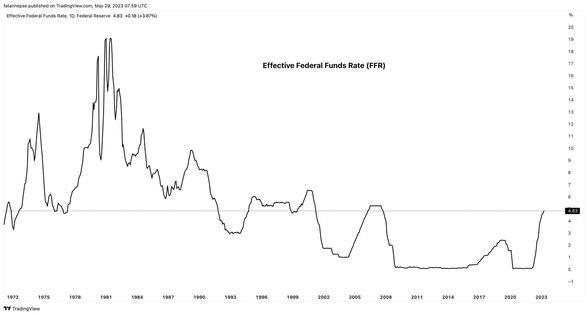

The Federal Reserve has increased interest rates ten times in a row and ended its bond-buying program from the pandemic era since it began its fight against inflation 15 months ago, marking the fastest pace of monetary policy tightening in four decades. It has so far managed to strike a balance that its detractors regard as nearly impossible, cutting headline price growth nearly in half while maintaining the U.S. economy's momentum.

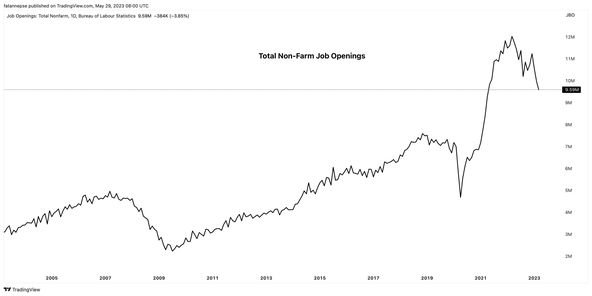

The challenge is that there is still much work to be done, and the hardest parts are yet to come. The Fed has the moral authority to keep inflation under 2%, according to Fed Chair Powell. The hotly contested job data and the price index data also demonstrate that the central bank's policy committee is preparing for its June meeting and that the widely anticipated 11th rate hike will signal the start of a new, more uncertain phase in the tightening cycle. The likelihood of a mistake is rising, and overshooting or undershooting would have serious repercussions.

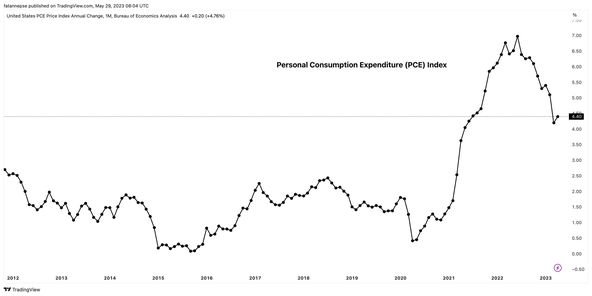

The main issue facing the Fed is that the outlook for the economy is deteriorating just as efforts to control inflation are stalling. According to data released this past week, economic growth slowed down more than anticipated in the first quarter, but the Fed's preferred inflation gauge is still higher than the bank's 2% inflation target despite being down less than a full percentage point from its peak.

The Fed will be forced to decide how much economic pain is acceptable in the interest of restoring price stability and how much would be deemed too much for the nation to bear as it weighs whether and when to pause its rate-hike campaign in light of this contradiction.

In the best-case scenario, the Fed will find a middle ground between two losing strategies: either abandoning the fight against inflation too soon, which would increase the likelihood of a severe recession later, or pushing interest rates too far into restrictive territory, which would cause the economy to contract as early as the second half of this year. Success is not guaranteed and will depend on both talent and good fortune.

They haven't even reached the toughest mile yet. The Federal Reserve increased the federal funds rate from almost zero to the current range of 5% to 5.25%, and future increases are expected. By doing this, it brought an end to the easy-money policies that have characterized the American economy since the start of the financial crisis in 2008–2009.

A continued shift toward a more restrictive stance on policy will exacerbate the pain by weakening the labor market, reducing demand for goods and services, and significantly raising the cost of servicing debt, such as mortgages, auto loans, and the government's more than $31 trillion in federal borrowings. Additionally, it will put to the test a generation of businesses that were raised in a climate of accommodating monetary and fiscal policies.

The financial industry is also becoming more and more unstable. Higher rates have had a disastrous impact on bank balance sheets; according to the Federal Deposit Insurance Corp., the industry's unrealized losses on securities reached more than $620 billion in the fourth quarter of 2022. Two prominent bank failures in the first quarter of this year compelled the Fed to set up an emergency lending facility. Furthermore, if interest rates rise significantly, there is much talk on Wall Street of impending chaos among alternative asset managers and non-bank lenders.

Errors in either direction, such as raising rates too much or too little, run the risk of upsetting a precarious financial system and costing millions of Americans and others worldwide their jobs, undoing years of labor market progress. As long as the Fed is steadfast in its determination to keep interest rates high despite rising unemployment, sluggish growth, and a backlash from the public, even the best-case scenario of cooling the economy without triggering a deep recession will probably result in some painful consequences.

Because of policy choices made more than ten years ago when central banks all over the world began to worry about deflation in the wake of the financial crisis, the Federal Reserve finds itself fighting inflation today. Despite the U.S. economy's recovery, the Fed's early 2012 target of 2% annual price growth was frequently missed.

