...people should remember that the Gold quantities involved are arbitrary (in other words, the pricing of gold could be in grams, ounces, pounds, kilograms, even tonnes) so direct price comparisons are meaningless.

For example, right now, in the commodity exchanges, "Cocoa" is listed with a price of 2200$. Does this mean Cocoa is more valuable than Gold (1170$)?

The answer is it depends on what kind of quantities are we measuring. Cocoa is not measured in troy ounces but much, much bigger quantities.

It's the same for the stock market. There are stocks with one, two or three digits, and then there are stocks like Berkshire's which are valued at 250k USD each. Why? Because the stock never got a split. Thus the number of stocks is far smaller and this is compensated by increased value per stock. A company's value is dependent on how many stocks there are multiplied by the value of each stock. If a 100 billion company had just 1 stock, that stock would cost 100 billion. If it had 100 billion stocks, these would cost 1$ each.

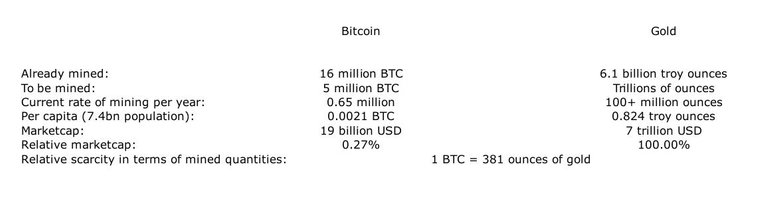

Bitcoin is like a Berkshire stock, in the sense of having so few "pieces" or "stocks". That's also why, as far as the BTC v Gold comparison, absolute price is useless: Instead, people should focus on marketcap (mined quantities * value per unit), rate of mining, relative scarcity, potential, etc.

The average person might find Bitcoin "cheap" at 1$ (in an imaginary scenario where 21 billion were issued) and "expensive" with a price of 1000$ (but only 21 million issued) - yet they are exactly the same in terms of marketcap. It's just maths and psychology which affect investment sentiment.

A small infographic is in order:

Ok, all that is cool, but do you have any predictions?

I don't like giving investment advice, so I'll leave it at that. In any case, I do think that 1% of the gold marketcap (~4400 USD) is both viable and desirable.

Unlike people who think Gold and BTC are competitive, I like to view them as complementary. Reason being that in case of a digital economy, where governments control all the switches to our bank accounts, entry and exit to gold via cash can be tracked, overtaxed (disincentives), or banned.

This will in turn necessitate an uncontrolled form of currency that one can use to buy or sell their precious metals without using government money (if it is even allowed). In other words, I predict that the existence and success of alternative, non-government controlled currencies, is essential to the long-run success of the precious metal market. Investors should have no illusions: The precious metal market will not be the same in the age of demonetization and government controlled money flows.

Great piece and thanks for sharing. Bullish on GOLD and BITCOIN as DEBT and DERIVATIVES begin to fail..!! Upvoted and shared on Twitter✔ for my followers to see. Stephen

Disclaimer: I am just a bot trying to be helpful.

Pure market cap to market cap comparisons are helpful only to get a sense of proportion. Bitcoin is beginning to behave like a currency - i.e., like money. It is being traded, it is being used as a unit of measure in exchange of goods. It is being used as a store of value - all classic definitions for money.

Consequently, it is helpful to start using money concepts to describe it compared with other currencies and other assets. The key concept for money is the velocity of money - how often it gets rotated through the system through exchanges. With a relatively fixed supply and growing usage (i.e., velocity) the demand for Bitcoin will rise - hence the price will rise.

Gold no longer has all the hallmarks of money principally because it is too complicated to use as a medium of exchange. It is now seen much more as a store of value. And that will be the key differentiator that will see increasing divergence in the value of Bitcoin compared to Gold.

You are right. I was tempted to write about monetary comparisons, global money supply percentages etc, but I had to suppress myself in order to keep it in context (gold comparisons as the price approaches parity).

For the uninitiated it often sounds preposterous that Bitcoin can be more expensive than Gold...

I'd note here that in western / developed countries gold transactions are almost non-existent, yet in some developing countries gold is still used (not officially though). It kind of depends on the location.

Good overview of this important psychological point in Bitcoin pricing. It comes down to what people feel more comfortable with holding. There is a lot of friction in the purchasing of gold, transport, market premium, taxes, customs duty, and of course insurance. Balanced against that there is much less volatility in historic gold price. I suspect than many holding Bitcoin may choose to cash out in favour of conversion to the traditional shinny stiff.

.

ColdMonkey mines Gridcoin through generating BOINC computations for science.

This post has been ranked within the top 80 most undervalued posts in the first half of Jan 05. We estimate that this post is undervalued by $4.39 as compared to a scenario in which every voter had an equal say.

See the full rankings and details in The Daily Tribune: Jan 05 - Part I. You can also read about some of our methodology, data analysis and technical details in our initial post.

If you are the author and would prefer not to receive these comments, simply reply "Stop" to this comment.