Week 13 - March 27 Investment Moves

- Options trades for March 27

- CIFR option trade explained

- BAC option trade explained

- Big Time (Web 3) investments moves

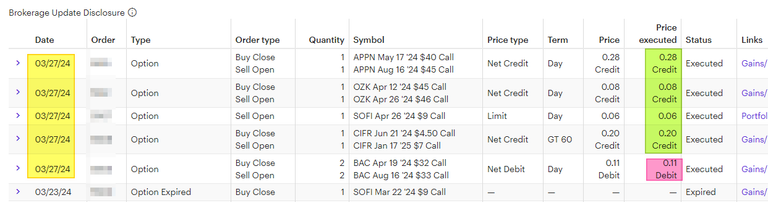

Options trades for March 27

Here are my options trades for March 27, 2024.

Quick Summary of My Trades:

- Rolled up and out APPN covered call. Collected $27.

- Rolled up and out OZK covered call. Collected $8.

- Create new covered call on SOFI (since it expired on 3/23). Collected $5.

- Rolled up and out CIFR covered call. Collected $19.

- Rolled up and out BAC covered call. Paid $24 ($11 x 2 plus fee)

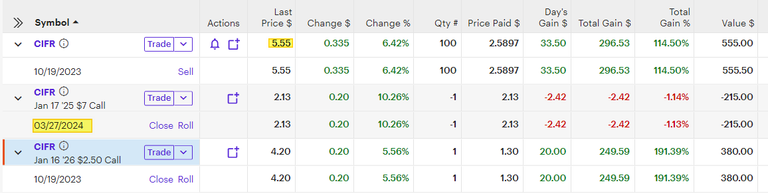

CIFR option trade explained

Here are the details of the trade and my long stock position on CIFR.

On CIFR(Cipher Mining), I rolled a covered call for $20 premium by moving the date to Jan 17 (adding 6 months) and moving the strike price from $4.50 to $7.00! So this means this covered call was ITM today and I moved it OTM and I collected $20 today.

At today $5.35 price, I went from giving my shares away at $4.50 (about a dollar under the market price) to holding my shares at long as CIFR stay under $7 a share.

Now I also have a LONG CALL option with a strike price of $2.50! This means I make more money as CIFR continue to move up faster than the "time decay". This option is already up 190% so far.

The original trade cost me under $400 to do. Today it is worth nearly $900. This was a play on the BITCOIN halving move.

BAC option trade explained

Here are the details of the trade and my long stock position on Bank of America.

The covered call is ITM and the stock is trading at $37.46! Why did I spend $24 on this trade? I have 2 covered calls, meaning I have at least 200 shares of BAC. Moving the covered call from $32 to $33, I get $100 x 2 (or $200), if and only if the shares stay above $33 (today it's $37). Spending $24 today, I can potentially reap the $200 more if the share stays above $33. This is the risk I should take because if I did nothing, I would give my shares away at $32 each.

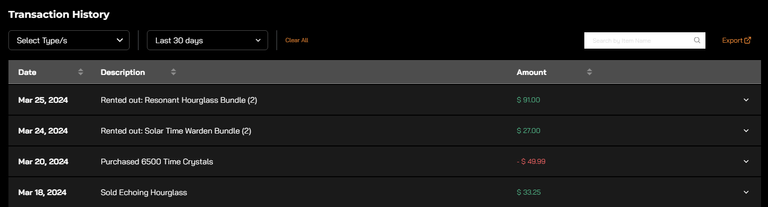

Big Time (Web 3) investments moves

Yesterday, I collected a purple CHG (cracked hourglass) from a rented space that I have.

You can rent spaces for $25 - $50 (USD) depending on the rarity and size. This one drop is worth 35 Big Time Tokens (BTT) x .36 each or about $12 (USD).

I rent spaces because I need them to connect workshops to them. The beauty of this is the rental can generate more than enough "in-game" currency to cover the cost of rental.

Each player has a different approach to this game. I enjoy the game and I use the assets for personal use. I also rent out assets that I'm not currently using at the moment.

I don't have time to grind every day so I often rent out my hourglasses (with time on it) and my time warden. Sometimes I play the regular portal for a casual game with friends.

I love @BigTime as a #play2earn game or a #free2play game. It up to you to enjoy it how you like. I have some friends that put in $0 dollar into the Big Time, and rent out their NFT to others for a monthly profit.

The game is still in early access and you will need an invite code to play:

https://openloot.com/invite/redeem?code=1J523-AKG44-2WXZR-M08EU

1J523-AKG44-2WXZR-M08EU

C0KLW-IBU5J-GT611-S2QAU

DXQ0U-FYWI5-SS37D-Z6OXP

EJKWA-GLD6Q-5APL4-L3O5O

Have a profitable day!

Solving Chaos