The prices of commodities (oil, gas, gold and silver, among others) have never been so low compared to US stocks since 1971. Due to the monetary policy of central banks, stocks and bonds began to rise, but due to weak economic growth, prices of important commodities like oil have been under pressure over the last couple of years. Meanwhile gold and silver are also struggling to break the downward trend of recent years.

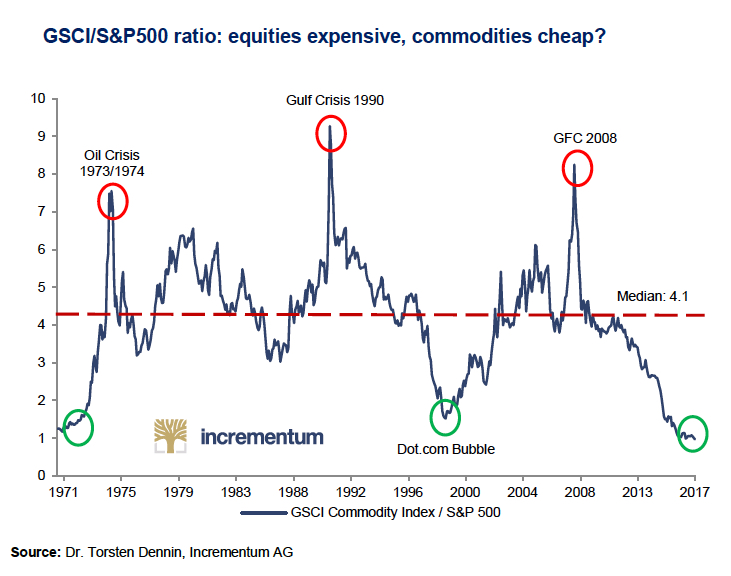

In relation to the S&P500, the GSCI commodity index is currently trading at the lowest level in 50 years.

The chart above outlines the valuation of the GSCI commodity index relative to the S&P500 stock index. The GSCI commodity index comprises 24 commodities from all commodity sectors and serves as a benchmark for investment in the commodity markets and as a measure of commodity performance over time. If the ratio is low (green circles), it means that commodities are cheap relative to shares. If the ratio is at a high level (red circles), like during the Gulf Crisis in 1990, the prices of raw materials are relatively expensive.

The current ratio is 0.87 while the median is at 4.1. A return to the median gives 371% potential, but in most cases a rally doesn't stop at the median. Markets usually evolve from one extreme to another. From cheap commodities to expensive commodities. Just look at the rally from 1999 to 2008.

As an investor you do not often get an opportunity to buy assets at the lowest price of the past 5 decades.

Stocks vs Commodities

Based on this comparison, we can conclude commodities are currently relatively inexpensive, or US stocks are currently overvalued. Or both. Either way, history teaches us that extreme valuation like this never last forever. While it's not a good timing indicator it does show that this ratio will need to regress back to the mean. The last time stocks were relatively expensive compared to commodities was during the dotcom bubble of the late nineties. We know that didn't end very well for the stock markets...

Are stocks overvalued?

Today, US stock markets are at record levels again, while the economy is still recovering from the previous crisis. Shares are valued as if companies are going to make even more profits in the future, while meanwhile US jobs growth is slowing down and the expansion of the world's largest economy remains stuck around the 1% level.

So the big question is what justifies the high stock prices of today?

