This part before the last part may interest a minority and some future users. Then I'll be posting specifically on the not very well known crypto projects and those that are coming up, after completing this basic series with the #5 and last part. If you already know the beginning of the cryptocurrencies (most in Steemit) it is likely that this post will be boring.

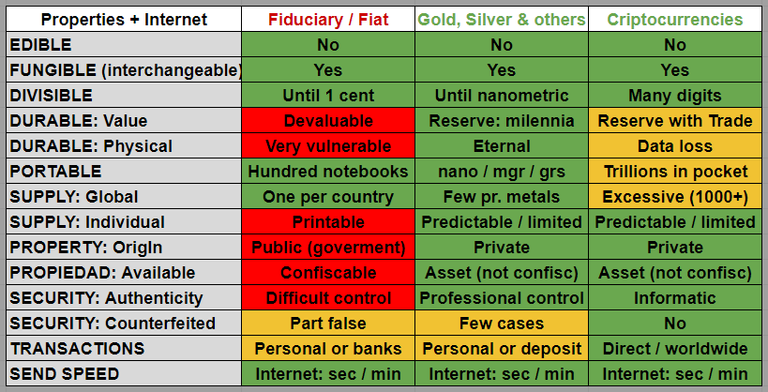

Since 2009 we have a new and excellent monetary resource, which adds to the money that are the precious metals. Like these, the new resource is also much better currency than the state, fiduciary or fiat currencies: very vulnerable to devaluation, and because it is an independent resource of governments and banks:

It represents a whole revolution considering how, for centuries, we have depended on third parties: issuing and regulating organisms to be able to make collections and payments with our money when receiving and using currencies.

It basically serves to make payments between two parties directly: without intermediaries; Also as a store of value. It is a solution that protects us from the irresponsible monetary issue and other erratic economic policies of governments, the provisions of central banks, and the decisions of private banks.

It's not a currency scan. Many who do not know the subject of the cryptocurrencies can confuse it thinking that it is the mere modernization of current fiduciary currencies and fiat; as can happen with any country and a world government's currency! (God save us).

This revolution began with the development of the underlying system of the pioneering Bitcoin: Blockchain, a shared and decentralized network for recording and sending unique (non-editable) data, such as a public ledger.

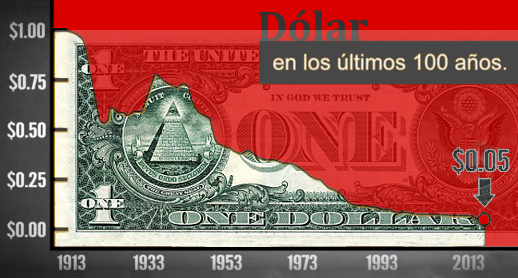

Due to the predetermined limitation of units to be emitted from a cryptographic currency, this new resource is prevented from suffering the typical devaluation of the currencies.

It is called a digital cryptographic currency because it uses a system of computer data hiding or encryption in the emission of units and their transfer over the network.

The lack of traditional (gold) traditional support (which has not existed in the dollar since 1971) in this new resource is not a problem for market use because cryptocurrencies have value for other reasons:

In principle, there is a value for the investment in its creation: the computer resources, electrical energy and time of administration of the miners (for them they begin to have value by their work, that in some cases also includes the development of software) by Which they would never throw them away: they will always try to sell them);

Are capitalized more as they are known, valued and used by more people;

A paradigm shift: a new value is created by creating a new economic and financial ecosystem of products and services;

And the people choose them, not for what some miners invested, but for their useful characteristics: freedom in the possession of Assets, speed, privacy, economization and security, which is a value in itself (and very high, given the Characteristics of the traditional monetary system):

- Decentralization: without going through the hands of governments or banks;

- Limited issuance: not devalued, regardless of the fluctuation of the price per unit in the public purchase / sale, and the issue of currencies of other networks;

- Free money send, fast, anonymous, economic: shipments from low amounts and with a reduced cost per transfer (lower than the banks). There are some faster than Bitcoin like Litecoin, Dash, Bitcoin Cash: less than 3 minutes. Ether (for developers): less than 30 seconds.

- Security: With unalterable, shared and public data registration; With multiple confirmations per shipment, which avoids damages due to possible computer attacks.

The vulnerable computer part is in the use of Exchange pages and in the possible occurrence of Wallets or fake Wallets. (This is why it is recommended to use the most popular and old, and the old practice of not having all the eggs in one basket).

As with any asset in which you can invest, there is a risk of losing a lot of money, besides winning, and in the case of the cryptocurrencies you can earn a lot (as it has for years).

When in the media they ask financial experts if Bitcoin and other similar ones (altcoins) are a good option to invest, in many cases they answer "no"; And not a few also say that it is not good as a currency. But this is because they compare it with the old currency paradigm, and in many cases because of the lack of knowledge or understanding about this new money resource.

A decentralized digital currency is not for long-term storage or ideal as an investment only, since it was not created as a financial asset but for the exchange of value between two parties, a secure digital payment medium, and everyday use.

It is not necessary to take certain criticisms against the Bitcoin and other criptomonedas as a sign of something bad: it is necessary to see for what is everything; And in this case we are not talking about financial instruments created to invest or save only. If all were kept for a long time, the coins would no longer be useful; For this reason, as no one obviously suits, all users of the network tend to use them as a means of payment rather than to accumulate value indefinitely.

