This is part of a series on How to Escape a Cult that's Taken Over the World.

- Part 1 - The Cult

- Part 2 - Know Your Comrades

- Part 3 - Let The Music Lift You

- Part 4 - Establish Your Goals

Hey freedom warriors!

We need to talk about our imaginary friend who only exists as long as we all believe in him.

Firstly, I know we all like money, but the truth is money is not our friend. Secondly, it doesn't really exist.

What I mean by that is that money is a concept, created by a consensus of perceived values. What we accept as money today - the plastic card in your wallet, the paper notes & metal coins - they're just tools used to represent conceptual value, agreed upon by the network of people who use it. Physically, it doesn't exist because we don't use real money. We use fiat currency which is a substitute for money and the moment we stop believing in it... POOF, it's gone. The paper notes are as good as leaves and your coins worth no more than pebbles or stones. Which is exactly what happened in Venezuela just a few years ago.

The existence of "money" depends on you and me both agreeing on its exchangeable value. That is, the understanding that after you exchange it with me, you will be able to exchange it again with another merchant who has what you wish to buy. So it requires a lot of confidence in total consensus. If your favourite local stops accepting it, well is it still worth as much to you?

Can we still be friends?

Sadly, no matter how many times you take it for dinner or how close you hold it at night, that bond you think you have is a lie. Money is completely devoted to the bank that printed it. Like everything in this world, the more of it exists, the less it is worth, so as they print it they burn a hole in your pocket and the value makes its way back to the bank. The richest people in the world don't keep money because they know this.

How did we decide that a €20 note (which is a piece of paper with some ink printed on it) is twice the value of a €10 note (also a piece of paper with ink printed on it) when they are the exact same type and weight of paper? The truth is we have been playing with monopoly money since 1971. Even according to Wikipedia, states or the countries government "generally have a monopoly on the issuing of currency".

I highly recommend you watch Mike Maloney's documentary on the Hidden Secrets of Money. It's a fascinating story and the best education you'll probably get in your life.

Click here for the full playlist. - Bookmark it!

Understanding money is fundamental to escaping the cult.

The video above is a nice quick summary, but seriously watch the documentary to make sense of everything. It's 10 episodes (about 30-40 minutes each) you could easily watch it all in a weekend or 3 days.

Mike will encourage you to invest in more tangible assets like gold and silver. I'm not going to advise that, nor will I advise against it. My aim just for this article, is to help you to envision a future with a completely different form of money, and to demonstrate what would make it a threat and what would make it a shield from threats.

Money vs Fiat currency

First let's correct ourselves on what we call "money". We'll get to cash later in this article.

"Money" was originally established as a form of a commodity, (such as gold or silver) having a physical property as a metal with the value of many possible uses.

"Currency" was originally backed by the commodity, meaning it was a receipt for the commodity, exchanged with the bank that agreed to keep your gold safe.

Fiat money is government-issued currency that is not backed by a physical commodity, such as gold or silver, but rather by the government that issued it. The value of fiat money is derived from the relationship between supply and demand and the stability of the issuing government, rather than the worth of a commodity backing it as is the case for commodity money. Most modern paper currencies are fiat currencies, including the U.S. dollar, the euro, and other major global currencies.

The brief summary in the video above explains how the "Dollar Standard", happened. The United States benefited from strategically staying out of World War II until the end. If they had stopped the war much sooner, they would not own the federal fiat currency that all other fiat currencies are dependent on.

Now we're in World War III. Just as the US now sits on the economic throne as the World Economic Reserve, setting the rules and standards of global economies that are pegged to their dollar, soon they will be replaced by another who will determine the new rules.

All wars are about a transfer of power between the people and their government or from one government to another. Some call it a psychological or spiritual war because we see no armies, but all wars have used psychological and spiritual warfare to weaken their people into submission. Human armies are the usual weapon of choice, but bio-weapons are just as effective at sending nations into a state of fear, irrationality and submission to disruptive power transfers.

This is a game.

Society itself is a game. We are the players, made up of winners & losers (& cheaters) who are forever both competing and forming alliances throughout the game, in which we may have different or aligning goals. Most of us play by the rules. But by whose rules? Who gets to set them?

If you've never considered how society could be a game, I recommend you read "FINITE and INFINITE GAMES; A Vision of Life as Play and Possibility" by James P Carse.

We call the compliant herd sheep, because they play by the rules of the new game. If we're honest with ourselves though, we were all sheep not so long ago. We who consider ourselves to be "free" and "awake" now, were always playing by the rules of a corrupt game.

According to the game we were born into, the goal of the elites, for you to "own nothing and be happy", started a long time ago, with money. Since money was replaced by fiat currency, the "money" we've earned hasn't actually belonged to us. Firstly because the bank owns the currency, and secondly because before you get your hands on it, the government claims responsibility for part of it.

If your government can take your rights, your freedom or your money, they were never yours to begin with.

