By Rusticus of Stateless Homesteading

Lies, Damned Lies, and Forensic History

As regular consumers of alternative media have likely noticed, China's voracious appetite for gold has been reported on ad nauseam in the wake of the 2008 Depression. Endless geopolitical and economic analysts have mused about the implications of Chinese gold accumulation, with most concluding (perhaps prematurely) that some form of gold-backed Yuan is on the horizon. Some extend this scenario further, optimistically declaring that the BRICS NDB (New Development Bank) and AIIB (Asian Infrastructure Investment Bank), led by China, will usher in a "New Golden Era" of progress and prosperity, spelling the end of the Western model of Central Banking tyranny.

The reason for this transfer of precious metals from West to East by the Anglo-American Establishment, these pundits prognosticate, is a simple and tragic combination of incompetence and malfeasance. The aged and corrupt West must end, and in the wake of its destruction, the Phoenix of the East must rise.

Does this narrative, however, have any basis in reality when viewed within the context of history? How have institutions traditionally defined as "Globalists" participated in satiating China's gold fever? Is the hand of the Red Shield, infamously and intimately involved in the metals market for over 200 years, at work, even in the East?

And what, ultimately, do the answers to these questions spell for the "BRICS Saviour" meme?

To begin answering these questions, we must analyze the history of the London Bullion Market Association (LBMA) and the ignominious "Precious Metals Fix" that makes it all possible.

The (Global) Fix Is In

In 2010, the alternative finance community was set ablaze by the revelations of bullion trader turned whistleblower Andrew MacGuire, contending that JPMorgan and HSBC, operating as agents for the Federal Reserve, had suppressed the price of precious metals in an effort to silence the "Canary in the Coal Mine" amidst unprecedented money printing. By using managed selloffs via algorithmic trading bots, bullion banks drove down the price of "electronic/paper" metals certificates at the COMEX, effectively capping their price and ultimately driving them down to new 5-year lows.

The Commodities Futures Trading Commission (CFTC) deemed MacGuire's claims credible enough to warrant further investigation; led by Bart Chilton, the CFTC's probe into silver price manipulation ended in September of 2013 with the stunning declaration that no illegal activity had occurred:

"Based upon the law and evidence as they exist at this time, there is not a viable basis to bring an enforcement action with respect to any firm or its employees related to our investigation of silver markets."-CFTC Statement

What many fail to realize is that the CFTC's conclusion is technically correct. JPMorgan and HSBC were not acting in violation of any legal structure; they were, in fact, merely implementing the dictates of the long-standing LBMA Metals Fix:

The LBMA's early history, as recounted by themselves

Already we can identify the hand of the Anglo-American Establishment at work by way of the East India Company. The LBMA's commentary on the nearly global "Silver Standard" of the 17th and 18th Century is not without consequence; the British Empire's domination of the gold market of the era made subjugation of nations like China and India, rich in silver wealth, notoriously difficult to colonize.

The Opium Wars changed this nearly overnight. Beyond the engineered addiction and mercantile foothold the opium trade gave the East India Company in China, it also made way for the wholesale looting of China's silver wealth:

"From China, the Company bought tea, silk and porcelain. The Chinese wanted silver in return. Over the next 100 years tea became a very popular drink in England, and there was a fear that too much silver was leaving the country to pay for it. To stop this happening, the Company became involved in a triangular trade by smuggling opium (a highly addictive and illegal drug) from India into China.The Company grew opium in India. They were looking for something that the Chinese would accept instead of silver, to pay for the goods they bought at Canton. Opium was a valued medicine which could deaden pain, assist sleep and reduce stress. But it was also seriously addictive and millions Chinese became dependent on the drug."

-British LibraryWith China gutted of her material wealth, the Chinese silver standard came to an end in November of 1935, a mere decade before the implementation of the first truly "Global Gold Standard," the Bretton Woods agreement.

The path was set for a worldwide metals price-fixing mechanism, and the LBMA was more than happy to provide. Front-running the Bretton Woods agreement by decades, the LBMA's own gold fix - run by N.M. Rothschild - was officially established in 1919:

By the LBMA's own admission, the Rothschilds maintain this price fixing mechanism to the present, and seemingly, the sole beneficiary of their recent price suppressing actions is none other than China, the very country looted of monetary metals a century ago. Is this a rare act of benevolence from the Rothschild family, or do they have big plans for the East's newfound wealth in the coming World Order?

The writings of the British analogue to the Council on Foreign Relations, Chatham House, seems to suggest the latter.

Chatham House Rule and the Gold-Backed SDR

Established in the wake of World War I at the Paris Peace Conference, the Royal Institute of International Affairs was created. Fulfilling the dream of the Last Will and Testament of Cecil Rhodes, the RIIA also birthed its more widely known American outpost, the Council on Foreign Relations. Its headquarters, Chatham House, have become the RIIA's colloquial moniker.

