In this video, I talk with author and economic analyst John Sneisen about the recent warning from Morgan Stanley that we'll likely see a correction in global stocks this year.

The bank recently sold off all of their junk bond holdings and the CIO Mike Wilson said this,

“While the tax cuts just enacted in the U.S. may lead to better growth in the short term, they may also bring forth the excesses we typically see before a recession — which is something credit markets figure out before equities." As a result “we recently took our remaining high yield positions to zero as we prepare for deterioration in lower-quality earnings in the U.S. led by lower operating margins.”

He went on to say,

"investors should prepare for at least one correction in global stocks this year."

Now this is happening as bubbles continue to gain pressure across the board and market manipulation meets its inevitable end.

While everything seems great, we're seeing an uneducated euphoria that we've seen far too many times before leading up to a crash.

People are flocking into decentralized assets like Bitcoin and other cryptocurrencies as well as gold and silver. This is a sign of a coming storm as individual demand moves closer towards freedom and further away from centralized manipulation.

See the FULL video report here:

Stay tuned as we continue to break these issues down! Don't forget to Upvote & Follow!

If you like what I do, you can donate to my Bitcoin, Litecoin or EOS addresses below!

Bitcoin:

Litecoin:

EOS:

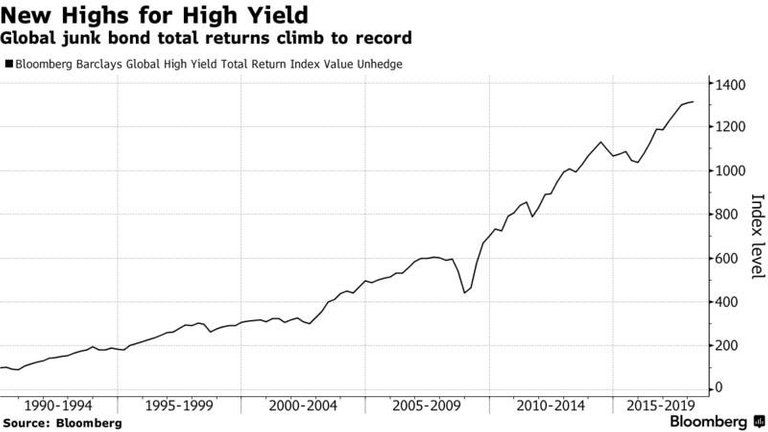

Ah, I miss the Junk Bond days of the late 80's and 90's. Quite pleased to see this post. Thank you @joshsigurdson. One must always be cognizant of the equity component of junk bonds and how it is one of many key indicators of future equity market moves/returns. It was a much more reliable leading indicator back in the day. However, with HFT, ETFs, etc., it has become somewhat less reliable, yet important.

If the stock market crashes, cryptos will go up!

A lot of people will lose there homes. Strange how some one has to suffer in order for someone to keep rewards.

Thanks for your post!

Please Follow, Upvote & Resteem my post to help us to travel & explore more

https://steemit.com/travel/@jonbee/travel-with-us-ep-01-kushtia-sugar-mills-kushtia-bangladesh-bd-steemian

Great interview as usual. Morgan Stanley is getting out while they can. You and John have great chemistry in your interviews!

Great opportunity for crytocurrencies to rise beyond the expected predictions.

If the market crashes, then what about crypto though? Won't silver and gold be the safest investment? After all, do we really know how crypto will end up?

Well if your in a pyramid that is closing quickly, gold can be difficult to get out with, quick. But if you have a hardware wallet, you can run.

But if everything crashes, then what good is a hardware wallet?

Yeah, I always hear this argument floating around. But if everything crashes, assuming it isn't because of the eventual coming of AI, then gold/silver/crypto/money will be the least of your problems. I'd recommend a couple guns, a guard dog, and food and water. No imaginary trade of value will matter too much if "everything" collapses. Oh, and drugs and alcohol, those would be winners.

Let's all build bomb shelters and start preppin' :) Thanks for commenting @luckynumber777

Food, commodities will be the only 'safe' investments when tshtf.

invest in canned food maybe? :)

LOL! okay, so this gif is hilarious.

Thanks for sharing :D

Anyone paying attention knows the crash is coming.. Buy SILVER!

Nothing wrong with a correction. We are now in a year long bull Market - its clearly time for a correction.

They sell their Bonds to hold crypto ..

People seem to think that cryptocurrencies are not subject to the same risks. They are.

Many of the largest currencies don't have any real underlying value and minimal purpose. The average newbie investor is buying coins because they're increasing in value, without understanding that the value doesn't exist. It's a ton of FOMO hype.

I foresee a major crash coming sometime. A lot of junk currencies are going to die out and we'll see a lot of consolidation of the market into the remaining cryptos that have actual real underlying products / services.

