Today, we will give you a technical analysis of Nano. Before we do that though, we will examine a technical position of Bitcoin. It’s still the king that sets example to where and how the whole market will evolve. In the bear market, when Bitcoin hits its high of the rallie and begins falling, altcoins have either already began falling, or they follow Bitcoin. In the bull run on the other hand, investors don’t want to loose Bitcoins that they have managed to buy cheapely. A lot of them therefore opts for investing into altcoins, which are undervalued against Bitcoin to hedge against fall in the price. That’s why after assessing Bitcoin’s technical position, we will also look at Nano, which looks strong when compared to the Bitcoin.

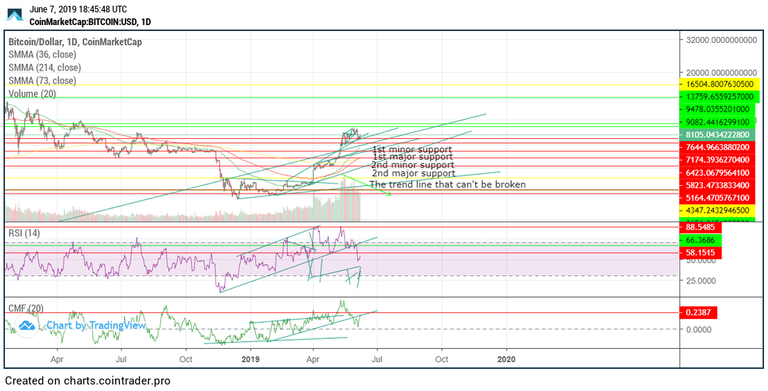

The first thing that you should notice is how daily RSI broke its rising trend. That’s important to note, because a lot of times, investors tend to get stucked in the fluctuations on the short time frame, and they completely miss the reversal in the intermediate trend, which influences the direction of the short-term trend. Currently, we can therefore conclude that on the intermediate time frame, Bitcoin is bearish. That however doesn’t mean that it can’t still reach higher prices in the meantime. Let’s therefore begin with two scenarios that we could imagine to crystallize from this setup.

One of them is a possibility that Bitcoin will still find a fuel to test the resistance laying in the 8105 – 9082 region. If the price manages to climb there, it will again be up to the volume. If volume picks up, and price manages to break the resistance, it’s still possible that Bitcoin will again surprise everybody who is still skeptical about its future development. That’s however still less likely taking into consideration that the latest high was just below the 0.382 Fibonacci retracement and that daily RSI trend line has been broken. The more likely scenario therefore is that the price will rise in the short term, to then test one or all of the supports in the picture below. That being said, it’s currently impossible to conclude the exact price at which it will stop, though we believe that if the price continues falling, the first minor support will be hit.

Since Bitcoin began falling, some of the altcoins, when compared to Bitcoin, seem ripe for a reversal. Would it be therefore possible that we are back in the bullish cycle during which altcoins pump on the Bitcoin’s retrancement, if the retracement isn’t too sudden and big? That being said, it’s possible that a lot of altcoins might still pump up even if Bitcoin continues retracing. It’s though important to keep in mind that this might not happen, and that altcoins might fall even more than Bitcoin itself. Being warned, let us then continue to the analysis of NANO, which has a potential to be one of the well performing altcoins.

As you can see from the picture below, daily RSI has already retraced to the bottom trend line, which has marked a local bottom two times in the past. On top of that, volume has been continually decreasing with each new low that the price hit, suggesting that the selling pressure has been exhausted. That being said, Nano is ripe for a reversal. In fact, on shorter time frame, it seems like the trend has already turned around, and that after price retraces, Nano will continue raising. In that case, the price of 0.0001958 BTC would be a good entry point to enter the bullish position. It’s however still possible that price might dip to the next area of interest, which is at the price of 0.0001764. It would be then very important to watch, if these two supports hold, because in case daily candle closes below these two supports on the increasing volume, there could still be a substantial drop in the price of Nano. If supports hold, it’s very likely that price will reach second green target, and potentially even more of them. All that being said, Nano is a coin to keep in mind in the close future. It will either surprise everyone by how much it bounced once it does, or it might mark the beginning of the panic sell. Only time will tell, and in the mean time, we can only prepare for one scenario or the other.

Sort: Trending