A lot of times you can learn more from people’s mistakes than their successes.

Even though it’s a lot easier to share my successes, (my ego gets in the way sometimes), it is more beneficial for you to see what not to do when you get started building your real estate empire. Instead of making costly mistakes you can see what to avoid in order to get to your end goal faster, cheaper, and without all the headaches.

These are things you DO NOT want to do…

So, without further ado, the three lessons I learned from my first investment property are:

“Wasn't She Lovely…”

Don’t count your chickens before they hatch

Imagine for a second…

Your rental has been cash-flowing from day one…

You have a great tenant living there who you just signed to a year-long lease only a few months ago locking them into the lease for the rest of the year…

All fine and dandy…

This is, until you and your partner come to the decision that the market cycle is at or near the top and want to sell the property NOW to “increase the velocity of money”.

***Before moving on, what do I mean when I say “increase the velocity of money?”...

Let me give you an example…

- My property cash flowed approximately $200/mo.

- When we did finally sell we pocketed a total of $121,433

- So, if we held the property to make that same profit of $121,433 from our cash flow it would have taken us over 617 months or 51 years to make that same amount of money

- $121,433 / $200 per mo. = 617 months or 51 years

Of course, we are ignoring future rent increases but we are also ignoring other expenses that might have popped up (new air conditioner, new water heater, etc.).

Anyways, instead of having to wait 51 years to make that same amount of capital as we did when we sold…We simply “sped” up time and made 51 years’ worth of cash in one day.

We “Increased the Velocity Of Money”

Pretty cool huh…***

Now that you understand that, back to my mistake. As this was the first property I had ever sold I was not aware of issues that would come up.

First, I had no clue the time frame it would take to sell a property.

I simply assumed as soon as I wanted to sell the property it would sell. (Such a rookie move)

Boy was I wrong…

Long story short it took close to three months to sell the property. With that, because as you will see from our next mistake, we had to pay those 3 months of rent out of our pocket because…

We did not know “to-the-t” what was in our lease

We thought we had a 60-day termination clause in our lease allowing us to break the lease with the tenant with 60 days notice if we were going to sell the property. (Our realtor told us it would be easier to sell with no tenants…SMH…Don’t listen to your realtor on that)

AS WE COME TO FIND OUT, WE DID NOT HAVE

A 60-DAY TERMINATION CLAUSE IN OUR LEASE!

So, to get the tenants out we essentially had to bribe them with what many call “cash for keys”.

We give them cash they move out and give us the keys.

Quite Simple haha

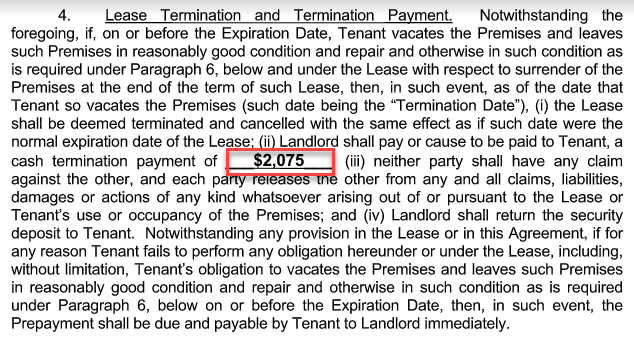

Essentially, we paid $2,075 for them to break the lease …

Problem solved!

Except now we had an empty property with a mortgage and utilities still to pay.

Overall, the costs to us were…

$925 (Empty Unit) + $925 (Empty Unit) + $925 (Empty Unit) + $2,075 (Cash for Keys) = $4,850

"$4,850 just to sell the property (Great)..."

Not only did we have to pay those 3 months rent, we came to find out that the first people who made the offer, that we accepted, were using a VA loan (Pretty much a loan that allows Veterans to buy a house with as little as ZERO down payment).

Which is great, I’m all for helping Veterans, but…and this is a big BUT…the amount of red tape to deal with a VA loan is insane.

If you are selling a property “as-is” that usually means “as-is”, but that is not the case when dealing with buyers with a VA loan. AS IS to an inefficient gov’t bureaucracy who are offering the loan means “as-is” except for that and that and that…

"Those and that’s” cost us another $3,450 out of our pocket to sell this property.

Now, our running cost to sell comes out to….

$3,450 + $4,850 = $8300 (money you can save by not doing what we did.)

So, my advice to everybody if somebody comes to you offering to buy with a VA loan… run away!

Because it is not worth the time and hassle to have to deal with an inefficient government bureaucracy supplying that loan.

In Summary,

Don’t assume your property will sell immediately (there are a lot of slow moving parts in the

real estate industry that take time to complete)Don’t kick your tenants out, let your new owner deal with them. Your realtor isn’t the one

paying the mortgage so don’t listen to them, they are just trying to make their job easier.If you see a VA loan, do not accept the offer. (Headaches)

Now off to search for a 20-unit apartment building! What are you doing TODAY to build your real estate empire?