Stocks are overvalued because those with huge amounts of capital are putting it into the market for short term gains. Commodities is a longer term asset. Like gold and silver it is more of a hedge against more risky investments and as a store of value versus a weak dollar. Another reason the commodities are so undervalued is due to the comex and the creation of fake commodities like paper silver that drive down the price of the physical metal which makes it cheaper to buy. What this tells me is to buy physical silver as much as possible and also to start storing fuel while it is still cheap. Once the market corrects itself the price of energy will go up and the buying power of the dollar will go down as everyone races to get out of the stock market bubble. People will lose huge amounts of wealth tied up in their retirement accounts and as a result this will effect the economy in a very bad way. People will not retire or go back to work because they cannot afford their bills. People will sell the houses they purchased because they cant afford their mortgages and this will lead to the collapse of the housing bubble and an increase in the rental market demand. In this time of transition it is those who are in jobs that are most needed, like in the medical field, Doctors and Nurses, who will have the highest job security while those in sales and the auto industry will find themselves in hard times, except for mechanics, who will have more business as people repair old cars rather than purchase new ones. This will affect credit, and banks will have massive amounts of defaults on loans, further crippling the housing market and debt bubble. People will lose huge amounts of wealth period, so for those with open eyes to the writing on the wall they need to protect their assets by buying physical silver and gold but more so silver. Silver is easier to use as currency in a hyperinflationary period which we will see, very soon, in my opinion. Over the past 50 years the dollar is worth only 2% of what it started out as. That is why you could buy a new car for $700 back in the day and the same car now is around $35,000. Think of a Chevrolet Camaro. In 1969, ~$700, 2017, ~$30k. Average house price was $40,000, today $200,000. Buy physical silver now while you have the chance and while its manipulated price is low. The usual ratio of gold to silver is 1oz to 16oz. Today it is 1oz to over 70oz. Gold is very expensive and yet silver is cheap due to the paper market manipulation so you need to trade in those paper 💵 for real, in your hands Silver, and realize that when the SHTF and prices come back to "true value" your house will be worth less than half, your 401k less than 50% if not 25% and the price of commodities like gas will go up to $7/gallon if not $10 or more. Gold will go up too but silver is the "common mans" precious metal. An ounce today is around $16-$17 so buy 10 a month if you can afford to. Sell your stocks and buy silver and hoard it up. Go to the bank and trade a $100 bill for a box of nickels and pennies because when the paper becomes so devalued the metal at least will still be metal especially copper and nickel which are themselves valuable and can be used as a medium of exchange. This is getting to be a really long reply but crypto will also go up as the dollar goes down but at the end of the day nothing will be a better thing to hold than real precious metals like silver and I would buy as much of it as I could. Also stock up now on food while it is still cheap. Store water just in case. I have a three month supply of rice and beans and some other food just in case people are forced to buy food at extremely high prices. You won't want to trade your $500 oz of silver coin for a bag of rice. Buy ammo (and a rifle/shotgun) because in desperate times people do desperate things and you want to be able to protect your wealth and food from would-be robbers. A bubble like this is unprecedented because each market is in one as commodities are cheap. I think this is the plan, to rob the wealth of the common man and create a second great depression, and those with the money will buy up land at very low prices as everyone is selling to keep their heads above water. "Beat the Street" (Wall St) and prepare now while prices are low and everyone is on autopilot. Buy extra for your family members who arent preparing. You have nothing to lose but everything to gain. Actually you have everything to lose if you have a mortgage and debt so try to get out as soon as possible. This is what a "prepper mentality" is and why people stack silver. Because once the dollars buying power goes down and people are being laid off those who prepared will keep their homes and those in needed jobs will still have an income. Reduce your risk, buy silver now and learn a skill. Sorry for the long reply.

Interesting commend indeed, I expect a very bad time too, a revolution comes never easy and I think we are in the beginning of a revolution now. I think people are waking up because of better information served by the internet and the elite is loosing control. Bitcoin gives people an alternative, and this alternative is way more efficient and will finally prevail.

My way of preparing however is not by buying food, silver and guns to stay on one place, but to own as less as possible what makes me incredible mobile. When shit happens it is easy to move to a part of the world where it is still (relatively) good and almost all my savings will be in crypto's, so I can bring it easily. Also some golden jewelry can be worn, but this is limited.

Great idea! But where shall I store these amounts of metal? I'll dig it in the forest.

Wow...interesting comment. Some good valid points there. Maybe consider making a post of it next time :) :)

Great reply from a fellow Marine! What an historic time to be alive, fortunes will be made (and lost) with simple preparation, do the opposite of what the banksters want you to do and you will be fine. Following lots of new people here from all the comments, it's exciting to see others who are awake!

Haha love the pic. It was tough getting my buddy to see the writing on the wall though. It was like a ten minute street fight haha. Semper Fi

If it dont make dollars it dont make sense (cents) 🤓

great advice

I think stocks are way overvalued and pumped with free money. The real economy is heading to a depression (ten years of recession, will be in 2018) in my opinion, but it looks good because of the high stock markets. If the economy was really good commodities should be expensive, because of high demand for production. Since the bull run in the stock market is all fake, I expect a huge crash sooner than later. Gold, silver, bitcoin and other crypto's will be the only way to go.

Totally Agree here! Best to keep watching the Markets

Yup, I'm with you on this. Agree 100%. It's just a question of when...not if.

Totally agree that cheap money (not free money), is driving valuation to insane level. With cryptocurrency entering the market, i expect people dumping fiat onto the wider marketplace which will eventually drive up the stock market. Is the overvaluation over? I doubt so. All it takes is a catalyst for the domino to come tumbling down.

I found this post interesting. I think you did a good job

This comment has received a 0.13 % upvote from @booster thanks to: @hamzaoui.

I think I need to start parking some of my crypto earnings into commodities

It would appear that the cycle is starting to repeat itself . . coming to the end of the fear cycle apex . . this meme won't be that accurate for long.