I think you're spot on @weaselhouse, I couldn't agree more.

The dream of a use-able currency right now for blockchain.. BTC just can't deliver.

It's definitely sowed the seeds, and I think new tech like Hashgraph will be able to deliver on this dream in the future.

In the meantime, 99% of these cryptocurrencies in my view are wildly overpriced, and will return to their intrinsic value soon enough.

I think, like any investment strategy, you want to utilize diversification and cryptocurrencies are another thing to diversify into. It is hard to predict which choice will be the right one when things go south, so be in many things, including cryptocurrencies.

Thanks as always for the good advice Josh!

Morgan Stanley sees what’s coming. Another reason cryptos are exploding, to get out of fiat. Gold and silver would see the same if they weren’t “managed”

I'm pretty convinced silver is "managed" like you say as well as gold.

I guess it all depends upon how bad you think it is gonna get. If the prediction of a financial crash is just a prelude to WW3, or some natural disaster, or a CME from the SUN (kill shot), then having digital money might be problematic if systems are down for a time. Gold and Silver are always difficult to travel with -- unless you put gold fillings in your mouth or something. Never will I do the implant in the arm or the forehead. I'm thinking Yoko's advice is the best: "You can't take nothing with you but your soul. Dig?"

On the topic of bonds...

My friend's parents just met with a financial advisor. They told him their risk tolerance was low, so he suggested a portfolio made up of 80% bonds. It saddens me that the wicked ones at the top have incentivized the pawns at the bottom to pass the buck to an unwitting middle class right before a 30 year bubble pops.

I think you don't understand the varying levels of bonds, they are selling off the high rate yield bonds , which as much riskier, the FA probably suggested low yield bonds

I understand there are different risk levels that come to bonds. But in this market, all bonds are risky. You've heard of the "everything bubble?" Well bonds is the biggest piece to that bubble. Bonds have been in this bubble for 30 years now. Plus Bonds are literally monetized debt by the federal government as a promise that they will pay you back. We are having a debt crisis right now in the United States and the amount of money that has been borrowed is an impossible amount to pay back. I mean why would any sane person purchase debt of a government that's been running deficit spending for decades?

Hi , new and following you really « nice » topic you brought up , just last night I was watching one of economist here in France , Olivier Delamarche, who just got fired from the radio show on economy because he was giving away his inner thoughts about the crisis to come and how pur gouverments were playing with fire . His in5erviews are only in french but it would be nice I translate and post one of them , because he talks real about banks and how politics make figures talk yo their advantage and to hide and keep people sleeping ...

Thanks for the heads up. Looks like I might need to pull out the rest of my stock money then and invest in cryptos soon! Once the bubble pops I can always reinvest at a lower price.

Hi backlau, totally agree with where your head is at on cryptos. I also think that the post might portray a doomsday scenario. We still need chicken and bread on our tables from Whole Foods and we still need gas from Exxon. Sell some and put it in crypto.

I think you can wait until around early March. As the 1st quarter, 2018, starts to draw to a close, this is when we will learn if the tax cuts are biting in in terms of productivity in the USA. I'm thinking lots of CEOs and executives are going to have some difficulty deciding what to do with all the extra money they have due to the tax savings, and so obvious things like stock buy backs, or investing in automation will occur. But some of them will do stupid things with it, or just leave it in a money market as the dollar drops in value. So there will be some company earning reports that will come out bad. Further, employees, if they don't ask for a raise, will make the same they make now. You MUST ask for a raise. Do it!!!! Next, you have sales people that may not be as motivated because they imagine the company is now DRIPPING in money. Thus, productivity and sales may actually drop. We shall see.

There certainly could be a recession, however, that shouldn't mean we should all race for the exits. Using the approach of dollar averaging, if you would like to be in a net sell position, you can sell your positions at a percentage rate over a period of time. This would help you to lock in some gains if the market doesn't turn south.

First time I’ve seen an EOS address posted like that, that’s a great sign! Here’s to seeing more people post their EOS addresses.

EOS is the future

i would like to know how to get a EOS address...

I make my EOS trades at Kraken.com. I hope that helps.

Go on the EOS website they are still having their daily token sale. So you need an ether wallet have some Ethereum and send it to 0xd0a6E6C54DbC68Db5db3A091B171A77407Ff7ccf (Don’t copy this link I could be a scammer, silly) once you have bought you need to register, to do that go to the EOS website and click register they will give you an EOS private and public key, map it to your ether address (they show you how) and presto when the blockchain hits in June you’ll have EOS on the the EOS blockchain. If you want the tokens now to trade you can claim them and use them right away. Buying from the ICO is 99% of the time cheaper than an exchange like kraken, and you normally save 10-20% on the exchange price. Peace x

Another crash is to be expected after the last massive one in 2008. It’s part of the play by financial institutions to drive valuations down as the fear generated by them causes individual investors to sell low what they bought high after the last recovery. Here we go again. Lots of people going get screwed real soon. After the crash, the same financial institutions will go in and mop up distressed assets and ride the next run up. All within the tenure of their current CEOs careers before they retire and anoint their successors.

