How to pick a stock that will pay you (increasing) dividend for decades?

What stocks will pay you money year-after-year, and even better, increasing dividend year-after-year? In this article I will briefly introduce companies that are regarded as the best dividend paying companies in the world.

In my first entry here on Steemit I tried to explain what the dividend growth investing strategy is. I highly recommend to read this one first, you can find it here:

https://steemit.com/money/@nordal/start-earning-passive-income-from-stocks-dgi

Common denominator

From previous entry we know that you have to think like a business owner when investing and that many of the best dividend paying companies in the world perform well in in bear markets. Many of the companies have strong balance sheets with remarkable cash flow.

By this time is fair to mention the Dividend Kings list that Sure Dividend has put together (link at bottom). These are companies that have paid consistent increasing dividends for 50+ years!!! Think about that for a second. 50+ years!!

Some of these companies have existed through multiple wars and kept paying dividend to its shareholders. These companies are not your ordinary fancy technology company, Facebook, Amazon or Alphabet. These companies are typically Industrials, Consumer Defensive, and Utilities. That means that they are much more stable in nature and in income. This facilitates dividend payments over a long period of time.

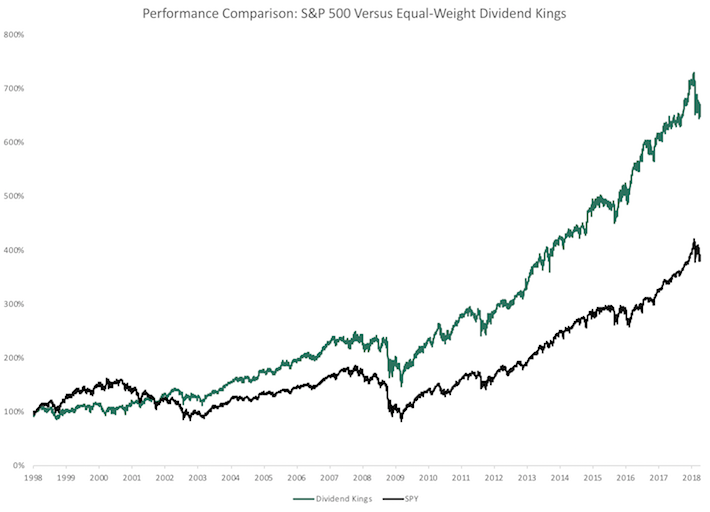

On top of paying increasing dividend for over 50+ years these companies have provided great returns regardless of the dividend payments.

Graph from: https://www.suredividend.com/dividend-kings/

So, on top of returning better total returns, these stocks often have increasing dividends. This means that if you buy one of these stocks, then you will probably earn more and more in dividends every year. The share price increases are sometimes not too major, but the total return granted to shareholders beat the S&P500 over the decades. Historic returns are no guarantee for future returns, but these stocks have existed for so many years, and will probably be here for many decades to come. In a later post I will go over some of these companies in specific, but here are some of these companies.

Coca Cola (Ticker: KO)

Coca Cola is one of the Dividend Kings. They are one of the biggest beverage companies in the world. In addition to this they have one of the most iconic brands in the world. No matter what country you are in, they probably have heard of Coca Cola. They have partners all over the world, this allows them to gain market shares in different segments all over the world. This gives them the ability to try out new products in a limited market and then expand if they are successful.

The Coca-Cola Company has paid a quarterly dividend since 1920 and has increased dividends in each of the last 55 years. Right now they have a dividend yield of approx. 3.57% yearly.

3M (Ticker: MMM)

Another dividend king is 3M. 3M has a portfolio of 60,000+ products that are used in homes, offices, hospitals, schools and businesses around the world. You have probably seen their logo in for example post-it notes or other office materials. 3M sells its products in more than 200 countries. They have raised their dividend for 60 consecutive years, which makes them a member of the exclusive Dividend King list. Right now 3M has a dividend yield of 2.77% a year.

I hope you enjoyed this post, I will continue to post more regularly in the future. Be sure to check out Sure Dividend and his list on his website: https://www.suredividend.com/dividend-kings/

If you missed it, be sure to check out my first post elaborating on the dividend growth investing strategy: https://steemit.com/money/@nordal/start-earning-passive-income-from-stocks-dgi

In the future I will write more in detail about different companies and more about the dividend growth investing strategy. If you want me to write about any specific companies be sure to let me know.

Disclaimer: These companies were just picked out of the Dividend Kings list. It should not be considered as financial or investment advice of any kind.