Introduction

Having a blockchain technology and a cryptocurrency whose invention was primarily based on "decentralization" and if the same decentralized cryptocurrency is being used for trading in centralized exchanges then the basis of invention of blockchain technology is getting nullified. In other words I can say "There is a conflict of interest".

Whenever a cryptocurrency comes into picture, it is essential keep the term "decentralization" intact, be it trading, storing or exchanging etc. If the "decentralization" does not remain intact then there is no use of cryptocurrency at all.

Blockchain always values "decentralization", then why not decentralized exchange also. Before going further, let's have a brief picture of "Centralized Exchange" and "Decentralized Exchange" first.

Centralized Exchange | Decentralized Exchange |

| Power lies with central authority. | Power lies with the participants of the decentralized network. |

| It is primarily profit oriented which generates revenues in the form of transaction fees from the participants. | It works in a distributed manner routed through several nodes. |

| There is no privacy. | Very high level of privacy. |

| It is subjected to legality and regulatory requirement. | No such requirement. |

| The private keys of the cryptocurrency that is held is the exchange are not with the participant or trader but with the central authority, so in case the exchange is breached or hacked or something like that then all the funds will be gone. So there is no absolute security. | The private keys of the cryptocurrency lies with the participant only. So authority and ownership always lies with the participant and hence even in case the exchange is breached, the fund is still secured. |

| There is a rick of freezing up of the account and also it is susceptible to hacking as a large amount of fund lies with central authority. | There is no such risk as it works through distributed nodes and the owner of the fund is the participant itself. |

| Identity theft risk. | No such threat. |

| Centralized exchanges have enough liquidity | Don't have enough liquidity. |

Now let's have a brief understanding of what is "Future Market" or simply "Futures".

Futures

It enables buying and selling an asset on a future date and at an agreed price.

The exchange acts as a bridge between buyer and seller (or maker and taker) and both pays required margin to the exchange and also honor the contract.

Investopedia Definition: "A futures contract is a legal agreement to buy or sell a particular commodity or asset at a predetermined price at a specified time in the future. Futures contracts are standardized for quality and quantity to facilitate trading on a futures exchange."

As per statistics, almost 99% of the cryptocurrencies are still being traded in centralized exchanges and the reasons for this are :-

(1) We don't have many decentralized exchanges.

(2) With the available decentralized exchanges there is a shortage of liquidity and this is probably the major reason to "why decentralized exchanges are not gaining popularity" and in terms of liquidity centralized exchanges have the upper hand.

(3) Very fast execution in centralized exchange.

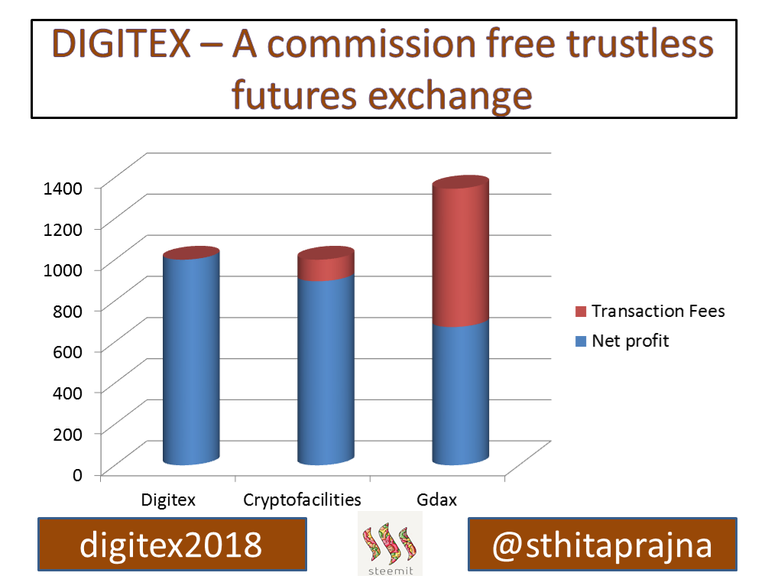

So fundamentally we need a "decentralized exchange" and in order to ensure ease of doing trading and to ensure maximum profitability to the participant or trader, we need to eliminate "transaction fees" and for a better trading experience, we need better "liquidity". The combination of all these three aspects gives rise to the introduction of "DIGITEX".