Fed officials responded by maintaining interest rates close to zero to boost demand and inflation. Additionally, they participated in quantitative easing, a type of bond purchase intended to expand the money supply and promote lending and spending.

When COVID-19 struck in 2020, the Fed had only slightly increased interest rates, and it used the same strategy it had developed a decade earlier to lessen the impact of pandemic-related shutdowns. It reduced the federal funds rate to zero and purchased securities to boost the financial system's liquidity.

Fed Chairman Jerome Powell and other Fed officials, along with many economists, initially dismissed the trend as "transitional," a brief side effect of closing and subsequently reopening the global economy. When inflation started to pick up early in 2021, however, many economists and Fed officials disagreed. It was anticipated that as supply chains recovered, workers went back to work, and factories restarted, price growth would naturally slow.

The previous recovery took more than 10 years to get going, and because of how long it took for the labor market to approach what economists define as full employment, the Fed refrained from intervening in the post-COVID recovery. Even as Congress passed an additional $1.9 trillion in pandemic-related fiscal relief and state and local governments announced enormous budget surpluses, the central bank remained in place. The headline consumer price index had already risen to 8.5% by the time Powell made the first rate increase announcement in March 2022.

For two reasons, the historical context is important: For starters, it raises concerns about the Fed's ability to know when it's time to change course after being caught off guard by inflation two years ago. Fed critics worry that the institution will be prone to maintaining restrictive policy for a longer period than necessary to make up for having initially allowed price growth to spiral out of control.

The backstory also serves as a reminder that some aspects of the current economy have grown accustomed to and are even dependent upon low-interest rates over time. Some economists caution that returning to a world of stricter regulations—or the previous normal—would be a significant shock to the system.

Will we be able to make this change and deal with the shock of everything happening at once? The argument is that

The economy is already sputtering, according to economists who believe the Fed should take a break. They believe that the tightening that has already been implemented will be sufficient to return inflation to the target because monetary policy has a lag.

Recent data is in favor of this theory. With the percentage of Americans receiving unemployment aid up nearly 45% from a September low, unemployment claims are materially increasing. With factory activity declining for five consecutive months, the manufacturing sector is slowing down. Additionally, the 1.1% annual growth in the first quarter's gross domestic product fell short of the 1.9% growth that economists had predicted.

The small-business sector, which has so far supported the labor market and needs access to loans to keep hiring, will face trouble as credit conditions tighten. Some economists anticipate even more anarchy in the banking industry.

Inflation is still significantly higher than the Fed's target. The long-awaited decline in housing costs has been difficult to come by. The Fed wants to see service prices decline, but they have barely moved, and goods prices, which had been falling, are now beginning to rise. The pace of wage growth has accelerated from the 1.1% rate seen in the previous quarter to 1.2% in the first quarter of 2023 for all civilian workers.

According to a different set of data released on Friday, the core PCE deflator, the inflation indicator that the Fed pays the closest attention to, stood at 4.6% in March and slowed down less than analysts had predicted. Core PCE has essentially been moving sideways since the middle of last year when viewed quarterly, which smooths out volatile month-to-month changes. And that's after factors like supply-chain snarls, pandemic shutdowns, and generous fiscal stimulus, which were initially thought to be the main causes of inflation, have largely subsided.

The Fed now has more work to do, as it has vowed to prioritize a return to price stability even at the expense of economic suffering. Posen observes that only a small number of what economists view as the key indicators of tightening monetary policy are decelerating significantly. Wage growth, employment in the construction industry, and credit spreads are all factors that seem to be in good shape.

Inflation surprises on the upside are still a possibility. Labor markets are still constrained. A shortage of semiconductors persists. Additionally, financial stimulus is still being distributed to sectors like green infrastructure and defense.

The Fed is prepared to continue tightening for the time being, given the cards on the table. But how will the authorities know when to stop? The likelihood that they won't is possibly the biggest threat to the economy in the upcoming months.

For one, given how the pandemic has changed consumer behavior and muddled seasonal adjustment calculations, bank officials are dependent on economic data that is backward-looking and challenging to assess. Before easing up on rate increases, they also intend to secure a slowdown in service inflation, which will entail waiting for spending categories like airline travel, daycare, and recreation services to exhibit price deceleration.

In particular, since the agonizing inflation battle of 40 years ago, when then-Fed Chairman Paul Volcker dramatically raised rates, cut them when the recession hit, and then pulled them up again months later when inflation proved to be more ingrained than anticipated, Fed officials have emphasized their fear of repeating history. Powell and other top officials have recently made public remarks that seem to indicate they would prefer to keep rates high and endure the economic hardship rather than lower rates and then have to raise them again relatively quickly. As a result of their research into previous instances where the Fed allowed inflation to spiral out of control, they concluded that the common error was giving up too soon.

A more recent historical lesson is also important to remember. Misreading the economic environment and failing to act swiftly enough to change course were the Fed's main policy mistakes over the past two years, which allowed inflation to run amok. We will now watch to see if they repeat their error.