Without you giving any consent or having any authority on how they're expensed, your taxes are taken and all employers are forced to pay them in order to have any contract to employ you. This money is then supposed to be spent on public services & benefits, but we have no say on what public services we fund with what's supposed to be our money. Repeatedly we see it wasted on programs the public doesn't support, such as extortionate printers that can't fit through the door, the water meters installed and never used, or TD's giving themselves fancy raises, while leaving our most valued public servants on the back burner.

Now I am not advocating that we do away completely with taxes. That topic is for another article I look forward to writing. In that article I hope to demonstrate how technology that exists today can solve the problem above. But for this article, I am simply saying that you and I currently don't make the rules, and those who do set them in their own favour.

Now the rules of the game are changing again. Why? Partially because since the invention of that technology I just mentioned, a new game started which is designed so that you can quit and start a new one. That's no fun for cheaters. So they need a game you can't quit.

As you're probably aware, the jab passports are simply a gateway to a social credit system. They need compliant people as beta testers, because the beta testers will start with the highest points. To get points you need to impress people with more points than you, so you will have to impress compliant people. This new game will appear to be optional at first, even fun and beneficial. The fun will end when it's the only money we have.

We as a society can't survive without money. You can abandon society & take your chances off the grid, but those of us who wouldn't survive without each other would much rather you stick around and help us to build a new grid.

Currently we are using a currency that is designed to eventually fail because it is not backed by any physical commodity like money is supposed to be. That documentary I recommended above tells the history of how real money keeps getting stolen and replaced by fiat currency. All fiat currencies throughout history have failed. The average life expectancy for a fiat currency is 27 years. Ours has been fiat since August 15th 1971 (only 50 out of 5000 years of currencies).

The World Economic Forum calls the current state of the world the "perfect opportunity for a Great Reset". While the blissfully ignorant deny it, we're seeing many of their recommendations for global transformation come to life. One of their steps in disrupting and transforming the world is to bring on a "cashless society".

Cashless Society

In economics cash can mean any money that is readily used and doesn't involve any form of credit. That would include the money on your bank card. But to common folk like you and I, we tend to use the word "cash" to refer to the money that's not in the bank. So what does Dr Evil mean when he promotes a "cashless society"?

"If everyone were connected to an end-to-end e-payment infrastructure – a cashless environment – there would be transparency in money flows. Whether it’s international aid or private investment, if everyone in the chain were connected digitally, you could see where the money went and how it was spent."

Clearly the privacy aspect of cash, which is when money isn't in the bank and is transfers without any records of whose hands it transferred through, is what the World Economic Forum would like to extinguish. They would like all of our transactions to be traceable and disclosed.

A MONOPOLY is a dominant position of an industry or a sector by one company, to the point of excluding all other viable competitors. They lead to price-gouging and deteriorating quality due to the lack of alternative choices for consumers. They concentrate wealth, power, and influence in the hands of one or a few individuals.

Anybody who thinks there are no transactions that should be kept private are clueless to the deficiencies caused by monopolies. Amazon has been accumulating multiple monopolies because of all the data they've collected on their own merchants and their transactions. Private transactions enable healthy competition in the world of commerce. Without private transactions, the wealthiest will easily take advantage of all the best deals and wipe out all competition, obtaining total monopoly of the industry.

They also say:

"1.4 billion people [...] make do with less than $1.25 a day. Around $1.26 trillion is effectively stolen from developing countries, due to corruption, bribery, theft and tax evasion. If we could reclaim that money for those countries, we could lift those 1.4 billion people above the poverty threshold."

While they like to sound virtuous and righteous in their reasons for wanting total control of people's funds, I would be extremely concerned for your lack of critical intelligence if there aren't alarm bells going off as you read this. Having said that, this isn't completely new to us. The only difference between the taxes we're forced to pay through the banks, and what he is suggesting we should be allowed to do, is the infrastructure that enables our transactions. Instead of banks, who could be held accountable, they would use blockchain.

What can we do?

There are a few things we can't stop and we have to accept as inevitable in order to move forward prepared.

- We can't stop the European Central Bank from flushing our economy into hyperinflation by printing more currency to save themselves.

- We can't stop the Digital Euro Project which started last month and will be a "complementary" currency to use in addition to the existing euro (until hyperinflation renders it worthless).

- We can't stop the European Central Bank from issuing this new currency as a reward for their desired behaviours, replicating the social credit system of China.