Further DIGITEX also ensures very fast execution as it is a hybrid mechanism of centralized matching engine and decentralized account operation.

The liquidity issues can be solved in decentralized exchanges(which is one of the major disadvantage) can be solved in two way:-

(1) Establish a bridge among the various decentralized exchanges to ensure liquidity.

(2) Develop a native token for the decentralized exchange which is to be used as a base currency for settlement, loss, profit etc and also allocate a percentage of it for the exchange so as to ensure liquidity.

DIGITEX does have a native token called DGTX token which is an etherum based token and profit, losses, margin requirements and account balances are denominated by DGTX. So one has to own DGTX token for being able to participate in DIGITEX exchange.

In conventional centralized exchanges the trader is generally charged by a certain percentage of commission for every buy or sell and at times this commission gets huge if the trader is a day trader and/or a scalper. A scalper generally settles a trade in a short time and very frequently. As the transaction fees that is charged to the trader is in percentage, the scalping strategy by the trader generally does not yield much profit and sometimes even results in losses after calculating with transaction fees. So the bottom line is that transaction fees offset a good scalping strategy. So there is a need for other alternatives.

DIGITEX eliminates this transaction fees and since the transaction fees is eliminated in DIGITEX, a trader can get much more profit even in thin market conditions. Scalping startegy will find its best display with DIGITEX. With the same trading conditions DIGITEX yield a larger profit as compared to other conventional exchanges.

DIGITEX eliminates transaction fees by introducing a native token called DGTX and everything like profits, losses, margin requirements are denominated by DGTX token. One has to buy DGTX token to be able to trade in DIGITEX.

DGTX is an etherum based ERC 223 token which can be tradable BTC, ETH, LTC and other cryptocurrencies.

However it must be noted that for any exchange there are operation and maintenance cost and in DIGITEX the cost of operation and maintenance for running the exchange is done by creating new DGTX token every year and the number of new coins to be minted is decided by the DGTX owners.

In centralized models, the cost of operation and maintenance is generally derived by imposing transaction fees and the transaction fees in reality are much more than the actual operation and maintenance cost.

In decentralized model like DIGITEX in particular, the true maintenance and operation cost is assessed and new tokens are minted and the number is decided by the token owners. So there is complete transparency in the model of DIGITEX.

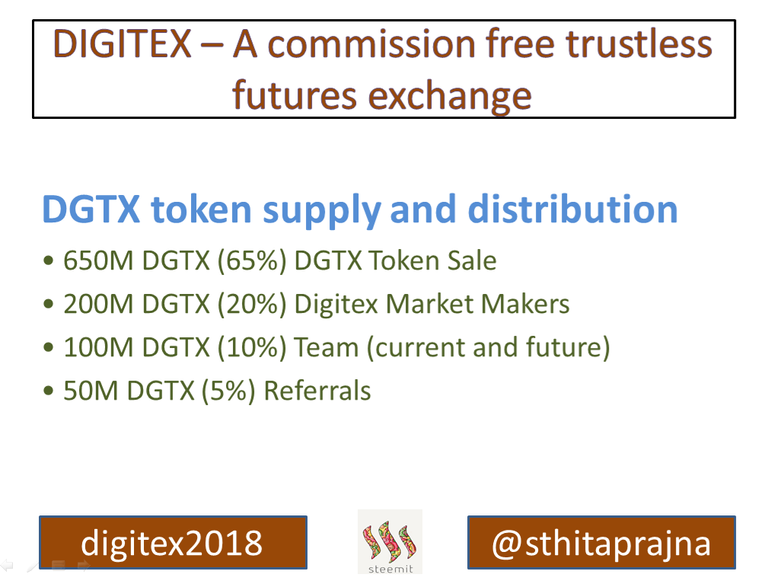

65% of the total supply is sold in ICO on 15th January 2018.

20% of total supply are for Digital Market makers which helps to ensure enough liquidity with competitive spreads.

10% of the total supply is for DIGITEX team both current and future and this 10% will be vested till Jan 2022. Jan 2021 will be the first token creation event.

5% of the total supply is for referrals.

