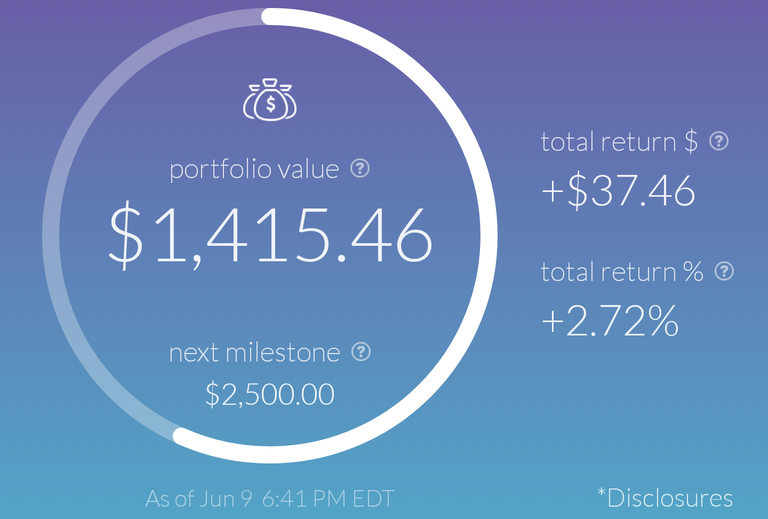

Hello and welcome to my weekly Stash Invest recap where I will go over how my portfolio has been affected through the market week. If you are unfamiliar with Stash Invest, it is an app that allows you to invest with as little as $5 using fractional shares so even someone who doesn't have much money can get started. I plan to make a lot more posts about Stash - which I think is an excellent beginner's tool to help get into investing - so follow me to learn a lot more about it.

This week saw a slight recovery from the previous week’s closing tumble, which saw markets rebound nicely after the previous week took a big hit. There was also a new ETF added to those supported through the app. I will go into that in some more detail after the weekly recap, so let’s get on with it!

Week Open

Two weeks ago, since I am posting this a little late after working all weekend, saw a sharp decline right at the end of the week. The largest decline was “American Innovators”, or the Vanguard Information Technology ETF, which has long been my top performer, so you know I was going to put more money into it!

Day One

I had set up a trade for the first window of the week over the weekend. $100 more dollars into my favorite ETF, as well as another $40 into one of the other funds (a cyber-security fund) that took a beating at the close of the previous week.

Day Two

No Data

Day Three

It’s been a long week on a work project that has demanded far more time to complete than we originally assessed. I even forgot to snap screenshots for a couple days! (Sorry) Really, there wasn’t much going on through the week, as my various funds did very little day to day. There was a least moderate gains through the week.

Day Four

Like last Friday, the end of Thursday took a shot. Unfortunately, nothing I was particularly excited to drop more money into took a hard enough hit and I did just throw a larger chunk in, so I just added a little to an under-performing clean energy fund. I love putting into this guy because it is cheap (less than $9 per share) and I feel it will be a strong player long-term.

Day Five

Markets did little today with only moderate gains or loses. All in all, the portfolio was virtually unaffected having only very slightly increased.

This screener slows percentage returns over time and the funds Rsf, or Relative Strength Factor. I will delve into this more in a future article, but the idea behind this metric is to compare one fund with all other funds. It is scored on a scale from 0 to 100, 100 being the best. This, of course, is only comparing current performance, not overall and obviously isn’t the only factor to measure when considering an investment.

Looking Forward

I will continue to post overviews of the funds I am currently invested in, probably one every week or two. I’m also going to get into some investing jargon to explain a variety of terms. Next week should begin the dividend payouts so that will be pretty exciting. Of course, I will be working next weekend as well so no promises I can get this posted Saturday morning like I prefer. After that, things should lighten up on the weekends a little though, so I can start getting some of these other articles out too. If you want to learn more about Stash Investing, check out this old article. I plan to redo it and continue the series soon.

i love this app... Good ot see others doing well with it. Have you tried Acorns? Another good one

I haven't tried it but I do know it's the same price structure and principle. If I do any more apps, it would either be to track a specific portfolio for Steemit, or Robinhood app for access to direct stocks. Right now though, Stash is most efficient when it's just under a 5k portfolio, so I plan to just keep investing in it until I get close to that mark.