A couple of Bitcoin permabulls trusts that the best positioned digital money will achieve new highs in 2018 and past.

HUMAN PSYCHOLOGY AND BITCOIN PRICE

As per Anthony Pompliano, Bitcoin will reach $50,000 before the finish of 2018.

In an ongoing tweet, the accomplice at Morgan Creek Digital Assets proclaimed that the rest of the long periods of the year would enthusiasm from a value development point of view.

Pompliano constructs his BTC value conjecture in light of three cardinal parameters: human brain research, ETFs, and institutional financial specialists.

Concerning human brain science, Pompliano distinguished the discernable buzz and fervor in the market once any positive value development happens — as we've seen for the current week. He additionally said that individuals by and large tend to like round figures, along these lines prompting a positive push between each thousand-dollar esteem.

With ETFs, Pompliano communicated questions around an endorsement coming in 2018. In any case, the likelihood of an ETF is sufficient to catalyze positive notions in the market. In this way, holders are less inclined to offer in the expectation of a noteworthy value rally. (Recently, the SEC rejected the Winklevoss' ETF application.)

With respect to institutional financial specialists, Pompliano reports that they are starting to plunge their toes in the water. Prior in the month, Barry Silbert of Digital Currency Group (DCG) uncovered that the principals themselves have been exchanging BTC for some time. In any case, the absence of custodial instruments and obvious directions have kept them from completely to conferring multifaceted investments exchanging capital into the market.

DMI SUPPORTS PRICE RALLY PREDICTION

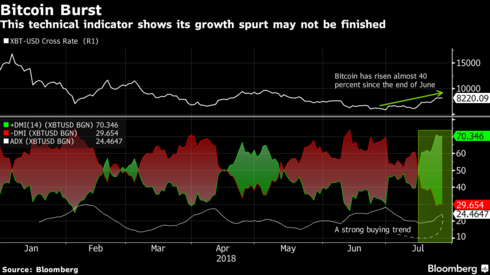

As indicated by the Bitcoin Directional Movement Index (DMI), the ongoing value rally is no place close wrapped up.

The DMI works by demonstrating the level of difference amongst positive and negative DMI as a sign of an advantage's value slant, which is communicated as an Average Directional Index (ADX).

Picture result for Bitcoin $500,000 Creates a Buzz, But Technicals Point to Rally

By and by, the ADX for BTC is right around 25 — which is a positive sign for the bulls.

A lower ADX connotes an unavoidable convergence of the positive and negative DMI, which as often as possible outcomes in a value diminish. The last convergence of both DMIs happened in May, and before the finish of June, the best positioned cryptographic money had declined by in excess of 30 percent.

THE CONTINUING TREND OF EXPONENTIAL ANNUAL PRICE INCREASE

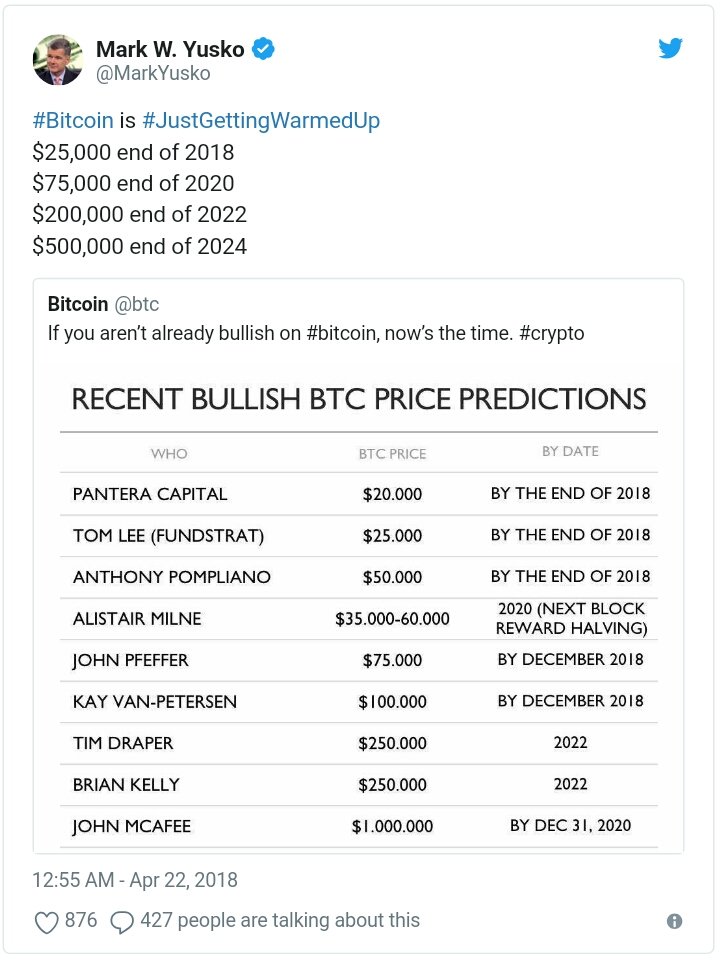

For Morgan Creek CEO Mark Yusko, Bitcoin will at present be going solid, even quite a while from now.

In a tweet from April 2018, Yusko gave a moving figure which put the cost of Bitcoin at $500,000 before the finish of 2024.

For Yusko, the illustrative idea of Bitcoin's cost history implies that its cost continues expanding with consistently. Clarifying further, Yusko says:

I don't think you require a major occasion, and you've seen it in the recent weeks, isn't that so? When the value begins to run. Those individuals that have been looking out for the sidelines to ensure that the bear advertise is over are prepared to bounce in, and afterward once it really begins moving, at that point it begins moving quick, and that is the point at which you get those explanatory moves.

Bitcoin's logarithmic value development is settled, and Yusko references it with all due respect of the $500,000 value estimate.

The Morgan Creek boss says the organization likewise built up a model to evaluate the genuine estimation of the Bitcoin arrange. As indicated by Yusko, this esteem depends on the hash intensity of the system, exchanging volume, and the quantity of members.

Do you concur with these Bitcoin value projections? Tell us in the remark area beneath.