whenever I hear about entrepreneur, Freedom, courage and passion are the terms that come to my mind to start your own business, you can get inspired by a lot of things. Maybe you are passionate about something and it is your dream since your childhood. Maybe you do not want to work under someone and wish to be your own boss. Reasons could be anything, I will tell you everything from the start to end that you need to know to start your own business in this post and to become an entrepreneur in India.

So friends, the first step to start your business or start up is that you must know what exactly do you wish to do. What’s your idea?

Many people thinks that I need to think of an idea which no one has ever thought of. But according to me, it’s a wrong thinking. There are two reasons for this, First is that there is a very less chances of thinking of such idea which no one has ever thought about. Because there are more than a billion people in the country hence there’s a very less chance of it and the second and more important reason why you should not do this is that to start a business where there is no customer base established, no source of revenue and no one has done trial and error no experiment that to do this business, such kind of revenue comes or problems arises, then it is a very new thing and a very risky work. So I would recommend you to not think of an idea which no one has ever thought of. In fact you have to think that what do you yourself like to do. Here I would recommend you to focus on two things first, what’s your passion, your interest what do you like to do. How can you give value to people from your work and how can you benefit people and give value that they will give you money in return. When these two things are clear, you can see which business already exists which coincides with these two things. Then study what kind of such businesses are already in the market and how do they run. For example imagine if you love adventure sports like river rafting thats the first thing, then the second thing is how can you give benefits to people then here you can start an adventure sports company. If this satisfies you then look what all kind of adventure sports company already exists in India. how do they function, study them, call and ask them about their business and study their business model.

Next step after this is to create a business plan. Suppose if you are staring your business from tomorrow, then prepare the budget report of full one year from tomorrow to the year end, that how much money will you need to start the business, how much capital and investment will be required? And in the whole year how much will be the expenses and what will be the profit that you will gain. Where will you get the required capital and money that you will need? Will you borrow from your friends, ask your family or take a loan from the bank. Start a business where you don’t need to take a loan from the bank or any third person. Start a business where your family is able to afford the initial investment, because if you get into banks and your business fails then you will have to face a big loss and lots of problems .So think of a business where you are able to invest yourself and you have the capital or your family of friends are ready to give you that amount. I am suggesting this for the initial stage, once you business is established then you can think of taking loan to move it to the next step. This will the risk can be minimized. You can borrow the money from anywhere friends but the business plan that you have made for the year should be as detailed as possible so that the investors will get convinced that this business will surely work and if we invest in this then we won’t incur any loss and will gain only profit from the business.

Now that you have made your one year business plan then we can move on to the next step.

Next step is to register your business with the Government.

According to the type of your business there are different ways to register it, these different ways are called as business entities. The First, the oldest and the easiest way to register your business is, “sole proprietorship”; proprietorship is a way to register your business where the business owner is you, whatever will be the profit or loss of the business will be your own profit or loss. So in a way you are personally liable for everything that is happening with the business. Small business owners like a shopkeeper use this way and register their shop as sole proprietor. If you want to become a pakode wala then you will register your business as the proprietorship. There are many benefits of proprietorship, here the government regulations are the minimum. To register your business as the proprietorship you have to go to the local authority. If live in a city then you have to go to the municipality and if you stay in a village then to the Gram Panchayat. This is available even online in few cities whereas not in some. This will cost around Rs 1000 and 1-2 days to register. But also keep in mind that you may be asked for bribe as you are visiting the local authority and you know the scenario of our country. So be prepared for this. You can apply for proprietorship only if your company is a small scale and not more than 4 people are employed because it becomes very risky if it is on a large scale. Imagine your company is of crores and you have incurred a loss in crores then it will be your own loss of crores. You would not want this hence in this case you should not do proprietorship and if you want to keep your profit and loss different from the profit and loss of the company and want to keep separate legal entities, in such case there are different ways to register so there is another way called OPC, One person company. Here you are not personally liable if there is something happening to the company. So here they can’t come to your house and ask you to leave your house, car to repay against the failure of your company. The registration cost of this is around Rs 6000 and more or less in different companies. It will take 8-10 days to get registered and since this is a one person company you will have to be the director and share holder of this company. Once you have done the registration of your company as OPC then if your company’s name is Chikara Pakodewala then it will be Chikara Pakodewala pvt ltd and OPC in the brackets. Next way to register your company is pvt ltd company here a minimum of 2 share holders and 2 directors are required. Maximum limit of share holders here is 200 and if you want more than that then you have to make a public limited company. So as the name is private limited it is limited in the same way as one person company is limited. There is limited liability here, so the share holders have limited liability. so if there is a loss in the company then the share holders won’t have to pay for the loss personally. It’s a very reputable and credible way to register your business. If you do so then the trust of customers and clients on your company and the trust of banks increases manifolds if your company has pvt ltd written. Many start-up registers their company as pvt ltd or tries to do so as it is easier to get loans from the banks and also the seeds funding, the investors investing in the company becomes easy. The cost of this is around Rs7000 and it takes between 5-10 days to register. Its obvious as this is very trusted and hence the regulations by the government also increases, but towards the end of this video I will tell you an easy way to register your company.I would like to talk about another way to register your company and that is limited liability partnership. This is useful when you are a professional in a field like doctors, engineers or chartered accountant. And this is useful when you are forming a company for a limited time and you are going to dissolve it afterwards. For example, you are a builder and you started a company to construct a building where you have employed the workers, engineers, architects but after the building is constructed you don’t need that company and so you dissolve that company. Here this limited liability partnership comes into use. These four ways which I’ve told you are the main ways and most of you will require this, you need to know that if you want to deal with the corporate field or large companies then the preferrable way is pvt ltd only. And if you want to keep your own small business and do not want to get into more regulations then proprietorship is the best way.

