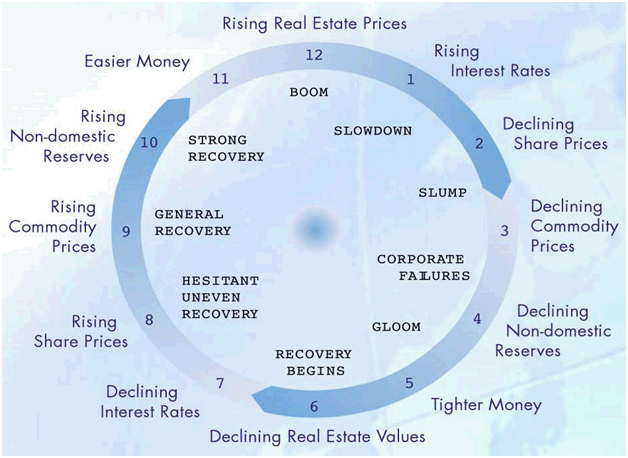

We are always encouraged to make financial investments for our future financial security but school curriculum gives financial literacy a wide berth. How are we supposed to know what we are doing in the financial market? Knowing the different stages of the economic cycle can make the difference between winning and losing in the financial market.

12 O’clock: Is boom time and is characterized by a real estate and stock market boom. The economy has been doing well. Blue chip companies have been turning record profits. Commodity prices are rising. Credit is cheap, life is good and the investment atmosphere is euphoric. Exotic investments promising mind boggling returns spring up all over. Am I talking about bitcoin and other cryptocurrencies? What about pyramid schemes of yester years? These are the times we are living in.

1 O’clock: Is slow down time. Policy makers are alarmed by excesses in the economy. There is too much prosperity and strong purchasing power of the people is overheating the economy. Inflation becomes a problem and policy makers slam on the brakes. They raise interest rates. The stock market and bonds begin to decline. Have you heard central bankers talking about raising interest rates?

2 O’clock: Is slump time. Policy makers raise Interest rates even more. Business activity slows down because credit is now expensive. Stock prices decline together with bonds. Have you heard rumors that a recession in the horizon?

3 O’clock: Here is where we start seeing corporate failures. Corporations that are sustained by debt succumb to high interest rates. Commodity prices decline because of a slowdown in manufacturing. Easy money disappears. The good high life comes to an end.

4 O’clock: Corporate failures continue. Many Jobs are lost. Foreign exchange reserves decline.

5 O’clock: Is gloom time. All remaining traces of the high life and prosperity disappear. Lenders take huge losses from credit defaults and they freeze lending. Money becomes scarce. Only strong corporations survive. The economy slows down to a crawl.

6 O’clock: Real estate gives and property prices tumble. Corporate failures climax. Commercial banks are hit hardest as real estate assets they hold as collateral lose value and undermine debt recovery efforts.

7 O’clock: All bubbles in the economy have popped. Bonds, commodities, real estate and the stock market have all corrected to fair value. Policy makers feel the pressure to jump start the economy and they begin to lower interest rates.

8 O’clock: The economy responds to lower interest rates by recovering unevenly. The stock market begins to rise.

9 O’clock: Interest rates are lowered further and the economy responds by going into general recovery. Employment picks up.

10 O’clock: Is strong recovery time. Credit becomes cheap again. Lenders lower interest rates as they compete for market share. Real estate prices begin to rise. Foreign exchange reserves increase and the good life makes a comeback.

11 O’clock: The economy is in upbeat mood. Employment reaches new highs. Bond, stock, real estate and commodities markets enter into a strong bull market phase. Politicians and policy makers who find themselves at the helm at this time chest thump their efforts. Media complements the chest thumping. Blue chip companies start returning record profits. Goods and services become expensive but people have more than enough money to buy them. The good life returns full swing and people are encouraged to spend. The economy then goes to 12 o’clock and the cycle repeats itself.

This cycle lasts between eight and ten years. The last boom tumbled in 2008. As an investor, you made money if you tuned your portfolio to flow with the economic cycle and lost money if you went against it.

Investing without having this understanding is throwing money at the financial market and expecting it to grow. If you are too busy, or if this subject is not your cup of tea, find a good financial adviser and let him help you walk your portfolio through the different stages of the economic cycle.

https://www.bloomberg.com/news/articles/2018-02-15/austrian-bitcoin-scam-triggers-police-search-across-europe