Note - There will be no minting of new DGTX token for the first two years after the launch of DIGITEX futures exchange. The cost of operation and maintenance for these 2 years shall be covered from the proceeds of DGTX ICO. The first minting of DGTX token will be on Jan 2021, which shall cover the operation and maintenance cost.

There is inflation to DGTX token as new tokens will be minted to meet the operation and maintenance cost and the numbers shall be decided by the token owners. It is to be noted that the native currency in DIGITEX is DGTX token, so all the operation will be based on DGTX token denominations. So for a trader to trade in DIGITEX, he/she has to buy the token, so the model of DIGITEX obviously will create an indirect buying pressure in DGTX token. More the number of buyers means the price of DGTX token will go up. When the price goes up, the inflation will go down as less number of token will require to be minted for operation and maintenance cost.

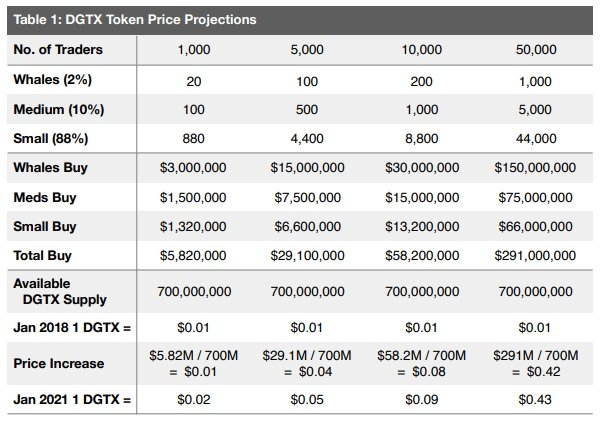

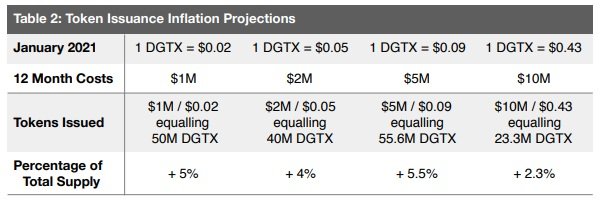

Above is sample analysis of DGTX token price projections. It is clearly evident that with just 1000 number of traders in DIGITEX the price of DGTX will jump to 0.02 USD per token and with 50000 trader in DIGITEX the price of DGTX token will jump to 0.43 USD per token.

We should not forget that we are already in an era where the cryptocurrency demand is really significant. We have many futures market now, most of the enterprises and institutions are adopting cryptocurrencies and even the forex markets have started offering BTC based account and also enabling other crypto assets as a deposit and withdrawal options. With such a craze in crypto segment, even 50000 trader will be considered as a moderate figure and the potential is much more for DIGITEX.

Above analysis shows a projection of inflation with relation of price projection of DGTX token. The above analysis shows a inflation as high as 5% if DIGITEX gets only 1000 traders and if it gets 50000 traders the the inflation will be just 2.3%. And this inflation will further drop if the number of traders in DIGITEX goes above 50000.

So we can sum it up that "even if there is inflation in DGTX token it is low and looking in to the potential of DGTX, the inflation in reality will be much much lower going into the first minting of token in Jan 2021. Minting of new tokens will happen in DIGITEX every year after Jan 2021 so as to cover the yearly maintenance and operation cost. So even with less demand (like only 1000 traders) the inflation will not go beyond 5%."

20% of the total supply of DGTX token which is 200million(as total supply of DGTX token is 1 billion) is allocated to digital market makers and these 20% tokens will all be in circulation so as to ensure liquidity in futures exchange.

Another source of liquidity will be from the participants. Because of the trustless nature of DIGITEX, more traders will get attracted to register in DIGITEX and as more numbers will register, more will be the buying of DGTX token, which will raise the price of DGTX token. As a result of price rise, some of the DGTX owners will try to sell it and that shall be bought by the different traders again. In other words mostly, there will not be dormant DGTX token and there will be more active and liquid circulation of DGTX tokens.

When it comes to offer a composite and absolute solution to futures market, one has to address the issues pertaining to both models of centralized and decentralized exchanges. A centralized exchange does not offer trustless security however on the other fronts like speed of execution, liquidity, reliability, scalability, real time trading etc centralized exchanges have the upper hand. Where as decentralized exchanges are well know for its trustless security.