True that, and well said. That's the way the game is played.

It seems so obvious, and yet few seem to capitalize on it.

Thanks!

Upvoted & resteemed

Ripple provides one frictionless experience to send money globally using the power of blockchain. By joining Ripple’s growing, global network, financial institutions can process their customers’ payments anywhere in the world instantly, reliably and cost-effectively. Banks and payment providers can use the digital asset XRP to further reduce their costs and access new markets.

They can also deny your transactions because they are centralized.

Crap product.

I too will avoid Ripple because its for the banks and run by them. Ripple may in fact grow significantly, but just on principal, I would rather be in cryptos, like bitcoint, that can't be controlled by these big players. Not yet anyway.

Thanks for lesson, jamie demon. Tell Merrill lynchmob we aren’t buying anything you’re saying. Xrpoop

Excellent advice, thansk for sharing!

Thank you for this kind of information.

Dear your very amazing post .how to you work steem give me some ideas @joshsigurdson check my Articals thank you

We are all being warned, but how many will take notice. No doubt 'greed'will get the better of many.

Two thoughts on this. Be an investor in things you believe in and things you know about. Don't shy away. Second, invest in companies that have a PEG that is 1.0 or less but also have a 9 or greater analyst rating. These are undervalued or near fair market. If you find these companies, they will rise for certain as clever algorithms also find them. Be sure to read up on the company too, to make sure there are no scandals, or no legal issues, etc. Be proactive in your research. One reason to got into the market and to go out of the US dollar, is that the dollar is dropping. During the Trump admin, the dollar has lost about 10% already. So if you stay in the dollar, you are losing purchasing power. So you have to get out of it and into something else or some other currency.

Great post 💹 Cryptocurrency will change the meaning of recession when the banks crash 📉

thanks

I'm always glad when I click a WAM report and Jon is there.

Not good.

You could do a video about the debt in detail, exploring the harzards to economy.

Steem Jhon's username?

Great meassage all the video long.

Peace V.

I think the crypto market will grow if there is a stock crash. Due to increase in people getting involved in the crypto world and higher amounts of fiat being transferred from the current crypto investors. Thoughts?

I believe the crypto market will grow if investors take the PREMPTIVE step to exit legacy financial assets like bonds, equities, mutual funds & the basket of derivative products BEFORE the crash and invest in quality crypto assets. There will be significant loss of asset value & confusion to make clear headed decisions in the midst of a crash. If investors are caught flat footed in a crash, I believe it’s best not to panic and hold onto the distressed assets and wait for the dust to settle. Far too many investors tend to repeat the same old cycle: Buy high & sell low. Some of the distressed assets may recover in time.

Every position in a portfolio has to be seen from an opportunity cost perspective. must mean they have a better option (risk reward profile) for that capital. Said otherwise, they sell sell the junk bonds, where does that money go? more inflow into FANG stocks?

I dont think so, the market is strong in this moment.

Great opportunity for crytocurrencies to rise upvote me please

https://steemit.com/bitcoin/@mianusman/off-the-leash-bitcoin-looks-north-after-breaking-usd16k

Looks like my late 2015 prediction was off by 6~7 months.

Thanks for your post!

Please Follow, Upvote & Resteem my post to help us to travel & explore more

https://steemit.com/travel/@jonbee/travel-with-us-ep-01-kushtia-sugar-mills-kushtia-bangladesh-bd-steemian

joshsigurdson Thankyou ,your advice is worth millions :)

The last year I made some short trades with the german DAX and the Nasdaq100 and the DowJones. Hoping that some day this madness of cheap money out of thin air will find its end.

I really thought, that the time is right for a bigger correction in the stock markets.

Yes, there were some minor sell offs... but nothing that would have changed that bullish trend...

Therefore yesterday evening I finally bought two calls.

One for the German DAX (DE000UW8P3S7) and one for the DowJones (DE000UW9RZE1). The knockout level is set under the support of the last bigger correction.

There were severel moments when I did a short trade and got out of it with some euros in my hands. But very often the market just went further and further bullish.

Strange... everyone knows that something is wrong... but we´re still reaching new highs...

hi, vote and follow me, i will do it again for you

Correction means get off the cloud and keep you feet close to the ground, so it will hurt on the way down sadly, markets will continue to find better ways to invest also,therefore cryptocurrencies will grow exponentially.