As what many would contend is the world's premier "Think Tank," Chatham House has been far from bashful in exploring a wide range of topics, and in the wake of the "Great Recession," gold and the IMF's "Special Drawing Rights" (SDRs) have been chief among them.

While national Central Bankers like Ben Bernanke have been vocal in their opposition towards a remonetization of gold, the supranational level represented by groups like the IMF, Bank of International Settlements, the CFR, and Chatham House have been far more accommodating towards the idea of a return to a "partial gold standard." Chatham House has gone so far as to create the "Chatham House Gold Taskforce" designed explicitly to examine gold's role in a "multipolar World Order."

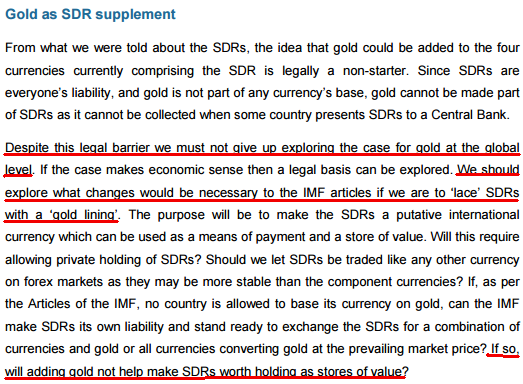

This task force has yielded a number of fascinating forecasts. Take, for example, these 2011 comments by Lord Meghnad Desai, the Indian-born, British-naturalized member of the House of Lords and Chatham House member in a paper entitled, "Gold, the SDR, and Other Matters." Desai remarks:

Far from challenging gold's role as a monetary metal, Chatham House is recommending the exact opposite: Nothing less than a gold-backed SDR to take the place of the dollar as World Reserve Currency, with calls for the IMF to make legal the monetization of gold. All this coming from a man who is a Professor at the Keynesian London School of Economics, lecturing chiefly on econometrics and Marxian Economics. Quite the curious blend of ideology, no?

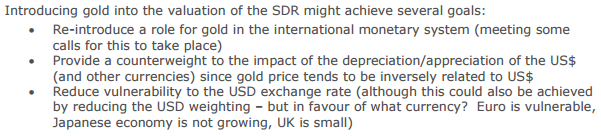

Desai's commentary is far from the only (seemingly) pro-precious metal rhetoric born of the "Chatham House Gold Taskforce." Also included in the report were the writings of one Catherine Schneck of the University of Glasgow, entitled, "Adding Gold to the Valuation of the SDR," directly echoing Baron Desai's recommendation:

Schneck, perhaps directly referring to Chinese gold acquisition, makes specific note of the RMB's current exclusion from the SDR in the paper's introduction. The inclusion of the RMB in the article also seems to imply that "reducing the USD weighting" as called for in bullet point 3 could indeed be "in favour" of the RMB in the future, overtly stating that the Euro, Pound, and Yen are unfit for the task:

Schneck concludes her paper by recommending potential avenues to "mitigate possible obstacles" in implementing a gold-backed SDR. Manifestations of Globalist "monetary magic" could include:

Allowing the IMF to issue more SDRs than they have gold hearkens back to the era of bank-issued Gold Certificates and their eventual monetary debasement; not a new scheme by any means. Nor are "residual" gold claims, which were commonplace during the Bretton Woods era. The last statement, "not include any right to sell SDR for gold," would effectively ensure that gold could never be redeemed by "citizens" from banks, assuring gold coinage would never actually circulate.

A pseudo-gold standard if there ever was one.

The Chatham House Gold Taskforce's premier publication, "Gold and the International Monetary System," maintains the more typical Newspeak of Globalist documents with its somewhat reserved analysis; its most revealing passages, however, greatly reinforce the thesis already outlined herein.

The document reiterates the "rising China" narrative, noting that China's recent advancements in the form of the recently-launched Shanghai Gold and Silver Exchange are a "small step" in subverting the dollar as the World Reserve Currency:

Ultimately, the Chatham House Gold Taskforce concludes that, while the RMB is a strong contender for reserve currency status, it still lacks one major prerequisite for the role - Inclusion in the IMF's SDR basket:

Chatham House also seems to advocate a digital, cryptographic version of gold as opposed to physical notes. Perhaps as a direct response to the rise of cryptocurrencies like Bitcoin and BitGold, perhaps as the implementation of a "One World" digital currency as foretold by Nicholas Rockefeller, Chatham House devotes an entire section of its policy paper examining "digital gold."