DIGITEX combines the advantages of both centralized and decentralized exchanges and offers a combined mechanism where it ensures speed and reliability like centralized servers and trustless security of decentralized smart contracts. That is why DIGITEX is very very unique and offers an absolute solution to the futures market.

Trading in DIGITEX is complete secured as it offers trustless security of decentralized independent smart contract. The exchange keeps on interacting with the smart contract for every operation and the exchange does not hold the private key of the owner, so in other words exchange does not have access to the funds of the trader. If a trader wants to withdraw, then the smart contract asks the exchange to get an update on profit, losses and marginal liabilities etc and accordingly smart contract updates the amount available for withdrawal.

Now if someone hacks the exchange then also the fund of the trader is safe just because the exchange does not hold any private key. Second point is that if the hackers tries to send false and incorrect information to the smart contract then DIGITEX has a feature that calculates trader's profit and losses from scratch of the matched orders, so in this way hacker will be unable to create fake matched order, so DIGITEX provides absolute security.

Further security in DIGITEX is enhanced by Metamask browser plugin.

A trader participating in DIGITEX futures exchange can also eliminate DGTX falling price risk by DGTX peg system.

Futures Contract specifications

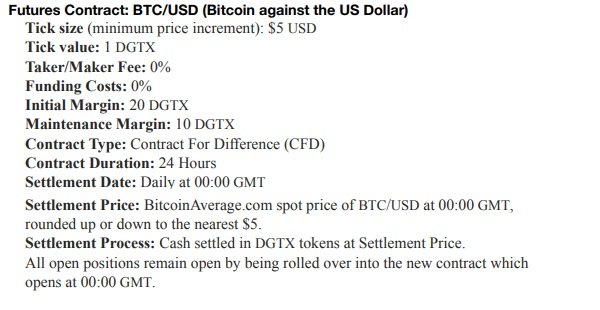

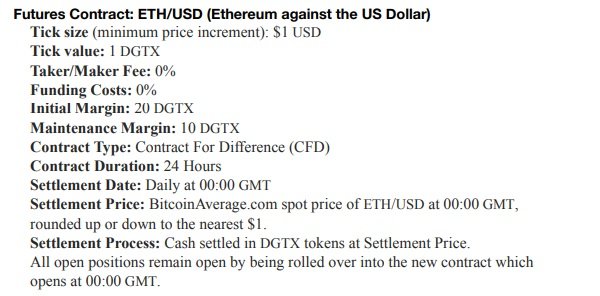

DIGITEX offers three futures contracts : BTC/USD, ETH/USD and LTC/USD. It offers a leverage of 100x. Apart from that, unlike other exchanges DIGITEX will not close a winning position of a trader.

The following are the specifications of futures contracts in DIGITEX.

DIGITEX

No of BTC/USD contracts = 500

Buy Price = 6500 usd

Sell Price = 6600 usd

So profit = 6600-6500 = 100 usd

Tick Size in BTC/USD = 5 usd

Tick Value = 1

So total tick for 100 usd = 100/5 = 20 tick

Initial Margin Requirement for Pardeep = 500x20 = 10000 DGTX (1000 usd)

So Pardeep requires 10000 DGTX(1000 usd) in his account to enter the trade. His account balance is held by an independent smart contract and not by the exchange.

For 1 contract the profit = 20 tick

For 500 contract the profit = 20x500 = 10000 tick

Market price of 1 DGTX token = 0.1 usd (given)

=>Total profit for Pardeep = 10000x0.1 = 1000 usd

There is no transaction fees for this trade in DIGITEX.

CRYPTOFACILITIES.COM

The equivalent figure here is 10 BTC/USD.

Buy Price = 6500 usd

Sell Price = 6600 usd

Profit = 10x(6600-6500) usd = 1000 usd

Price of 1 BTC = 6500 usd

Price of 10 BTC = 6500x10 = 65000 USD.

Initial Margin Requirement = 65000x16.7% = 10855 USD.

This amount is held by the exchange.