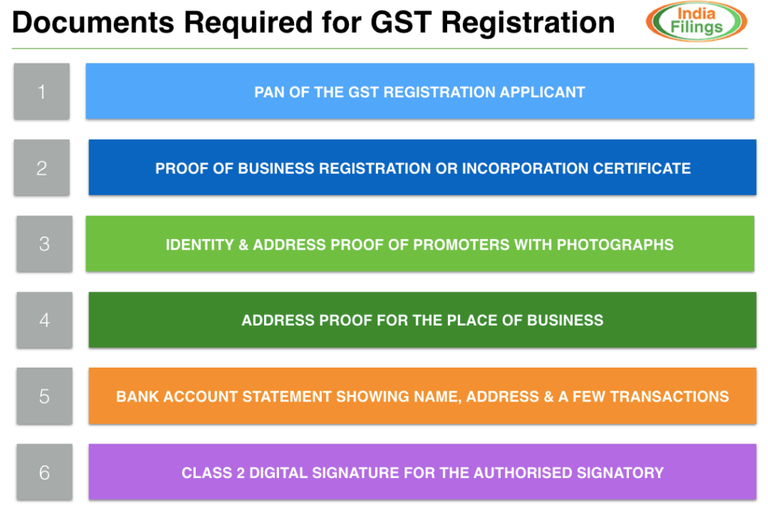

So friends, you have register the company and the next step is to do the tax registration. GST registration is at number 1 here, if your company’s turnover is more than 20 lacs in a year then you have to register for GST.

In some of the Northern states, the minimum turnover is 10 lacs and GST registration is also required if you deal with import-export even within the states or if you have a business related to e-commerce. if you have import-export business then you also need to get Import-Export Code Registration done. In some states, there is a different kind of tax called as Professional Tax Registration which you have to get done if you reside in such states. If you have more than 10 employees in your company then you have to get Employee State Insurance Registration done and if you have more than 20 employees then you have to get even Provident Fund Registration done. There is an optional registration called MSME, this is not compulsory but you will get a lot of benefits if you do it. It will be easier for you to get bank loans, you will get some tax subsidies, exemption schemes and many such benefits so it is good to get it done. There are so many types of company registration and tax registration as well.

Now I have told you about tax and company registration but if your business is about website related he can help you buy the domain name any consultancy required during this work, get your bank accounts open, so all your work can be done by him for the lowest fees.

As the last step friends, I would like to tell you that there are few things which a business has to do every year. It is Yearly Mandatory Compliances, the first thing is Income Tax Returns, every business has to file income tax return at the end of the year. The second thing is Accounting and which you need to do and I would say that you must do it with care. It’s a balance sheet where all your profit, loss, money received, etc is done on a balance sheet. You can hire an accountant for this or if your company is small then you can do it yourself. If you are registered for GST then you have to file GST, It has monthly or quarterly compliance. Next is secretarial compliance which you have to do if your company is OPC, LLP or PVT LTD Statutory Audit you will have to do if your company is OPC or LLP with the yearly turnover of 40 lacs or more than that.

So, friends now you are ready to become an entrepreneur and to start your own business. The post might be long but you will get all the necessary details here.

Thanks for your time. DO follow me, UPVOTE , RESTEEM AND COMMENT below

Thank You and have a great day.

Very good business ideas

Bro this brings me to my company when I had started , it’s amazing experience right from scratch till the end , thank you for refreshing my memory

Thanks bro hope this post might help someone

Informative to grow.. nice buddy keep it up...

Well explained

@nayanborah starting a business step first : Do Your Research.

Very nice, nice content, thanks for upvoted me, same way I m follow you

nice blog