What happens when we pass 10% debt ratio and continue to grow past it without no easy way to convert SBD to Steem?

Nothing changes really (in terms of SBD; it does imply a further 50% drop in the price of STEEM which would certainly be painful all around). Since no one is converting SBD the amount of STEEM you would get by converting it is irrelevant. If SBD does drop to $1 or below and it starts getting converted then the ratio would probably drop (eventually).

BTW, the main reason conversion was removed from the UI was people were doing it anyway when SBD was worth $10 and burning 90% of their money. To protect people who didn't really understand what was going on, that option was disabled. However, with SBD back close to $1 it would be reasonable to re-enable it (I'm also told that it is possible to perform conversions using steemconnect for people who don't want to use the CLI).

What happens when freedom decides to sell his 944,780.18 SBD?

The price will drop! If it drops to $1 or below then people will start converting it and the ratio will drop.

Most of the large SBD holders are exchanges and that liquidity is required to maintain their market.

Most likely the SBD held in exchange accounts is actually owned by exchange customers and not the exchanges themselves. Most of it isn't being used directly for liquidity, it is just being held. Who those customers are, what they want the SBD for, what they will do in the future are all unknown.

If SBD remains unpegged to $1 USD, is there any reason to keep it?

As you noted there are improvements already being made in the upcoming hard fork. Also, at a current price of $1.03, I wouldn't consider it to be all that unpegged (this is within the range observed for other decentralized pegged tokens such as DAI or BitUSD). You can take a glass half empty approach and say that SBD going up to $12 proves that pegging doesn't work or half full approach and say that it dropping back down from $12 to $1-$1.20 and staying there for the past couple of months proves that pegging does work (if imperfectly). Eye of the beholder I suppose.

BTW, a large part of why the print rate is zero has almost nothing to do with SBD and everything to do with the STEEM price dropping. When STEEM isn't worth much the whole system is hobbled in a lot of ways, SBD being one of them but hardly the only one.

tool for this exact purpose when the SBD seemed to drop under 1 USD for the first time after the removal of the convert functionThe user @mwfiae made a very easy to use

Thanks for the mention!

Hope my tool can help some people who aren't familiar with cli's etc. :)

I think from an investor perspective, a lot changes.

I believe you are right, but you can also use cli wallet to do it. The blockchain still supports it, it's just missing from the UI as it is a bad idea to do it when SBD is more than $1.

I'm suspecting the same.

I disagree, it is extremely unpegged, just happens to be near $1 right now. If Steem was to rise to $2 or even $3, I would bet SBD will travel with it, albeit slightly behind. So I don't think it's come down to it's peg as much as just happens to be following Steem which happens to be near $1.

Yup marky wins :)

Here is an interesting chart to test the hypothesis of SBD being linked with STEEM.

https://www.tradingview.com/symbols/spread/BITTREX%3ASTEEMBTC%2FBITTREX%3ASBDBTC/

In fact, there isn't that strong of a link. The ratio has varied from 0.2 in December (SBD worth 5x more than STEEM) to a high of about 1.6 in mid May (SBD worth only 62% as much as STEEM) before reversing and heading back down. What happened in mid May to cause such a clear and rapid reversal after an 8x increase?

Well that was exactly when the the debt ratio reached 2% and SBD printing started getting reduced (and STEEM printing increased)! This had precisely the effect one would expect from the change in supply (though not what one would normally want): SBD got relatively stronger and STEEM got relatively weaker.

The improvements made in HF20 (mostly increasing the 2-5% threshold to 9-10% instead) should be very helpful, although it still may not be enough. It's a step in the right direction for sure.

I’m not saying link as closely related, more like BTC / alt coins. When BTC falls they all fall. Some faster some slower. But they go in the same general direction. If Steem went to $2 I am not saying SBD would as well but I would expect it to move to $1.25-$1.50+ until something changes to actually peg it. It was $1 a while ago and went up when Steem had a bump.

