I have been tracking my expenses, and it has helped me to 'see where my money is going'. Every dollar has been timestamped and receipts organized, double recorded by hand and from this I will be able to see it all.

Totaling the expenses, will also help me see what my budget was this year, and what I might expect to buy and when next year. I will see where I spent the most money, on what, and how often. I should eat rice and chicken most days while I finalize this big project that is my financial expenditures.

The entire process is as painful as it is necessary. However over the past 3 years in an effort to escape the 'convenience/ignorance' of ~assuming having an account means you understand what is going on~ I have been diligently recording receipts. Are you feeling strapped for cash? Wishing you had more money at the end of the month?

Chances are you had it, and spent it. But why and what for? We come up with all sorts of reasons but only in retrospect in detail can we see what our purchasing habits are, and that's not something I need to outsource.

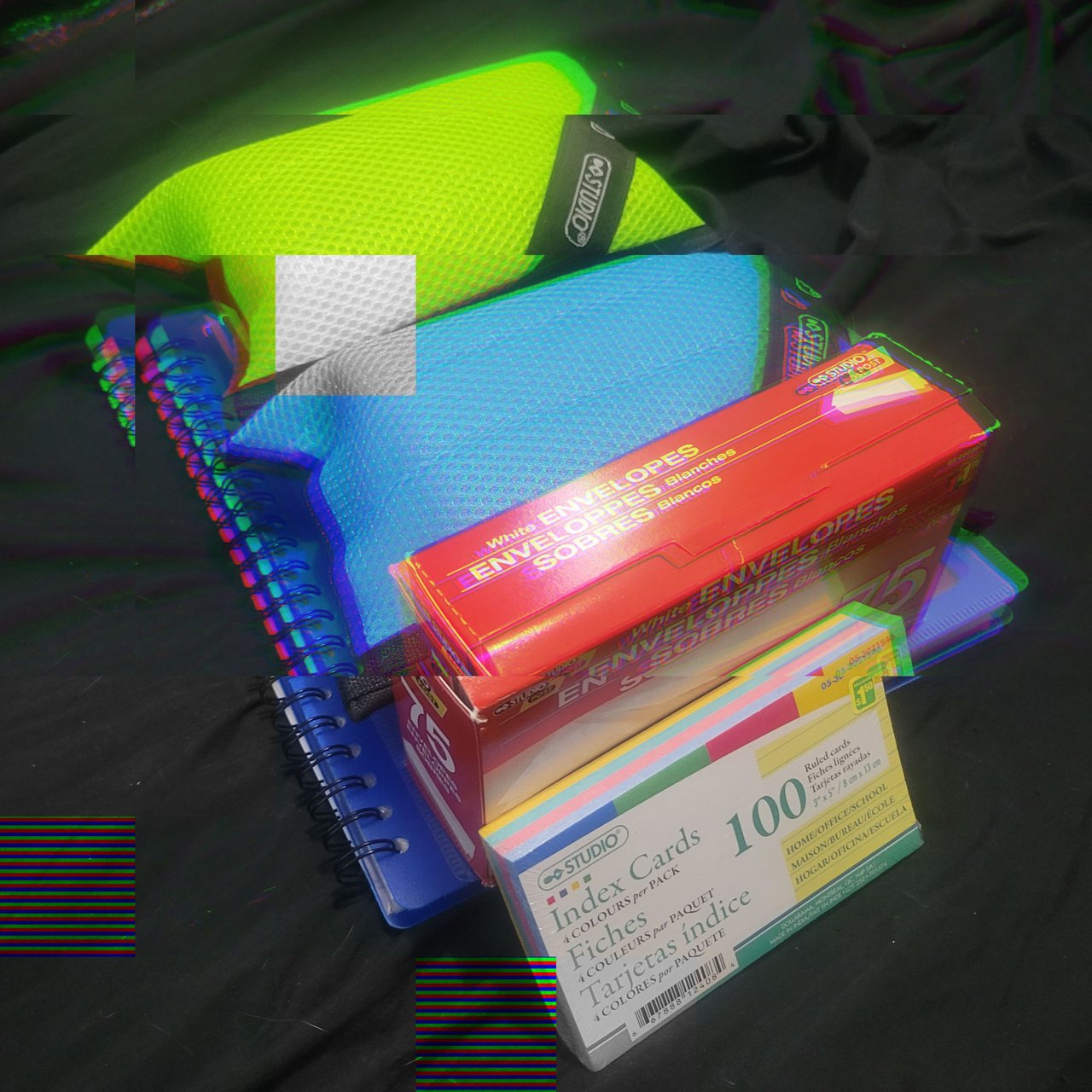

If you read my old posts about this you'll see it's really a simple thing that I can always do, it's not to hard at all. Every reciept should be worth as much as what I spent on it. Getting the receipt is key to tracking each transaction and understanding what it was, and where the value went.

In a whole year you will be amazed to know how much money you really had! How much less can I spend in 2026 knowing precisely how I survived 2025? How much can I save if I know what things cost, and can estimate how much they might cost the next year. Relative values matter!

I can't even seem to find many Stagg chili cans around town, they are starting to look worn from time sitting in a warehouse, as well that there was no Folgers at the Superstore anymore. And now the post office is on strike again! So who knows how anyone will be able to get anything done.

At the very least, we can take account of our daily and weekly expenses, and know and understand our own consumer choices better. I have noticed that I am paying less for power this year than last year, at least so far. Stay ahead of bills to avoid extra charges and excess interest, by putting all cash towards paying off debts. Avoid impulse purchases and junk food!

Imagine if you could identify $1000 in mis-spent money, what would you spend it on instead? Do you have savings goals, but never can find a dime to save after all the expenses are out the door? You are not alone.

Save $1000 in an emergency fund, and put an extra +2000/month in savings until you reach $10,000. And I notice that $10,000 isn't as much silver as it used to be, is that only 145oz now?