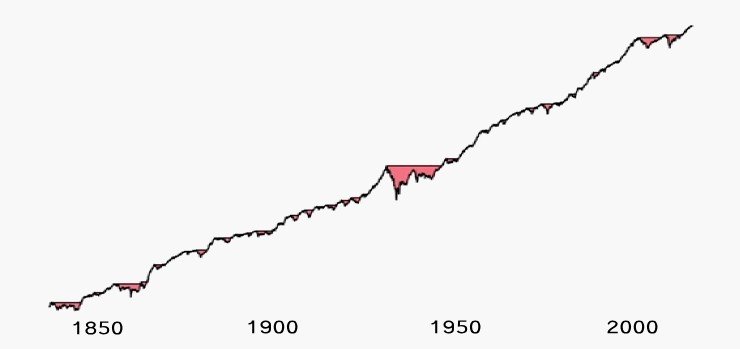

It's fascinating how religiously humanity follows the exponential curve of evolution. Look at the chart above - this is a global market index since 1835. A perfect straight line on the log chart.

I found this beautiful illustration and it blew my mind (thanks to Robert Frey's presentation about drawdowns in the markets). Well, I knew that technological progress is exponential before, but I never thought in the same way about markets.

Speaking about where we are now, I'd like to make a bold statement: the next recession will be very soft and short. I know some experts are waiting for a flat 10-20 year market with very small returns, but my point is simple: they underestimate the exponentiality.

What if I told you that the chart above doesn't show a strait line but an upward curve? In other words, what if we are accelerating exponentially?

Imagine the worst-case scenario when all markets start to crush: credit, equities, housing market - everything. But in a next few years we come up with a bunch of new technologies that double our productivity. And after a couple more years we connect AI and brain through fast neurointerface which gives us another nX.

The result will be a fast bounce and the beginning of a new economic cycle.

It's becomes obvious that macro-events are getting closer and closer to each other in time. The timeline is "compressing". We will probably reach a point where boom and bust cycles will occur within a minute. Sounds crazy? But that's what singularity looks like. (check the mood of "Slow Tuesday Night")

The framework

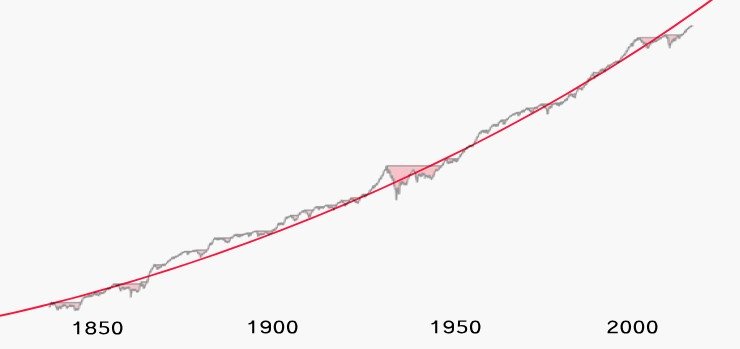

To understand the global picture, I use a simple three-bound method:

- upper-bound shows us how high we can go (super bubbles). This means I definitely need to sell equities near it.

- lower-bound shows us how low we can go (super depression). Great buying opportunity.

- golden-bound (near The Golden Ratio) shows when I should be more cautious and rebalance my portfolio.

I checked several markets: Chinese, German, British and others - you always can draw these three lines. The angle of the channel shows you how fast a particular economy can go.

Looking at this chart I could speculate that before so-anticipated crash we first need to jump over the golden-bound. Another observation: we are probably somewhere around 1955 in terms of the channel position.

Very interesting, so what happens when we cannot no longer use technology to start the next cycle. I do agree with your statements.

That's a good question. I'd say it's better not to stop, otherwise we will experience total collapse.

Yeah hahaha the debts will catch us

Posted using Partiko Android

It is showing ups and downs but do job constantly. Everyone trying to goes to higher and higher but always first step is taken from Down side after that hardness of work is going to higher.

I also think he missed the percentage and rise of debt which could have been interesting to view against each other

I wanted to look at the most general picture (as a big exponential process). I think debt is contemporary mechanics and It could be replaced in the future.

Hmm not sure as debt has a big influence on the economy and doubt people will be willing to cancel it

Posted using Partiko Android

Now we have this crazy thing called... Bitcoin! Jokes aside, I hope AI could come up with something more stable.

Telle est la vie!

Grandes pensées concernant la vie

I wonder if this just shows how much the economists can twist the numbers? Don't forget that they print lots of fiat in recessions, so the stock market gets a big boost, because stocks are worth more fiat but it doesn't mean they are doing better. Maybe put this on the same chart as the decline in value of the dollar?

This seems to me like a slowing down process. Maybe just linear. The most amazing thing that almost every aspect of human development is exponential. (did you read "The Singularity is Near"?)

I didn't read it but I did watch something about it. Population growth changes the numbers as well. More people in the work force increases GDP but as we've seen in recent years, they might not be earning more.

Posted using Partiko Android

I think we are entering an era of total automation. It is likely that GDP will depend more on robots than on humans.

Congratulations @guest2888! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click here to view your Board of Honor

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Congratulations @guest2888! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click here to view your Board of Honor

If you no longer want to receive notifications, reply to this comment with the word

STOP