Silver Shines As Gold/Silver Ratio Back Above 80/1 by Rory - The Daily Coin

Some people believe the Gold/Silver Ratio (GSR) is an out-of-date measure of value for the precious metals. These people, in my opinion, would be wrong. History is one of the greatest teachers known to mankind and history teaches us about natural laws and how nature maintains balance. This is not to say the balance is maintained in a harmonious way, as nature can be and is quiet often extremely violent. The so-called "markets" the precious metals have been forced into for the past several decades are anything but natural and at times, like now, have moved so far away from the natural laws of supply and demand that anyone with a third grade education could see how rigged these markets have become. Anything that is disjointed and broken can only carry a load for so long before it completely breaks down.

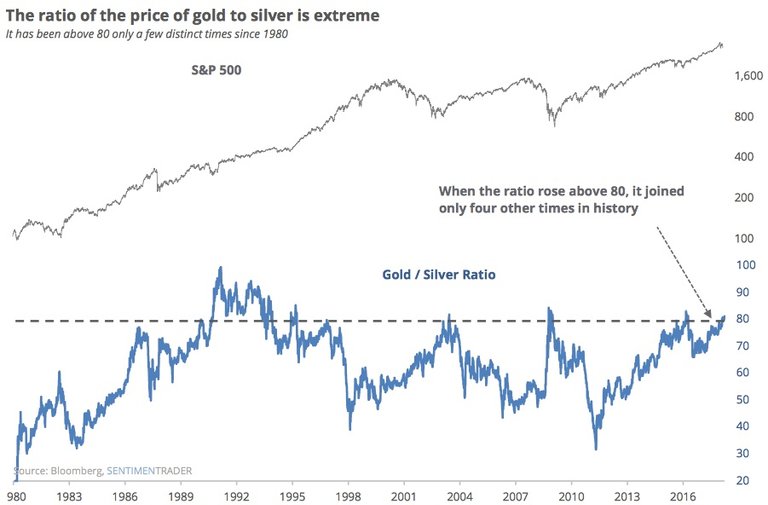

Gold/Silver Ratio Extreme!/chart - King World News

Gold is money and the word silver translates to "money" in more languages around the world than not. The natural gold/silver ratio, coming out of the ground is approximately 9.5/1 - meaning for every 9.5 ounces of silver that is mined there is 1 ounce of gold mined. The so-called "markets" would have you believe the GSR is greater than 80/1.

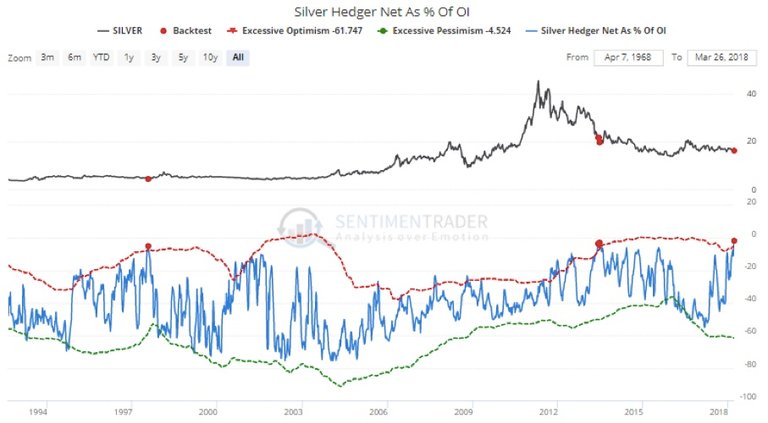

Gold continues to move to higher ground and all the while it is taking silver along for the ride. Silver has been attracting a lot of attention lately, especially from people that watch the Commitment of Traders (COT) report on a weekly basis. According to some very studied analyst, like Craig Hemke and John Rubino, the Silver chart on the COT is set up for silver to begin moving to higher ground - we can only hope to see what has been started will continue to gain momentum. If silver is allowed out of the trading range, on the high side, then silver should begin moving higher at fairly rapid pace. Once silver breaches $20.25 it will be "off-to-the-races". We actually see silver getting within range of this resistance by years end. We are not saying it will breach this important line, but it should get to the high $18 -low $19 range.The COT report shows ‘Managed money’ silver specs have their largest short position in at least 28 years and maybe ever. From a contrarian perspective this is very bullish. - Source

The latest Commitments of Traders report showed that “smart money” hedgers were holding their lowest-ever short exposure as a percentage of open interest in silver futures (see chart below).

“Smart Money” Least Short Silver In History! / King World News

The analyst at Scrap Register have been following along as well, noting how "cheap" gold is considering all the fundamentals that should pushing gold higher.

Gold might be sharing some of its magic allure with the struggling sister metal, silver, said the head of commodity strategy at Saxo Bank, adding that there is a growing demand for safe investment options that are cheaper than gold.

If gold manages to break above its resistance at $1375 an ounce, silver can benefit, said Ole Hansen in a note on Tuesday.

“The current rally may help silver attract some attention given its relative cheapness to gold and the fact that hedge funds on March 20 held a record net-short of 35,000 lots, well below the five-year average,” Hansen said. Source

If this situation continues will we see another short squeeze of the large (bullion bank) speculators like we saw in 2010 and early 2011?

What will drive gold and silver higher? Will it be sentiment, will it be actual fundamentals or will there be other forces at work? Only time will tell, but whatever it is, we can with certainty, once the metals begin moving in earnest, if you aren't already close to where you would like to see your stack it may be too late. With the mining situation that we have been reporting for the past 5+ years the mine supply will become tight very quickly. We will probably see the secondary markets moving silver and gold through once the metals achieve levels individuals have set for themselves. Pay attention to large round numbers for more coins and bars to find their way back into the market from individual vaults. Remember, everyone is broke and living on debt and as soon as people see a little relief from the storm they will take it.

We are sticking to what we have been saying for close to a year - gold and silver will be moving to much higher ground over the next 3-5 years and once the metals achieve higher levels they will not look back - at least not during our lifetime.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://thedailycoin.org/2018/03/28/silver-shines-as-gold-silver-ratio-back-above-80-1/