As a dividend investor we are for the main purpose income investors and should not be worried about the current price of the share price. A high share price gives you a good feeling but is not very helpful when it comes to buying more shares. A drop in the share price is bad for portfolio performance but gives you the opportunity for additional investments. Today I will show how averaging down can improve your dividend income and dividend yield.

What does averaging down mean?

Averaging down simple means that you buy more shares after big drop in the share price and if the share price is below the price the first investment. The goal of that strategy is more or less to improve the your the yield on costs. In the following examples I defined the following assumptions.

Investments every time of 1 500 USD

only invest when share price is below average investment price

dividend growth of 4.0%

period of 10 years

starting dividend of 1.50 USD

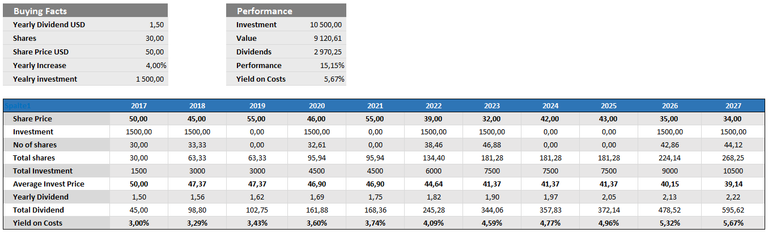

In the example above the share price at the beginning is on a very high level of 50 USD, but we wanted to buy this company because of moderate pay out ratio and because of its constant moderate dividend growth. Furthermore the outlook was quite positive and the financial situation of the company didn't really change. Just the market volatility will be a little crazy in the upcoming years (this is assumption not a prediction).

Well after all you can easily see that we are buying stocks as soon as the current share price is below the average investment price by doing that we are able to improve the the Yield on Costs to 5.67% and will have a total performance of 15.15%, without dividends the performance would be at -13.14%. So you can see by averaging down our investment price it was possible to turn a negative overall performance in solid positive performance.

Of course the dividend growth is also a big factor in this example, without any dividend growth the yield on costs would be at 3.83% and total performance at 8.57%.

I also think that this example shows especially two things be patient with your investments and don't sell when share prices drop take the chance for further investments.

Dividend Investing is a long term play!

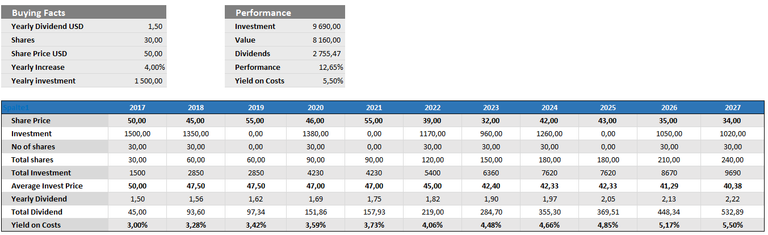

There is also another possibility to do averaging down, when you purchase each time a specific number of shares. The result will look like this:

The result is slightly worse than the other one but we were still able to improve our yield on costs and the performance is still ok.

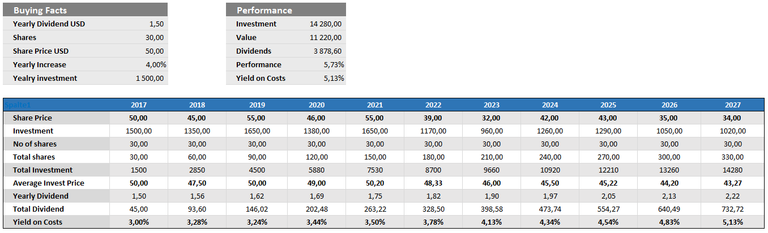

Another possibility is not to care about the share price at all and to buy 30 shares each year no matter what the share price is, let's have a look what our overall performance will look like:

Surprisingly the overall performance is not that positive anymore, but the dividend income is much better than in the examples above, but also your investments are much higher.

Conclusion

I am more a fan of the first two examples as it really improves your yield on costs and you dividend income significantly and you keep the investment to a minimum, and you are also forced to follow the stock news and the development of the company. In the third example it might happen that through the automate investments you do not follow the business development of the company anymore. Of course I have to say that these examples only make sense when the financial situation of the company is still stable and the business model still makes sense.

All in all I have to finally add no matter what kind of averaging down type you are doing always keep in mind it is for the long run and not the short term and by long run I mean 15+ years.

So keep on investing!!

How do you do averaging down? Do you have any specific strategy behind it?

Disclosure: I do not recommend any decision to the reader or any user, please consult your own research. Thank you for your understanding.