Whether you are filthy rich or just splashing out for retirement, we all want to go on a luxurious cruise and live up the high life. Some may dress up smart in tuxedos and ball gowns, whilst others may just opt for more simpler dress style such as trainers and shorts.

However, one equalising attire in the wardrobe is the humble life jacket which we all will have when we get on board. You know! The inflatable orange floaty thing. When you are on the high seas safety comes first no matter how wealthy you are.

These life jacket keeps you afloat and keeps your heads above water if you should need it. When you join the Populous cruise, there will be life jackets for everyone.

SMEs in the UK

Just some statistics from the UK government about SMEs in the UK.

Statistics from the UK government shows there just over 5,400,000 SMEs in the UK and growing in 2015. The combined annual turnover of these SMEs was approximately GBP1.8 Trillion, 47% of all private sector turnover in the UK. The report can be downloaded from the link below.

According to government statistics on insolvencies, the number of businesses that went into liquidation in Q3 of 2015 was around 3500. There has been a steady decrease in the number of businesses going insolvent and you can download the PDF document from the link below.

Just looking at the numbers, I would say the overall economy in 2015 was quite healthy and if my interpretation is right then insolvencies is only 0.14%. However the looming “collapse” of the world economy and BREXIT may change business outlook in the future.

Why Sell Invoices?

Businesses sell invoices to meet liquidity needs. You can drill down further to find a variety of reasons why businesses want access to more funds and two options are explored below.

Floundering?

When the business’ cash flow starts to dry up it can be devastating: bills remain unpaid, raw material cannot be purchased and employees have to work for free. There are a number of things that can cause this, but quite possibly the main reason is the owners/management themselves.

You could say that the government unexpectedly increases interest rates thus causing your existing loan repayment to go up, labour cost on the rise or rising inflation spiking the costs of your needed raw materials. Taking on too many orders at once can also cause liquidity problems but these issues can be mitigated by budgeting for the “unexpected”. Maybe easier said than done!

A business can be profitable yet come unglued because of cash flow issues. There is no point being able to sell the best product and then not having sufficient cash flow to keep the business running. The inability to forecast cash flow with reasonably accuracy can be devastating for a business.

Up Sizing?

A business sees a promising market but has no funds to help it expand causing missed opportunities. This is where invoice financing can help. Invoice financing provides the needed funds to buy more raw materials, hire more people or upgrade business tools etc… to meet the market demands.

A luxury goods retailer sells luxury goods to its customer at a discount compared to high street retailers and may waits up to 30 days or more for payment from its customers. In the meanwhile, the company sells these invoices with an invoice financing company to access funds so that they can procure more goods to sell thus increasing turnover.

The company can potentially increase their turnover by several factors with the help of invoice financing companies. The cash flow turn rate use to be 30 days and now possibly only take 7 days. That mean the company can increases in size by a factor of three to four times!

Discounting v Factoring

Many people are confused with the terms “discounting” and “factoring” when used in invoice financing. What is the difference? Invoice discounting and invoice factoring are essentially the same but with one notable difference.

In invoice discounting, the invoice seller is responsible for payment of the invoice to the invoice buyer on invoice due date. Whereas, in factoring the invoice seller’s customer is responsible for payment of the invoice at due date to the invoice buyer.

From the invoice seller’s point of view, invoice discounting offer a certain degree of confidentiality. The invoice sellers may not want their customers to know that they are selling invoices because it might raise a lot of unwanted questions.

However, that is not to say the invoice buyer cannot collect directly from the invoice seller’s customer in invoice discounting.

Factoring, Not Discounting

Depending on how invoice financing is structured, factoring may entails more risks in the invoice financing sector. A factoring company would shoulder the risks from the invoice seller’s business. What does this mean?