It is true that all or almost all cryptocurrencies seem to move together to a large extent. I still find the chart pretty interesting (the movements of which show how SBD and STEEM sometimes don't move together), especially the reversal when the soft limit was hit, which seems to say quite a bit about the pegging mechanism. But of course I can't prove any sort of causal relationship from a chart, it could be coincidence or some other factor involved.

Maybe a wager is in order :). You a betting man?

100 Steem and we set conditions and deadline? Donate it to a good cause like @Helpie.

I'm not against making a wager but I'm not sure what we are wagering on? That SBD and STEEM more together to some extent and to some extent don't? We probably agree on that. That SBD probably won't stay 'close' to $1 all the time unless other mechanism improvements are made? We probably agree on that too. That HF20 will improve the peg to some extent? We may not agree on that but it may also be difficult to measure or define.

You don't really need to wager with me though, you can buy SBD for about $1.05. If you are sure of a big pump (maybe to $10+ like last time) then just buy as much as you can. Not doing so would be giving up an 'easy' 10x.

I just wanna say markymark for president real quick.. ok, done

STEEM investor or SBD investor? Actually in neither case does much change right at 10%. As the ratio exceeds 10% then SBD becomes gradually less backed by STEEM. If SBD is worth more than $1 then clearly SBD investors aren't counting on being fully backed by STEEM anyway (they aren't). If isn't worth more than $1, then it would be getting converted and its supply would be shrinking, effectively resolving the situation (albeit at an uncertain rate).

Of course, if the ratio hits 10% that would currently mean that STEEM has dropped another 50% which clearly matters a lot to STEEM investors, but again the exact 10% threshold doesn't change anything here, its just an arbitrary number when looking at the STEEM price doing what it does (fluctuate).

So I'm not sure what you are getting at here.

Possibly you are right, but this is really just guesswork. Market conditions change and just because SBD got pumped, apparently mostly from Korea, in the past doesn't mean it would happen exactly that way in the future. There are some dramatic differences, for example the supply of SBD being 15 million rather than 1 million, where it was before the first SBD pump in 2017 (the increase occurred due to the slow, but not nonexistant, action of the pegging mechanism). That 15x ratio might matter, or it might not. Likewise for the planned changes in HF20. I don't see any way to know for sure in advance.

@smooth Can you make a youtube tutorial with animation of how sbd debt ratio and steem relates to each other? Im hardly a financial guy and im having hardtime understanding. Since i noticed youre so actively trying to explain it to everyone. I think making a youtube animation tutorial will save you lots of breath and make potential investors to understand more about the system. I really appreciatee if @steemitblog will consider this when releasing a new update each time. Not everyone is technically skilled at this. But an attempt to make it more digestable is highly appreciated.

Honestly I have not the slightest idea how to make a youtube tutorial, but if someone wants to create one I would be happy to proofread the script (or whatever it is that you write to make an animated tutorial).

Well if you're motivated enough, you can make a post on hiring some creative content producer to do it.. Considering the amount of stake you have in this platform, it should be easy? But it's just my suggestion.

That's a really big point

That's the pegging mechanism in action. It it just really slow unfortunately, and has other issues. But it isn't nonexistent or completely ineffective (I think).

This is my understanding. On the low side it has a hard ped (redeemable at $1) and on the high side it has a soft peg (prints more and no one redeems).

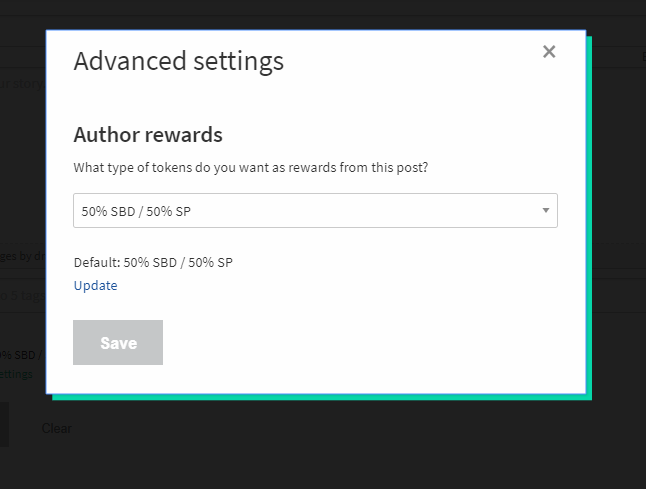

The UI still has it:

