SUMMARY

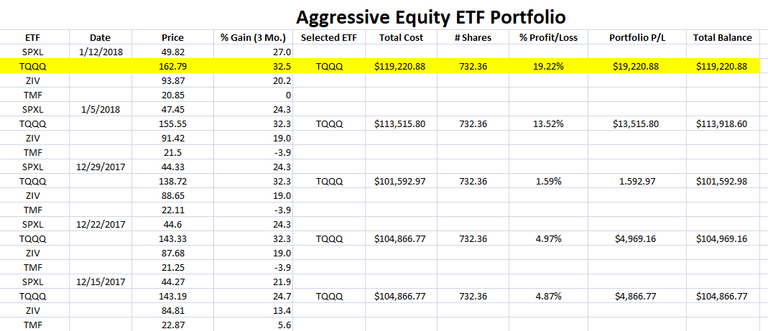

And it's Friday!!! TGIF! That means a check up of the Aggressive Portfolio. The rationale of this strategy is simple trend following. By check the rolling 3 month performance of these ETFs on each Friday, one only needs to see which ETF is winning and put the money in the ETF with the highest % gain.

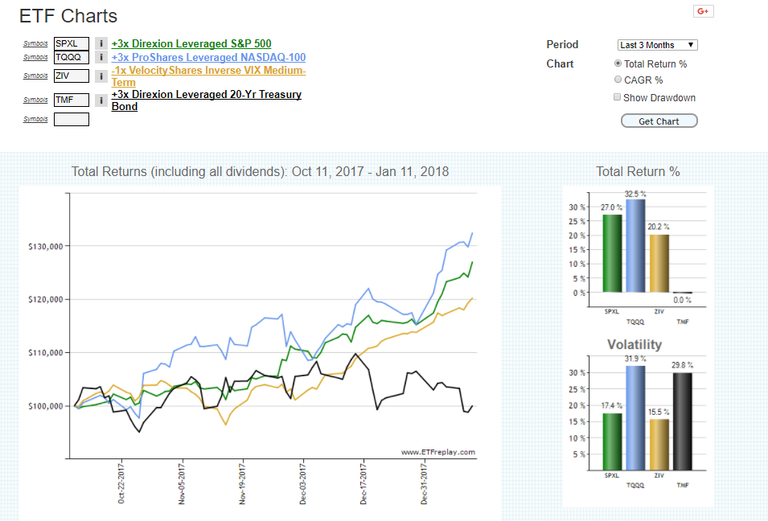

The below chart shows that yet again, TQQQ has the highes % gain in the rolling 3 month performance index. TQQQ has now been the winning ETF for 3rd week in a row. The simplicity of this portfolio is such that it adheres to simple trend following which is the smartest way to invest. Note that should the market experience a sizable bear market, the TMF will become the highest performer and will effectively take you out and into the safety of the Treasuries.

I started this in November 3 of 2017 and currently have realized 19.22% profit! So simple! So easy! Back tests of this method has generated 47% to 78% annualized returns! Yes, that rate of return beats just about every mutual fund and hedge fund manager!!

Please consider reviewing these Tutorials on:

Elliott Wave Counting Tutorial #1

Elliott Wave Counting Tutorial #2

Elliott Wave Counting Tutorial #3

Laddering and Buy/Sell Setups.

Laddering Example with EOS

Tutorial on the use of Fibonacci & Elliott Waves

These Technical Analysis Books: Elliott Wave Priniciple & Technical Analysis of Stock Trends are highly recommended

@haejin's Trading Nuggets

Essay: Is Technical Analysis a Quantum Event?

Follow me on Twitter for Real Time Alerts!!

Follow me on StockTwits for UpDates!!

--

--

If this blog post has entertained or helped you to profit, please follow, upvote, resteem and/or consider buying me a beer:

BTS Wallet - haejin1970

BTC Wallet - 1HMFpq4tC7a2acpjD45hCT4WqPNHXcqpof

ETH Wallet - 0x1Ab87962dD59BBfFe33819772C950F0B38554030

LTC Wallet - LecCNCzkt4vjVq2i3bgYiebmr9GbYo6FQf

Legal Disclaimer: This is only my opinion, make of it what you wish. What does this mean? It means it's not advice nor recommendation to either buy or sell anything! It's only meant for use as informative or entertainment purposes.