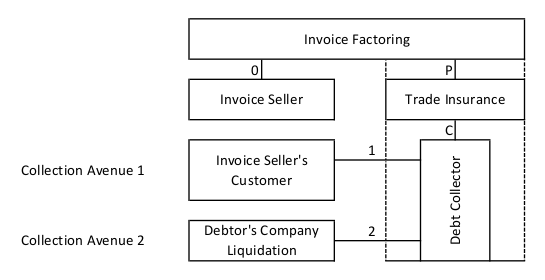

The diagram gives a pictorial view as to how this factoring and debt collection may work. In factoring, the invoice sellers will no longer be responsible for collecting its’ customers debt and this responsibility will be passed to the factoring company via the trade insurance/debt collectors (1). The invoice sellers has the funds as need and can go away happy with the knowledge that they no longer have to worry about the debtor not paying.

What happens if the debtors go bankrupt? The invoice seller does not lose out because according to factoring he no longer has responsibility for the paying back the invoice. The factoring company as a result will be left holding the bag, possibly an empty bag!

The bag will not be empty per se because the factoring company can still collect once the defaulting debtor is liquidated but this may not even be the full face value of the invoice (2).

There may also be trade insurance involved to lessen the risk but the party buying trade insurance are not the invoice sellers but the factoring company. As a result, insurance would be much more expensive because of the reduced number of avenues to collect the debt thus increasing the risks of a zero collection.

Depending on how protection is setup the insurance policy if available could be setup to payout (P) and the trade insurance will send out debt colletors (C) as soon as default is declared. There may be other safeguards in place to minimise risks.

The Populous Way

Now comparing the factoring approach to the Populous Way. A default on one of your loan is not the end of the world, so calm down! It is just part of doing business because you can’t win them all, or can you?

Populous will have trade insurance, a director’s guarantee and liens in place. That is all well and dandy, but how does it all work? Let us explore this further to see how this might work and what effect this will have.

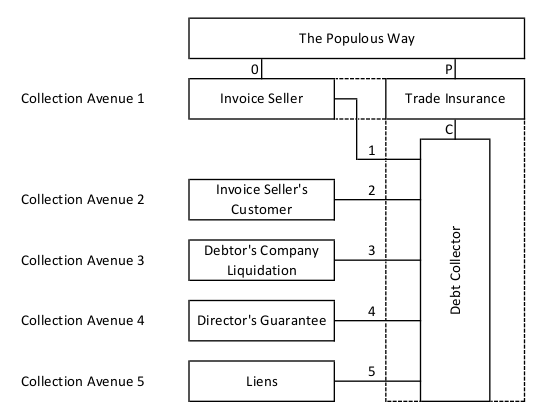

As you can see from the image, five collection levels are shown and each level represents a point where Populous can collect on the defaulted loan.

Collection Avenue 1 – Invoice sellers are required to buys trade insurance to be eligible to sell invoices on the Populous platform. If the invoice seller defaults, trade insurance will kick-in and Populous would collect on the insurance payout (P). My assumption is that a default triggers payout to Populous. However this does not mean the invoice seller do not have to pay back the loan, the insurance policy will probably contain a collection element (C) in the policy and can send in a debt collector to recover the overdue payment (1).

Collection Avenue 2 – If for some reason the invoice seller cannot make payment, for instance he could become insolvent or declare bankrupt in which he definitely cannot pay, then the debt collector can collect from the invoice seller’s customer to settle the invoice (2).

Collection Avenue 3 – If for some reason the debtor company also becomes insolvent or declare bankrupt the debt collector can try to collect from the liquidation of the bankruptcy of the debtor (3).

Collection Avenue 4 – The worst comes to worst and collection cannot be made or there is a delay in the collection then the director’s guarantee letter kicks in. Since the director’s guarantee is legally binding, the director is required to settle the invoice (4).

Collection Avenue 5 – If the director himself becomes insolvent and also declare bankruptcy, as a result of his business failure, then a claim on the company’s tangible asset is made (5). The process from this point on may take some time as the company is winded down by court appointed receivers.