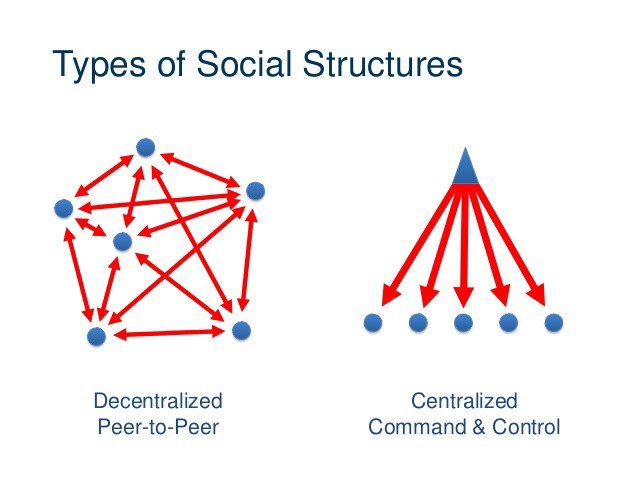

What we can do is we can be ready. They are building an economic system for us to depend on. On that system, they will continue to set the rules, and change them as they please. One of the steps to escaping this cult is going to be a tricky one. We will build our own economic system. We will set the rules and ensure those rules facilitate freedom. The key difference between their system and ours will be a little thing called DE-centralisation.

Now this is where the rabbit hole begins. In order to try to explain this concept to you, in my next article I'm going to tell my personal story of how I became part of a decentralised network.

Centralization refers to that organizational structure where decision-making power is confined to a central authority (or top management), and the subordinates need to follow the instructions of their seniors.

With de-centralisation, there is no central authority. The decision-making power is distributed across the network.

In short, this network has no owner. There is no Mark Zuckerberg or position like his at the top of this social network I'm writing to you from.

We own it.

I am a stakeholder and we the stakeholders set the rules. But this is a social network, not money right?

Wrong.

It's a long story. So I'll explain that in the next article. Just follow on telegram to get updated, or you can click my other articles below to keep reading.

Click HERE to subscribe on telegram!

Conclusion

There is no point in fearing a cashless society. It may have to happen temporarily while we abandon a currency that we can't control. Our existing currency is owned by the banks and we have no control of the value. The value is based on supply and demand, and as the banks continue over-printing and our fiat currency starts hyper-inflating, whether we want to use cash or not will be irrelevant.

The inevitability of the collapse of the Euro doesn't worry the ECB who are getting their replacement ready. The real danger is having no alternative currency to rely on other than the ECB's digital currency, or their social credit system, because once our existing currency crashes, we're not going to have any choice unless we have set one up.

Of course, there is unquestionable value of having cash for our currency. Originally though, cash was just a receipt from the bank for them to safely store your commodities (money). But if we are to transition to a new currency, unless we're all going to become extraordinarily skilled at melting and minting metals on the go, then during that transition period we may be without a form of cash for some time until new trustworthy banks are set up who can provide us with receipts for our money.

The last thing we should expect, is for the cash of our government fiat currency to continue to hold value just because we who have no control of the supply want it to. Let's face the real problem, and solve the cashless problem after we've solved the currency problem.

Related Posts:

- "What's New?" - Who I am, my blog & my re-introduction to the Hive network - this social network based on the Hive blockchain.

- Part 1 - The Cult

- Part 2 - Know Your Comrades

- Part 3 - Let The Music Lift You

- Part 4 - Establish Your Goals

If you're interested in discussing anything from this article with me, whether to provide feedback, your views or anything at all, please join our group chat:

I would only point out that historically, gold and silver ARE money. One could argue that fiat does not fit the definition of "money" as well as gold and silver, mainly because the supply of fiat is potentially limitless.

I completely agree, but I use the word "money" first because that's what we are calling what we use even though it isn't real money. Generally people don't call it "fiat currency" even though that's what it is, so I just thought "money" would make sense to the people who call it that. But yes that's the idea that I hoped to get across, that if it's not backed by commodities it's not really money. Let me know if there's somewhere I can make that more clear.

Cashless is a multi-part win for the wannabe ruling class. You covered the surveillance angle which is the biggie, and obviously there is the interest on credit cards (sometimes very predatory interest).

The less obvious part is the huge amount of profit the banks take in acting as middlemen, and how they can and will collaborate to increase their piece of the pie of almost every transaction. Right now paying with a credit card in the US results in them taking about 3% of the whole thing. Cash can still compete, and some stores and other vendors offer cash/check discount pricing. But if the war on cash is successful, there will be less customers with cash and with less customers dealing with it, it will be less useful to deal in cash for vendors. With credit cards holding a monopoly position, in a perfect market the different card companies would compete and we might see less of a middleman's take. But banks are banks, and we know what they like to do. Expect their take to rise. Of course the expense of their cut gets passed on to buyers in the form of higher prices.

Sarah and me, or I, or which ever pronoun I'm comfortable with using today, have been watching all these videos and we got really sucked in. I keep hearing that due to inflation houses in the US are doubling in price and that you guys have a weird housing boom too, with Chinese-style vacant neighborhoods, but nothing seems to be happening in Brittan, are the houses here just too shitty?

If this were America I would say to invest in bullets and then wait to trade them for gold during the purge, but as dirty foreigner I'm not eligible to buy bullets here, just more proof that the game is rigged! So what should we invest in to avoid cannibalism during hyperinflation?