreement to buy or sell a commodity, currency or other instruments at a predetermined price at a specified time in the future. Futures contracts do not require traders to post 100% of collateral as margin, because of this you can trade with a leverage of up to 100x on some of BitMEX contracts. All margin on BitMEX is denominated in Bitcoin, allowing traders to speculate on the future value of its products only using Bitcoin

2- Perpetual Contracts

A Perpetual Contract is a derivative product that is similar to a traditional Futures Contract but has a few different specifications like no expiry or settlement like traditional futures. Perpetual contracts mimic a margin-based spot market and hence trade close to the underlying reference Index Price. This is only available for BTC.

3- BitMEX UP (Upside Profit) Contracts

It allows buyers of the contract to participate in potential upside other f the underlying instrument. The buyer pays a premium on trade date for which he is entitled to receive the difference between the underlying instrument settlement price and strike price on maturity date if positive, else no payment occurs. All transactions are Bitcoin settled.

4- BitMEX DOWN (Downside Profit) Contract

It allows buyers of the contract to participate in potential downside the of the underlying instrument. The buyer pays a premium on trade date for which he is entitled to receive the difference between the strike and the underlying instrument settlement price on maturity date if positive, else no payment occurs. However, if the underlying touches or falls below the KO barrier price during the life of the contract it expires and settles early using the KO barrier price. All transactions are Bitcoin settled.

Cryptocurrencies supported

Currently, BitMEX only supports seven cryptocurrency name are:

• Bitcoin (XBT)

• Cardano (ADA)

• Bitcoin Cash (BCH)

• Ethereum (ETH)

• Litecoin (LTC)

• EOS Token (EOS)

• Ripple (XRP)

Leverage Available On BitMEX

BitMEX is the only exchange right now in the market that provides 100x leverage.

BitMEX provides different leverages for different cryptocurrencies and different type of contracts. To leverage trade on BitMEX only BTC deposits are accepted, and no other currency is accepted. Here is their leverage break-up according to the type of contract you are playing with for various currencies:

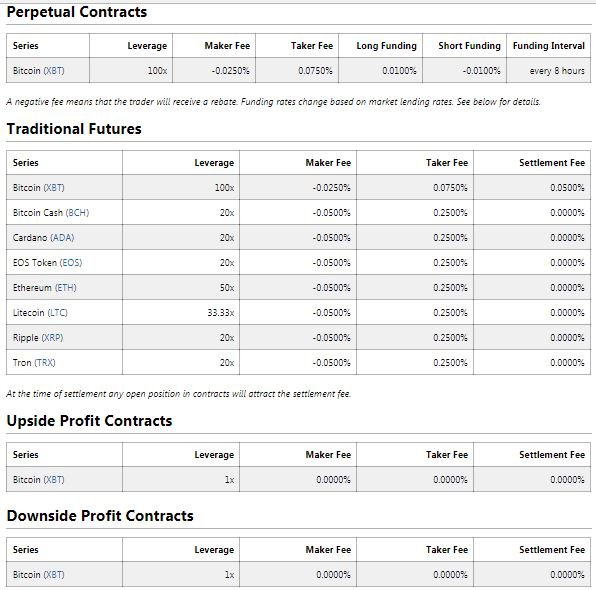

Perpetual Contracts:

up to 100x leverage: (BTC only)

Upside profit contracts:

1x leverage: (BTC only)

Downside profit contracts:

1x leverage: (BTC only)

Traditional Futures:

Read the table for all 7 cryptocurrencies-

| Cryptocurrency | leverage |

|---|---|

| Bitcoin | 100x |

| Ethereum | 50x |

| Litecoin | 33.33x |

| Bitcoin Cash | 20x |

| Ripple | 20x |

| Cardano | 20x |

| EOS | 20x |

BitMEX Fees

BitMEX fee also varies, depending upon the cryptocurrency that you are trading and which type of contract you are using. Here is the fee structure according to the contract.

Other things about BitMEX

BitMEX is a different and unique type of platform, which is Written in kdb+ and secured by a world-class Amazon Web Services. This allows only BTC for deposits and withdrawals.

Supported Countries

BitMEX is open for all customers and traders worldwide, except the United States.

Customer Support

With a world-class customer care they provide 24/7 support via the communication channels listed below:

• Support Ticketing System

• Weibo

• Wechat

• IRC

• Telegram

• Twitter

• Reddit

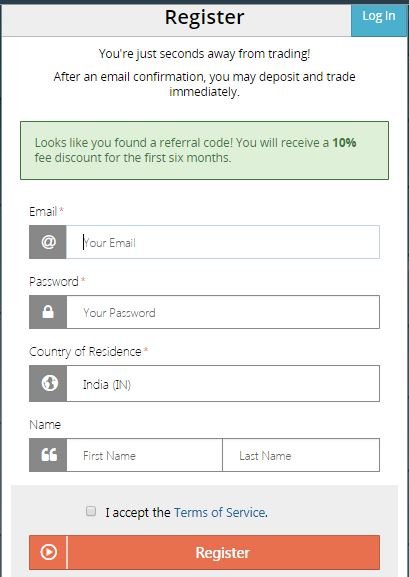

Registration process

The registration process on BitMEX is very simple. You need an email to registered on BitMEX. BitMEX also secure your funds by using the 2-FA authentication feature.

For registering an account click here

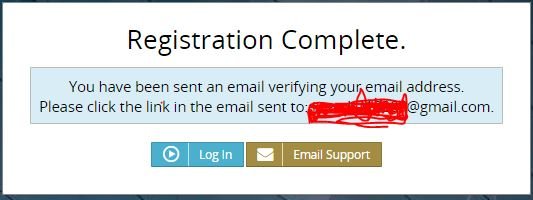

After completing your registration you got a box like given below, you need to verify your email id.

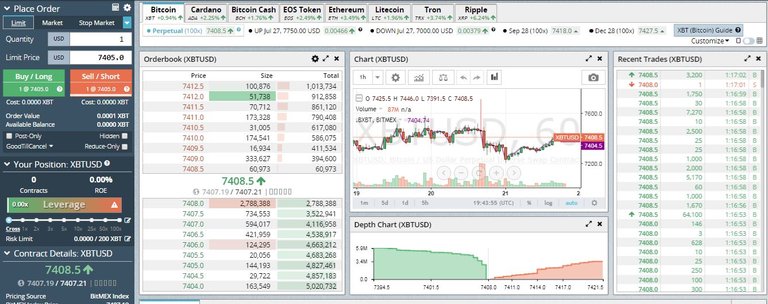

After verification and log in, you will see dashboard page like:

Declaration:

All the information collected from the internet and BitMEX official website. I am not an investment adviser.

Please comment your opinion about this article

Regards

Jitendra

@jitendrakrishnan