So it seems that the Anglo-American Establishment has lofty aspirations for China's gold hoard and the RMB after all. Regardless of the manner by which China's reunion with precious metals has manifested, however, this Globalist plot coming to fruition is still dependent upon Chinese participation.

Is there any evidence to suggest that China desires inclusion into the SDR basket? Would they allow the West to use their gold as collateral against the SDR (or something akin to it) as a reserve currency as opposed to the Yuan?

Enter stage East.

Crouching PBOC, Hidden Bank of International Settlements

Meet the latest actor in our twisted drama, Zhou Xiaochuan:

A Globalist by any objective metric, Xiachuan is the head honcho at the People's Bank of China, effectively the Janet Yellen of Eastasia. Readers, look into the eyes of this man. If anyone were to lead the world's return to "sound money," a BRICS without usury, and a gold-backed Yuan utopia of gold-plated puppies and kittens, by necessity, it would have to be China's most powerful Central Banker.

Think he can pull it off?

Unfortunately for those still steeped in the millieu of the "BRICS Saviour Paradigm," I don't think he particularly wants to. He probably never has, as long before Xiaochuan began China's purchase of Rothschild "fire sale" gold via the LBMA, he joined the Board of Directors of the Bank of International Settlements.

For readers not yet aware of the specific role the BIS has to play in the "Rings Within Rings" structure of the Anglo-American Establishment, it is referred to by Georgetown Professor, Globalist insider, and whistleblower Carroll Quigley as the "apex" of the "powers of financial capitalism."

"The powers of financial capitalism had another far-reaching aim, nothing less than to create a world system of financial control in private hands able to dominate the political system of each country and the economy of the world as a whole. This system was to be controlled in a feudalist fashion by the central banks of the world acting in concert, by secret agreements arrived at in frequent meetings and conferences. The apex of the systems was to be the Bank for International Settlements in Basel, Switzerland, a private bank owned and controlled by the world's central banks which were themselves private corporations. Each central bank...sought to dominate its government by its ability to control Treasury loans, to manipulate foreign exchanges, to influence the level of economic activity in the country, and to influence cooperative politicians by subsequent economic rewards in the business world."-Professor Carroll Quigley, Tragedy and Hope

It is to this "apex" which Xiaochuan counts himself as a proud member of, and it is via this "apex" which he published his official position on Chinese precious metals, the future of the Yuan, and the SDR. The title of this BIS paper? "Reform The International Monetary System," and its vision for the future is virtually identical to that of Chatham House and the Anglo-American Establishment.

Xiaochuan makes mention of the Silver and Gold Standards of the past, right before discussing the "creative reform" necessary to save the global monetary system

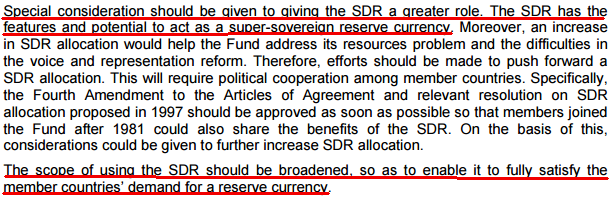

If the Yuan is to become a gold-backed currency (let alone the World Reserve Currency), it will not be accomplished by the desires of the People's Bank of China. It is not the RMB that Xiaochuan applies these grandiose aspirations to, but the IMF and its Special Drawing Right:

The PBOC's recommendation for the SDR as a supra-national reserve currency

Presumably, a world in which the SDR is a "super-sovereign reserve currency" would also include the Yuan in the SDR currency basket. At least, it will if Xiaochuan and Chatham House have anything to say about it. And of all those shiny kilo bars of gold and silver recently re-homed to Shanghai?

Zhou would have them priced in SDRs in international trade. It seems the PBOC would see the Shanghai Gold Exchange as a mere clearing house as opposed to a physical exchange devoted to pricing outside the LBMA fix.

Xiaochuan's damning statements as head of the PBOC and BIS Board Member are not his first documented foray into international financial debauchery. Precious metals researcher and forensic historian Charles Savoie contends that Zhou Xiaochuan had participated in the wholesale liquidation of "paper" silver contracts at the behest of the LBMA at the turn of the Century. If true, this would have effectively lowered the price of silver from 2000-2004 in favor of the COMEX pricing mechanism.

The Gold Anti-Trust Action Committee (GATA) pressed the LBMA on potential silver price manipulation via Chinese silver liquidation, much to the chagrin of Jeffrey Christian of the CPM Group, who referred to China's paper silver dumping as a "myth." A masterful PR move in providing an alibi of sorts for Xiaochuan's silver manipulation, as the CPM Group is a 1986 spin-off of none other than the criminal banking syndicate known as Goldman Sachs.