Much better than when it did not even have this option

No, that is not the SBD conversion. That's the payout rewards option.

I think it is pegged in one direction only.

We should add a way to convert steem to SBD for a small fee. This would create a better peg.

I would say SBD is a pegged asset with upside exposure :) with 1 USD being the safety net for retailers accepting SBD.

That doesn't work at all at significantly above $1 (say $10). No one will spend SBD worth $10 when retailers are pricing in SBD unless they are uninformed (and that is just taking advantage of noobs, who will end up with a very bad taste once they figure out what happened). So either it stops being used altogether, or it stops being used for pricing and becomes a regular effectively-unpegged token with a dynamic exchange rate. It would be mostly okay for a small premium like 1.01-1.10.

Also, nobody would design a token like that, nor objectively think it would be useful. This is essentially just rationalizing the flaws in the existing design with some claimed (but really not very realistic) benefit. (Okay an exception might be retailers who could get some extra value from it, but again, doing that by ripping off less informed users is not a good long term approach from a system-wide perspective.)

What system do you want? You seem to be knowledgable

I'd like to see SBD work better than it does. The upcoming hard fork has a couple of somewhat minor code improvements, additional code improvements can be made, and some improvements may come implicitly from scale should Steem (hopefully) grow larger.

I think it is pretty useful even without a perfect peg, assuming the peg is at least approximate. For small purchases a few percent fluctuation doesn't really matter. For large purchases people will adjust to the exact market price, but that's okay. Over time I think we can get there.

Should you and other top witnesses not setting price feed bias percentages, with a SBD Debt Ratio at 6+% ... there is to much steem being printed.

Or is it that you and the witnesses know this an play dumb? Because at 10% the SBD floor will be gone, and a bail-in is just what you guys want so that users and community be pickpocketed?

Who else is going to pay to bring that 15+ million SBD Debt down? Who is going to burn it?

Looking forward to your answer.

There is no basis for a price feed bias at this time. Nothing in the white paper (even accounting for subsequent changes in the consensus rules or understanding of the economics) would suggest it. Setting that aside, if a price feed bias were used, let's consider how that would work:

The rest of your comment is largely incoherent.

The SBD smart contract includes (since almost two years) the possibility that (based on 10% market cap) SBD may shift from being pegged (if imperfectly) to USD to being pegged to STEEM. If and when the ratio subsequently decreases, it returns to being pegged to USD. Any SBD holders who don't like taking that risk not only had the opportunity to sell over the past nine months at prices as high as about $10 but can still sell or convert at about $1.

Everyone is in the same boat here, we would all like the price of STEEM to rise. But if it doesn't the system includes reasonable rules for how to handle that situation with respect to SBD.

People may burn some coins (for example see the promoted feature) but that certainly isn't part of the consensus rules. No one should count on any amount of coins being burned.

BTW, referring to SBD as a debt instrument or debt-like instrument is an analogy. It isn't literal. "Debt" implies some sort of claim against an asset, which doesn't exist here. SBD holders have the right to trade their tokens or convert them according to the smart contract, that is all.

Those are the wrong answers. I am out. I see what course this ship has chosen... I wish you good luck on your adventures.

Should you and other top witnesses not setting price feed bias percentages, with a SBD Debt Ratio at 6+% ... there is to much steem being printed.

Or is it that you and the witnesses know this an play dumb? Because at 10% the SBD floor will be gone, and a bail-in is just what you guys want so that users and community be pickpocketed?