@penguinpablo easy money policy of the Federal reserve and the fact that companies are getting virtually free money.

Countries whose sole economic lifeline is commodities are now, in the interest of national security, are producing rather than trying to abate supply/demand issues. Add this to the flat (read: not increasing) economic power of people, and consumption stays relatively flat.

Also, wages are pretty stagnant so companies are not increasing salaries and are expecting employees to do more.

These are just some thoughts. By no means am I claiming to be an economist...

Great post PP... I am a regular reader but seldom reply as I know you are busy. Thought I would say thanks for this post thought and thanks @wwamd for the terrific reply. Really like your Steem Now tool too - thanks again. SirKnight.

Thank you. I appreciate it :)

I want silver, but I want the metal in my hands

If you do not already own any physical silver, www.silvergoldbull.com has got 10 oz bars at spot price. $160 dollars for 10 oz. is a steal. Buy some!

Peace,

The Last Sage

US stocks have been artificially propped-up by monetary stimulus and rock-bottom interest rates for too long. Now the Federal Reserve finally has to end that, the bubble will no doubt burst.

It's about to get ugly.

Why we need commodities when we have cryptocurrencies? :D

Totally agree,take a look at uranium prices and the forecasts,great opportunities.

I am with you @penguinpablo, I made a post showing my technical analysis on gold and silver, hope you can read it and give your feedback. Happy Trading

https://steemit.com/gold/@aker4444/huge-opportunity-on-gold-and-silver-both-with-a-w-pattern

What justifies high stock prices today?

Simple - Market Manipulation (IMHO). Automated computer trading accounts for the majority of the trades bumping up the prices and showing unnatural volume. Take away automated trading and the market and prices will crash.

Sadly, I fear many people don't have confidence in the dollar anymore and so invest in the markets because they think it a better place to hold their cash.

I believe you are spot on, there is no free market .

The PPT justifies the high stock prices today!

Enjoyed reading the post,very interesting. Sorry I can't give you the answer to your question because I'm fairly new to all this.

But I would love to hear the answer

Speculation and greed is what justifies big stock market in my idea, but i´m a noobie on the subject.

A big crisis like the Gulf crisis will probably send commodities to the roof! And there are alot of hotspots right now in the world. Also in relation to commodities, many people are beting that the prices of food (weaht, corn, cattle) in the markets is very low, and once it starts to go up, it wont come down in our lifetimes because of various reasons (population increase, climage disruptions, etc).

Peace, Carlos

interesting to learn about stocks and commodidies.

👌👍🍺🍻🍺

Nice info there pablo my old chum 😃

thanks for this post, :)

Check out armstrongeconomics.com

The bottom for gold in eur is probably in, but in usd could still make a final dip to form a bottom. Will be a good buy, if that happens. However it could bounce up next week, if it doesnt brake the 1213 dollars to the down side by friday.

Do you think this is just an over-inflated bubble, as is usually the case with major financial crises?

that's a complex post. I appreciate your work! upvote back!

I think aside from Gold, silver, bitcoin and other crypto's . Prices of Commodities will go up. Better start planting crops

Thanks. I'm observing these markets for a long time. The relation between gold and platinum is really crazy low. Normally, PT > AU. Do you know the comments of Andrew Hoffman and Steve St Angelo? In my opinion they both are the best.

There will be a big slump in the oil price and hence the markets will collapse.

Totally agree I have been loading up gradually on commodities over the last year. Trying to buy when its cheap. I use my 401K fund PCRIX to do so which has a pretty good income component too. I am watching the dollar devalue to signal the next upswing. Copper is moving indicating an uptick in manufacturing demand.

I believe it is stock buy backs and dark pools of money.

The high stock prices are bloating bubbles. They bop regularly. Thats how the market makers transform hard labour and time of the population into wealth for their clients.

Hi @penguinpablo, interesting article and upvoted! Do you want to check out a real undervalued commodity stock? If so, you need to check out my article about this oil explorer!

I think the reason is stocks overvalued, because the VIX is in lows too. Great post mate!

Loving this information, I thank thee for zees post. ..hat tip..

This post has been ranked within the top 50 most undervalued posts in the second half of Jul 06. We estimate that this post is undervalued by $28.81 as compared to a scenario in which every voter had an equal say.

See the full rankings and details in The Daily Tribune: Jul 06 - Part II. You can also read about some of our methodology, data analysis and technical details in our initial post.

If you are the author and would prefer not to receive these comments, simply reply "Stop" to this comment.

Isn't that a sign that the economy is not that well

If nobody needs commodities

Or is just to much printed money in the stock market

Thanks for explaining that