Last month I did not make it in time to publish the monthly report in a timely manner so this month the number goes up from 19 to 21!

Let's take a brief recap of what has been happening with PWR over the past 2 months:

In mid-April I announced the implementation of a change I had been planning for some time. The 'relaunch' of PWR as a growth token. If you've been under a rock I recommend this read.

Since the changes implemented and in less than a month, thanks to some lucky moves, PWR is now overpegged!

Further adjustments to staking rewards + bonus airdrop in mid May.

Higher Delegation rewards for Hive Power Delegators. From 8% up to 15% (minimum until 2026).

Which brings us to today :)

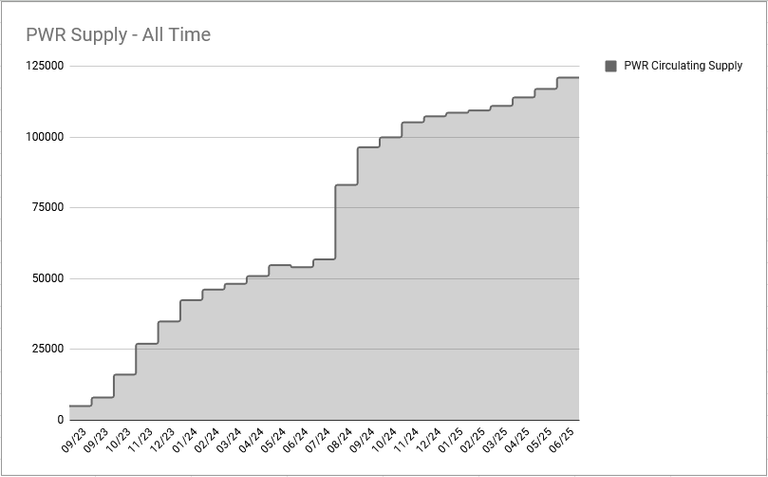

This is an updated graph for the Total Circulating Supply of PWR:

Nothing spectacular. Circulating ticking up a bit after the introduction of staking rewards in January + increased delegation rewards from very recently.

@empo.issuer (account which distributes PWR to delegators) still holds ~2950 PWR.

- @empo.voter has 160K HIVE Power Delegated, at 15% it's 24K HIVE (65,75 HIVE daily).

- Since PWR is being traded at ~1.7 HIVE -> approx 40 PWR are being shared daily as rewards.

2950/40 => 73 days of rewards (assuming all numbers equal).

A look at current PWR inflation

PWR into the empo.issuer account are already being counted into the circulating supply of the graph above. Which makes me think about how much PWR are entering daily into circulation.

- 40 PWR from delegation rewards (calculated above).

- 17,26 PWR from Liquidity Pool APR (1726 PWR into 100 remaining days).

- 4,8 PWR from staking rewards (1752/365).

Which brings us a TOTAL of ~61,5 PWR daily which translates into 22400 PWR/year.

Gross numbers, but next to the total supply, 22,4K equals to a ~18,51% yearly inflation.

It may seem like a lot, but in reality it is not so much when we take into consideration curation rewards from @empo.voter or recycled rewards funneled into @vventures.

How is PWR Portfolio doing?

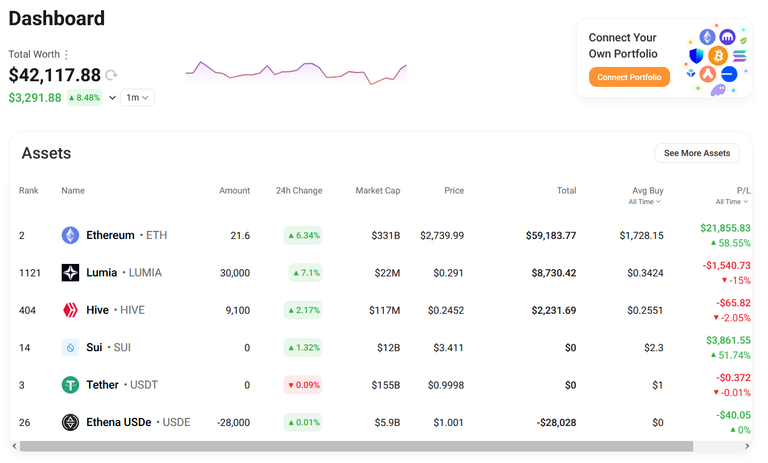

Let's take a brief look into our external ventures.

Remember you can check in real time through this [hidden].