Who else is going to pay to bring that 15+ million SBD Debt down? Who is going to burn it?

Looking forward to your answer.

Indeed it would. Any idea of why it hasn't been re-enabled?

Because as long as SBD is over $1 you will lose value. It only recently came close to $1 but I still don't feel it is "pegged" but more happens to be near $1. A lot of costly mistakes were made with the conversion feature when SBD was worth more than $1.

This sounds like a "Nanny State" type of response. Sure there is an argument for protecting ignorant users when the SBD price is maybe 1.10+ but at the current level there may be genuine non-technical users who would be happy to pay a small premium for the convenience and/or to see the systems debt level reduced.

Right now it is trading at 1.03 according to steemdollar.com. We would probably pay less now using this conversion than an exchange. Blocktrades charges 5%, and I think they are one of the exchanges with lower fees. It would be nice to see it keep within 5% in a bull market as well but this hasn't happened yet. We will see what happens when McAffee's private parts become safe or the next halfening of the blockchain reward for BTC. Which ever comes first. :)

No, but my guess would be: a) other priorities, b) SBD is still above $1 (if only just) so in most cases conversions are pointless still. Most of the major traders/investors who want to do this are comfortable using the CLI (or possibly steemconnect) anyway.

a) Is just not valid. To re-enable previously disabled functionality in a UI is seriously a 5 minute job - maximum.

b) I wouldn't consider it pointless. If I was a big holder of SBD and wanted to liquidate, converting to STEEM at 1.01 or 1.02 it is still much more preferable for all involved than dumping my large SBD holding on the open market - paying brokerage and damaging my sell price with volume in the process.

But sure, major traders/investors (a.k.a. speculators) are not affected and those are the ones we really care about...

If you are really a big holder such that you can't sell without crushing the market below $1 (easily thousands of SBD can be sold >$1 though, just not instantly) and you care about this you can manage to figure out how to use the CLI or it can be done with steemconnect (which amounts to putting the request in a web link and typing it or copying it into your browser; I believe there are some posts explaining how to do this).

Bear in mind that the UI in no way supports the entire range of Steem blockchain features. For example, withdraw routes are another feature that can only be done using the CLI (or steemconnect). Or creating accounts, or fill-or-kill market orders, or several other things. Once SMTs arrive there will likely be a lot of SMT functionality that can't be accessed via the web site. I think its okay that the web UI provides basic functionality and to do the rest you have to use some other tool.

You mean slippage maybe? Because if you trade on the internal market there are no fees. You can only trade for STEEM, but that's what you get if you were to convert anyway.

I agree with you on a) but in practice there seems to be a problem with walking and chewing gum at the same time around here.

Okay, Sorry but I just have to ask, this conversion function that some of these people want to come back, is this the same conversion that took 3 1/5 days to convert SBD to steem? If so I, as a non-crypto person thinks it should stay gone. the internal market does the same thing only faster.

Yes that is the function they are talking about.

I hope they do not bring it back, after @everittdmickey explained the internal market, It was a big boon to me. So thank you for trying to keep things clear.

Nice

I could implement this over on steemfiles.com but you'll have to audit Typescript/Javascript code or trust me. I should link to the source code of the steem-js fork I use but the rest is clear un-obfuscated javascript.

Motivate me to implement it and I'll start on it.

Peg to $10 I say.

Cg

That would crush STEEM. At the current 50% debt ratio the outstanding SBD would be multiplied by 10 and would represent a 50% increase in the supply of STEEM. How is an already-weak STEEM market going to support that? It won't.

^^^^^^^^^^^^

What if for future value movements, as sbd goes back to 10 or more than 1, steem goes the same way? Or lets say steem goes higher than sbd? Would that make a correct proportion of debt ratio as a stable one?

Sorry I'm not understanding your question.

I think trying to manipulate SBD back down to $1 when Steem was $3 and SBD was about $8 is more detrimental to Steem.

Cg