The same Goldman Sachs that, in 2003, coined the term BRICS and "forecast" the rise of Brazil, Russia, India, and China in a paper entitled, "Dreaming With BRICs: The Path to 2050." Bear in mind, this is a full four years before the BRICs even existed.

What incredible foresight the analysts at Goldman have! Or perhaps it's insider knowledge? Maybe even assistance in drafting the BRICs "vision?" Whatever the case, it is to this "BRICS Dream," the dream of Goldman Sachs, that the United Nations Conference on Trade and Development make reference to when calling on the BRICS bank to fund "sustainable development" projects throughout Asia:

Some, when faced with the evidence of widespread collusion between financial Elites of West and East, paraphrase a passage of Sun Tsu's The Art of War - "Keep your friends close, your enemies closer," and perhaps this is indeed the ultimate goal of the People's Bank of China.

But an equally prescient American saying also comes to mind: "Don't let the fox inside the hen house."

In Closing

Has the fog before the eyes of Free Humanity begun to dissipate? Hopefully enough to realize that the BRICS "anti-hegemon" are no friends of human autonomy. In viewing the BRICS NDB's recent appointments to upper management, the organization's participants are barely distinguishable from World Bank and IMF rosters, and while the controlled demolition of China's financial crisis just begins to emerge, so, too, will the pre-arranged monetary "solution" to the woes it shall create, as outlined throughout this article.

An end to the "Debt and Death" paradigm will not come from national, supranational, or hierarchical structures, but from those seeking Freedom themselves. Unparalleled advancements in decentralization of trade and manufacturing. Truly local agricultural independence. Open-source software, not to mention news. Modern pioneers in liberty are already making great strides in these and many other fields, and it is from these men and women which hope springs eternal.

Not Zhou Xiaochuan's Globalist gold hoard and whatever "New World" monetary paradigm will be foist upon us in the wake of the next financial crisis.

Note: I originally published this article over a year ago in late July of 2015. Since then, a number of predictions outlined in this entry have come to fruition - from the RMB joining the IMF's SDR basket to increased Yuan liquidity, from further integration of Chinese commercial banks with the LBMA to increasingly public partnerships between the AIIB and World Bank, quite a lot has come to pass in a short time.

Given the increasing frequency of such events, I reblog my article here in full in the hopes of keeping would-be readers up to speed on the context of our macrofinancial reality. Thanks for reading!

This is a great article. I have been banging on about this problem for over 18 months and my message is just getting through..!! Was happy to share this on Twitter at stephenpkendal. Stephen.

That's awesome, Stephen! I've also been blogging about this issue for a little over a year now and am consistently flabbergasted at the amount of people in alt-finance media who refuse to put these dots together. Always great to meet a fellow like-mind who "gets it."

Appreciate the retweet too, dude. Do you have a blog anywhere besides Steemit that I could follow? :D

I know the feeling. I managed to get a breakthrough when Max Keiser interviewed me on the Keiser Report in January of this year which was tgen picked up by the guys at World Alternative Media in Canada. If you get a minute search "Stephen Kendal Blockchain Derivatives" & "Stephen Kendal Deutsche Bank" both on youtube. There's a few videos there. Cheers. Stephen.

My goodness, on the "Whiny Ragequitting" episode no less! A fantastic and memorable piece. I remember watching your segment as it aired and thinking, "Blockchain derivatives would certainly compliment a potential 'digital gold' settlement vehicle as recommended by Chatham House..."

Whether or not these things come to fruition in 2016 or later down the road, I think your prediction is spot-on. With increased SDR/RMB convertibility and the IMF's basket reweighting later this year, the monetary infrastructure for a "post-Derivative Bomb 3.0" world is rapidly and undeniably being erected at the global level. Blockchain doubtlessly has a role to play in that world.

Totally agree. Have shared you reply on Twitter, I hope you don't mind. Thanks for the support, I appreciate it. Stephen

Man i surely following you now . Great article

Thanks a ton, iggy ;) You can find the rest of my writing at my blog, http://statelesshomesteading.com

I try to repost everything I write here at Steemit, though! Hope this is the first of many interactions to come.

Please give more , this was a interesting subject to cover . When you read or see news it's just a chatter in air , to much of it and it's hard to place all the pieces together . When someone put's it like you did it's awesome , then it's easy to keep up . Cheers

You got it, @iggy !

My latest in-depth post: https://steemit.com/news/@rusticus/dr-bricslove-or-how-alt-media-learned-to-stop-worrying-and-love-the-nwo

Long entries aren't exactly the kind that gain traction on platforms like Steemit (which is shaping up to be a bit of a monetized Buzzfeed-esque thing; kinda disappointing) but I'll keep posting my stuff here as long as people like you are around to read it.

I don't mind if your entry is mile long ,i will read all . I like deep investigations .