Not much movement lately in terms of new coins/positions. I kept DCAing into ETH and LUMIA basically.

ETH gives us a massive core position with the perfect mix of stability and upside potential (10K$ ETH is programmed IMHO).

ETH is the 'safe' play.

LUMIA is my conviction play for the RWA sector.

Lumia was trading at ~2$ last December. Give me back those prices (which aren't unrealistic at all) and our 30K tokens are worth 60K$.

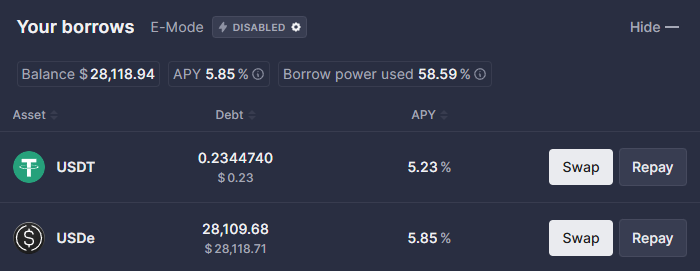

Only thing to note is to keep an eye on this. The 28K$ which we are borrowing.

Overall net APR is -1,7% so assuming static prices we are good (for now). Our liquidation price is ~1570$/ETH.

With 40K$ AUM 1 PWR -> 0,33$ or ~1,37 HIVE. This is the current backed value of PWR.

Long Term Targets

For Christmas My (un)realistic targets are:

10K$ ETH

5-10$ LUMIA

100% not financial advise based on my crystal ball. Can happen, or can not. Most people doesn't have stomach to handle such swings. I have.

20 ETH x 10K$ => 200K$

30K LUMIA x 10$ => 300K$

Wrap it those into 500K HBD. Get 15%. Buy HIVE, buyback more PWR. Repeat. You know, I'm writing it there just in case I forget about the initial plan.

Yesterday I was talking with @resiliencia about my ''strategy''.

I may look like a gambler. But to make a x10-x20 you have to be willing to eat a drawdown -90%.

I've endured this kind of pain before, I've endured it this cycle. I will hold for a massive ride up to Valhalla.

I've ride AVA from 0,1$ up to 5$.

AUTO from 150$ up to 10K$

ORN from 2$ up to 20$

Lost so much, many times. I'm still alive. That's more than most can boast (about staying alive and mentally healthy).

Such is life. such is the market. Happened before, will happen again in the future.

Do you want to share this journey with me? PWR is the key.

Delegate some Hive Power to @empo.voter for a ride (and a great 15% APR).

More than ever... Onwards!

You're not voting for my witness yet and love what I do? Don't ask me more:

- Direct Link

- Witness account

- Join the PWR Discord for doubts

Hello, @empoderat!!!

Thank you so much for another report of the project and its progress. We truly appreciate you keeping us informed.

My understanding is that the 15% APR inflation is our cost to attract capital, based on the thesis that the portfolios performance will outperform by far that cost. With that in mind, I thought it would be an interesting exercise to analyze the efficiency of this growth engine.

The "Cost": Based on the calculations, with 160k HP delegated and a 15% APR, the project is paying the equivalent of ~65.75 HIVE daily (or ~1,972 HIVE per month) in rewards via PWR tokens. This would be the cost to incentivize and maintain the delegated capital (our growth engine).

The "Return": To analyze the return on that investment, I checked the curation rewards for the @empo.voter account over the last 30 days, where approximately 715 HP were generated. This would be the return obtained directly from using those delegations.

This leads me to think that the current cost of the delegations is (~1,972 HIVE/month) which is significantly higher than the direct return they generate Us (~715 HIVE/month).

I know and understand that the ultimate goal is not the profitability of curation itself, but rather the AUM growth of the main portfolio, which these funds act like fuel. The question that arises after all this wall of text is: is this "cost of capital acquisition" (a deficit of ~1,250 HIVE/month from this operation) factored into the project's strategy?

I believe this operational efficiency metric would further strengthen investor confidence by providing a deeper understanding of how the project's growth engine works.

Again, thank you so much for all your work and for creating this project!

Pp.

ETH with nice upside lately. 👍🏻

Thanks for updating.

Hay que tener cojone para estar en crypto, seguro! 😉 Have to check that Lumia for my own portfolio, still don't have any rwa related asset. Abrazo!

Onwards to Valhalla! 💪

2 HIVE per PWR soon.

Gay

Congratulations @empoderat! You received a personal badge!

You can view your badges on your board and compare yourself to others in the Ranking

Check out our last posts: