![]() Many cryptuurrency enthusiasts think that when this year's price decreases, in 2018, there has been a sense of recession in all the digital asset markets. Since the value of the continuous bull run of 2017 after reaching a high level of $ 19, after the fall in value, prices of BTC have declined between some small bounces. At present, BTC / BTC average of $ 11,300 is traded in the US market and trade volume has changed in only $ 10 billion in the last 24 hours. After some first unsuccessful attempts this morning, trying to re-examine the $ 11K raised in the morning.

Many cryptuurrency enthusiasts think that when this year's price decreases, in 2018, there has been a sense of recession in all the digital asset markets. Since the value of the continuous bull run of 2017 after reaching a high level of $ 19, after the fall in value, prices of BTC have declined between some small bounces. At present, BTC / BTC average of $ 11,300 is traded in the US market and trade volume has changed in only $ 10 billion in the last 24 hours. After some first unsuccessful attempts this morning, trying to re-examine the $ 11K raised in the morning.

Currently the top five exchanges include BitFinax, Okex, Binis, Upbit, and GDX. USC has jumped once again behind the Japanese Yen because the national currency was the most traded business with the Bitcoin core markets. The currencies made by the top five nations that have traded with BTC include USD, JPY, Euro and KRW. Tater USDT is the third currency within that lineup, which is not a national currency tied to a specific country.

BTC/USD Technical Indicators

Looking at the BTC / US weekly, daily and hourly charts, the bears show that at this time, the rule has been ruled. Two simple moving averages are still spread over 100 long stays under 200 trendline long periods. It usually indicates that some further action is taken in the card, as long as the value can not be received. Using the Fibonacci extension between 38.2% to 61.8% shows that a sale-off can be between $ 9,200 and $ 8500 less. Show similar basic support to backwards books respectively, if the price falls below $ 10,100.

If shoppers can manage to compete with some internal strength on flip side then the path for $ 12 has little resistance on the press time. Back at 12 o'clock the EDT $ 11,150 range has hoped for some traders although the problem with this specific low trend is more related to the higher volume, then the resistance at higher price limits. RSI and Stochestate have moved southwards but it seems they can move forward soon. Bulls are now charging with extreme devotion.

Bitcoin cash value is following the market pattern of BTC

BCH/USD Technical Indicators

BCH charts are similar to BTC charts, and during these past few weeks there is a significant correlation between the two markets. Small and long term SMA 200 findings indicate that there may be fewer BCH prices with 200 below 100 SMA. Bitcoin Cash RSI and Stochastic Oscillators are no different because the levels are very low but show room for improvement. Order books show that if BCH Bullage could break the resistance at $ 1,850, then it is also a good chance that higher prices can be higher. On the back side, however, unlike the BTC chart, BCH shows all the important support areas between $ 1,300 in all ways in between the current prices.

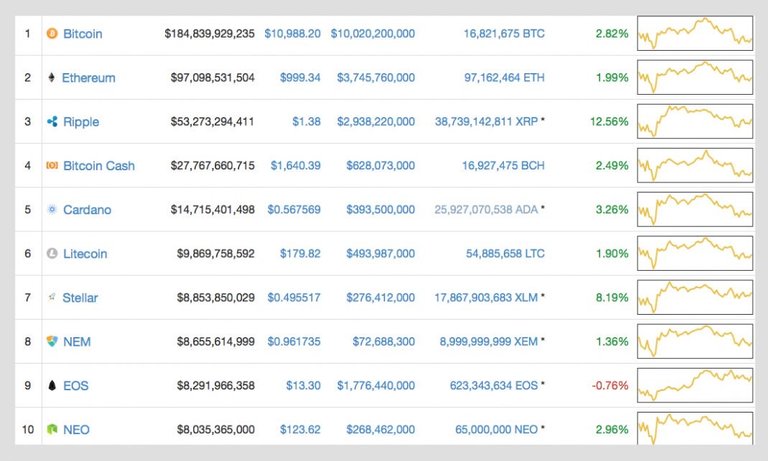

The Top Crypto-Assets

Altogether, the highest cryptocognacus is in green in contrast to yesterday's performance, the second largest market capitalization is organized by ether (ath), which increases by 1.99 percent with an average value of $ 999 per eighth. Prices of wave (XRP) are up 12% because an XRP is trading at $ 1.38. Finally, the fifth place is still organized by Cardano (ADA), because the market is up 3%, which is about $ 0.56 per token per token in ADA prices.

Congratulations! This post has been upvoted from the communal account, @minnowsupport, by arjeshv from the Minnow Support Project. It's a witness project run by aggroed, ausbitbank, teamsteem, theprophet0, someguy123, neoxian, followbtcnews, and netuoso. The goal is to help Steemit grow by supporting Minnows. Please find us at the Peace, Abundance, and Liberty Network (PALnet) Discord Channel. It's a completely public and open space to all members of the Steemit community who voluntarily choose to be there.

If you would like to delegate to the Minnow Support Project you can do so by clicking on the following links: 50SP, 100SP, 250SP, 500SP, 1000SP, 5000SP.

Be sure to leave at least 50SP undelegated on your account.