Transaction Fees:-

Buy - 0.08%x10x6500 = 52 usd

Sell - 0.08%x10x6600 = 52.8 usd

Total Transaction Fees = 52+52.8 = 104.8 usd

So Net Profit = 1000-104.8 = 895.2 usd

GDAX.COM

The equivalent figure here is 10 BTC/USD

Buy Price = 6500 usd

Sell Price = 6600 usd

Profit = 10x(6600-6500) usd = 1000 usd

Price of 1 BTC = 6500 usd

Initial Margin Requirement = 10+6500 = 65000 USD.

This amount is held by the exchange.

Transaction Fees:-

Buy - 0.25%x10x6500 = 162.5 usd

Sell - 0.25%x10x6600 = 165 usd

Total Transaction Fees = 52+52.8 = 327.5 usd

So Net Profit = 1000-327.5 = 672.5 usd

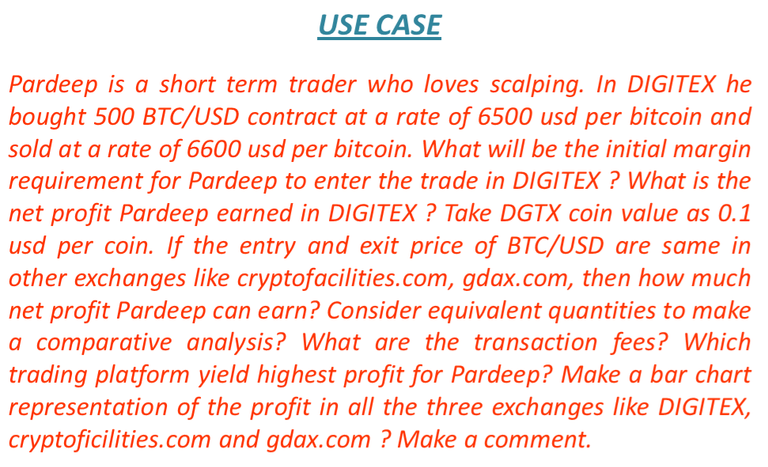

Now let's have a look at the chart representation of the transaction fees and net profit in all the three exchanges.

The above chart shows that not only DIGITEX yield highest profit for the trader under equivalent price and market conditions but also the transaction fees is eliminated in DIGITEX which helped the trader to maximize profit with the same scalping strategy as compared to other exchanges as mentioned in the chart. Apart from that the trader experienced a trustless future exchange.

Summary

DIGITEX with so many wonderful features like zero trading fees, decentralized account operation, DGTX native token, democratic token issuance revenue model, BTC, LTC, ETH futures contracts, one click trading interface, large tick sizes, high leverage, enhanced security, no auto deleveraging, sub-millisecond order entry, off-chain price discovery, on chain settlement, decentralized governance, complete privacy, ensuring enough liquidity etc constitute a model of new generations futures exchange.

With the rise in prices of cryptocurrencies the transaction fees based model gets even more uglier and the trader will stand to loose more, therefore the appeal for a model of exchange like DIGITEX will grow further. More demand means more buying of DGTX token also, means less inflation pressure as demand will offset the inflation.

The notable point to consider about DGTX coin is that even with such a bearish crypto market these days, DGTX is trading green and has risen to 0.03 usd in recent times, so there is considerable demand building up for DGTX token which otherwise indicates that more traders are willing to switch to the model of DIGITEX futures exchange.

Further DIGITEX has the potential to fill the voids of an ideal decentralized futures exchange, as it has those characteristics which ensures the speed of execution like the centralized servers and decentralized independent smart contract interaction.

Going forward DIGITEX will prove revolutionary in the segment of decentralized futures exchange.

More Information & Resources:

- Digitex Website

- Digitex WhitePaper

- Digitex Blog

- Digitex Telegram

- Digitex Reddit

- Digitex Facebook

- Digitex Twitter

- Digitex YouTube

This article is written with reference to the contest organized by @originalworks and The details can be read from the following link.

https://steemit.com/crypto/@originalworks/1250-steem-sponsored-writing-contest-digitex

Coins mentioned in post:

This post has been submitted for the @OriginalWorks Sponsored Writing Contest!

You can also follow @contestbot to be notified of future contests!

Congratulations @sthitaprajna! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click on the badge to view your Board of Honor.

If you no longer want to receive notifications, reply to this comment with the word

STOP