Thanks for the insight.

Hi @haejin

Can you please give your opinion on Achain Blockchain and it's hard fork aBTC that took place today?

Thank you very much!

Very nice. This is a great relax portfolio management

Could you please do an update on district0x (DNT)?

Can you please update Cardano (ADA) it doesn't seem to be following elliott wave rules from my limited understanding (wave 4 too deep?) much thanks to you Sir!

Thank you Haejin. This strategy is working great for me.

Would it be beneficial to also leave stop loss orders in place to limit down side loss? And if so, is there a stop loss level (2%, 5%, 10%, etc) that you would recommend?

Thanks again for so generously sharing your knowledge with us.

Any idea how far back this was back tested?

Hi @brojitzu (+@cryptobl0ck)

I back tested this myself. The four funds start on different dates, so I began my backtest when they all existed - 30/11/2010. I got similar numbers as what @haejin said.

I included tax and brokerage fees in my backtests, removing tax from the amount invested each time there was a capital event, and the result was around 44% annualised return (44% per year). Note - they are MY expected tax and brokerage fees for my scenario - if you invest a lot more (or less) and use a different platform, those fees will be different. But assuming my numbers are "around average" - it gives you a fair indication.

I also did a simpler back test (no tax/brokerage considered) on the "less aggressive" suggested funds, and got lower, but good, annualised returns. If I recall correctly it was around 35% annualised.

I don't think I ever saw specific info on the backtests that Haejin conducted. There is a little more detail in his original post where he explained this strategy - https://steemkr.com/bitcoin/@haejin/would-you-like-to-beat-every-mutual-fund-manager-here-is-an-aggressive-equity-portfolio-that-can-average-47-per-year-or-more

Very good post friend very interesting. I already follow you and I invite you to go through my blog maybe something you like and you can support me with your vote.

I hope u upvote back!

Good information and good luck in the future!!!

Your analyzes are mostly correct ♥♥

Do you have any beginners tutorials for newbies looking to start trading from the scratch?

Yes he does. He posted the links in the subnotes of this article.

Omg! Thanks... Wasn't paying attention... Didn't want my comment to be lost,.. So i rushed in.. Lol

ETH is rising because people are still scared of a bigger bitcoin correction.. ?? :)

Great info my friend thank you! Will be following

Really appreciate you sharing your knowledge @haejin . I've only been following for a few weeks and already see that your accuracy is outstanding. Looking forward to an Ether analysis when you do one next, very mixed opinions on Ether charting elsewhere.

Need to put 10k into this...

Nice nice nice! Perfect! What a profit with equity.

I started this two weeks ago and I'm already up around 4-5%, will be following these updates closely!

nice, I finally have my broker account opened and will join the party too now. Best of luck buddy

yep, I started mine a few weeks ago too :)

Haejin, does it matter when one buys into the etf market? According to my TA, it looks like TQQQ is in the 5th subwave of wave 3. Won't it be correcting soon?

Thats when you switch to the leveraged bund fond as example, but the good thing is you dont even need to check the chsrts, you might be down in the short term but on the longer run they compensate each other and you just want to make sure that you regulary bet on the winning horse. also you might want to learn the basics about funds first (if you havent already)

Part of the point of this is it's a fairly lazy portfolio, not checking the charts every other day to see if it's a good time to get in/out. Just check the trend every week or two and adjust accordingly.

Assuming it continues to work in the future (you know, "past performance is not an indication of future performance") it's a good strategy to fairly safely (or at least, lower risk than crypto) increase your investment 'foundation' funds.

Many thanks!

Thanks Haejin, although I prefer cryptos to fiat

How do you chose the 4 ETF ? If they are in a bear market together what happens ? You have to choose it carefully to be sure at least one of them is going up, right ?

bonds compensate stock fonds and the inverse one is another safety net. I recommemd you to learn the basics about funds first

I subscribe to Tradestops.com and he has a similar diversified portfolio. I like this very much because it's a simple way to get into the market and be in those segments that are trending higher and out of those that are not.

Wow thank you for sharing such a valuable information :)