The order of collection maybe slightly different or simultaneously to how it is describe above. There may also be more processes involved, but this is the gist of how collection on defaulted loans will probably work. The plan in place will ensure the invoice buyers, Populous and its partners; the insurance companies, will be made whole.

In Conclusion

It is not in anyone’s interest to see businesses fail but unfortunately these things do happen and as a liquidity provider, Populous have to protect the interest of its investors.

The number of business insolvencies in the UK is low compared to the large number of SME operating so the industry does not seem to be a particularly a high risk sector. But it could be said that SMEs facing liquidity issues and possibly insolvencies are the ones that will use some form of invoice financing thus increasing the percentage risk of defaults compared to the national figure.

Nevertheless, the Populous Way will ensure that funds are recovered; it is just a matter of time. The more avenues of collection the less risk will entail to the lender.

The liquidity pool is the heart and soul of Populous and must always be, at least, maintained or expanded in size to cater for the increasing number of businesses seeking funds/liquidity. The quicker the funds are returned to the pool the quicker the turn around the funds can be re-allocated to help more businesses.

A bankrupt company means loss of income for people employed in the company and a loss customer for Populous. So it is not in Populous’ interest to see its’ customer get into trouble. This is why Populous aim to revolutionise the way businesses view their account and how cash flow forecasts are made. As a result the possibility of business failure can be mitigated or even eliminated.

Forecasting is a pain and fraught with myriads of things to consider, however with the help of Populous’ “Prediction Analysis Tool” companies failure as a result of low accuracy in cash flow forecasting will hopefully become a thing of the past.

By being able to increase resources the businesses can make more sales to increase turnover, increase profit and hence expand the business. Selling invoices gives businesses that ability to leverage the liquidity pool of others, such as the one Populous provide. Populous will become an integral part of businesses that uses its service.

Populous not only plans to keep its own business afloat, but also plans to help other businesses stay afloat. Terminology is key and Populous is an Invoice DISCOUNTING Platform.

Populous is the life jacket you need if you get that sinking feeling!

Other Populous Posts

My other most recent Populous posts can be read by clicking the links below.

Populous – Through the Looking Glass!

https://steemit.com/populous/@marcusxman/populous-through-the-looking-glass

Populous – Wow! Wow! Wow!

https://steemit.com/populous/@marcusxman/populous-wow-wow-wow

Populous – It’s War!

https://steemit.com/populous/@marcusxman/populous-it-s-war

Populous – Swimming in Dough!

https://steemit.com/populous/@marcusxman/populous-swimming-in-dough

Populous – Clash of the Titans!

https://steemit.com/populous/@marcusxman/populous-clash-of-the-titans

There are many more Populous post and they can be found here.

Should you have any questions concerning Populous you can ask Populous through Slack, Bitcointalk forum or Twitter Account for answers and clarifications.

However, do bear in mind that Populous are not financial advisers and cannot respond to questions that are of a financial nature. The onus is on you to make that determination and what it means for you as a PPT holder.

This is NOT Financial Advice

In my humble opinion, the risks to the downside are small compared to the potential upside rewards. The contents in this article are for educational purpose only and should not be construed as financial advice. As usual do not invest more than you can afford to lose as these investments can go to zero and always do your own due diligence. If you need financial advice then speak to a licensed financial advisor.

Feel free to comment as you see fit below.

Who or what is the Director?

Director is referred to the owner or possibly someone with financial authority in the business who can make such a decision to issue such a letter.

Resteemed by @resteembot! Good Luck!

Curious?

The @resteembot's introduction post

The @reblogger's introduction post

Get more from @resteembot with the #resteembotsentme initiative

Check out the great posts I already resteemed.

Resteemed by @resteembot! Good Luck!

Curious?

The @resteembot's introduction post

The @reblogger's introduction post

Get more from @resteembot with the #resteembotsentme initiative

Check out the great posts I already resteemed.