The natural problem of the market is that practically anyone can create their own cryptonnet ... We say that each one has limited emission of units, but if too many people launch their own ... they will stop being a scarce good ... and many will lose value!.

How many will go out of fashion ?. Apart from everything good, given the opportunities of creation for all and free competition, among all the currencies that will be created will generate a devaluation global emission on the system in general. For this reason, of the thousand Cryptomonedas already launched, surely many will not prosper in the long term: among all we will not use thousands of coins, many with similar characteristics. But without a doubt we can choose among the best: for example, between five and twenty, and stay alert to transfer part of our capital to another currency when it is no longer convenient.

In general they do not have support in another Asset, but the values mentioned in this new resource make it a medium that is eligible for all that was created.

After the first generation of criptomonedas (Bitcoin) and the second: with improvements in data transfer speed, altcoins (Litecoin, Ripple, Monero, Dogecoin, etc.), we are passing the third generation: platforms for application developers with technology Blockchain (Ethereum and others), and the fourth: platforms for directly users to create decentralized systems, such as DAOs (Decentralized Autonomous Organizations).

In addition to directly implementing the Blockchain system, which allows the programming of intelligent contracts (self-executing according to conditions) to services that already existed in society, other variants and new systems are being devised.

The mining or extraction of coins that is done in many cases for the issuance of Tokens (tokens or units of a cryptomoneda) is done by investing computer and energy resources to solve complex mathematical problems. For each resolution a new _ block_ of the chain (Blockchain) is discovered that also allows to store and distribute the information of the transactions between the users.

The original protocol (from Bitcoin) is open source: anyone can see it and create improvements, as it is already done.

Unit of account: with public key system and private key (digital signature) for each wallet or electronic wallet.

Network: decentralized (P2P), public.

You can also apply the system without Internet (if a government "shut down" or restrict Internet use, it could equally be used), with coins and coded physical credit notes.

You do not depend on another currency. A bank account is only needed for the exchange between digital currency and fiat.

This is the last part, which includes videos, History, present and future of money. Thank you for reading!.

Then I'll be posting specifically on the not well-known crypto projects and those that are emerging.

In the comparison, some mention that the cryptomnedas are also decentralized and intelligent (programmable), but these are characteristics that are not expected in precious metals. Not everything is to buy ...

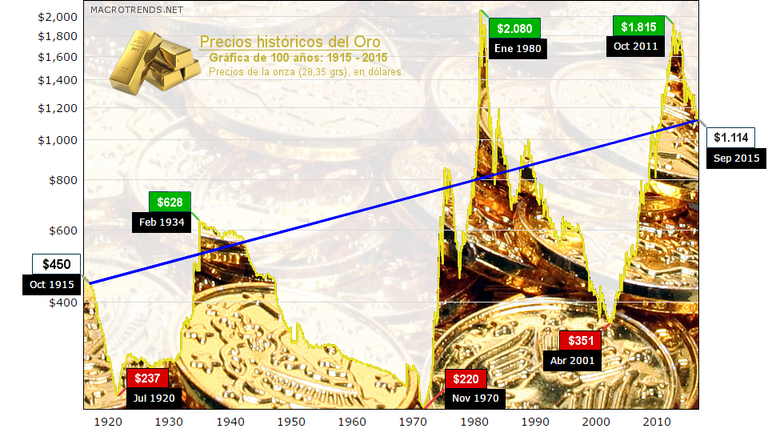

Precious metals such as gold and silver have never been devalued; Its price has logically fluctuated but always its own or intrinsic value remains. And because of the constant devaluation of the state currencies, the price of precious metals is increasing. These Assets are scarce, have a high cost of production (extraction) and can not be issued as paper (print as fiat tickets) ... Cryptomonedas are issued in a limited manner each, but among many that are emerging in the market are Produces an unlimited general broadcast. Metals are not infinite like the cryptographic coins that can be created.

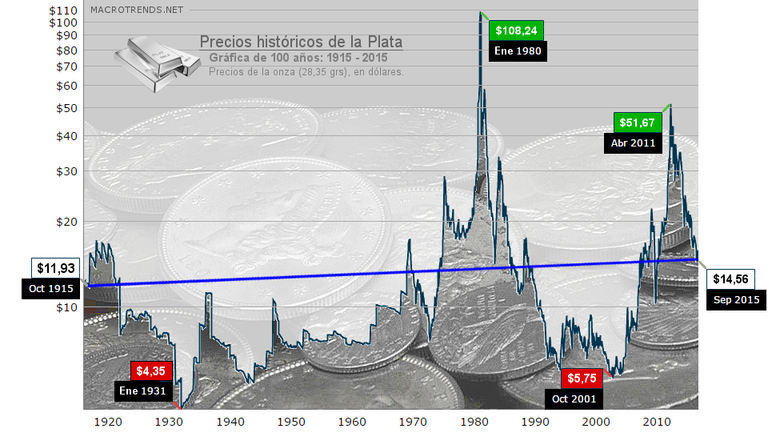

In the last century the price of Gold rose 147% (while the dollar devalued 95%): it went from US $ 450 in October 1915 to $ 1,114 in September 2015. And it reached peaks of $ 2,080 in 1980, and $ 1,815 in 2011.

For its part, the Silver rose only 26%, if we take the prices of the last 100 years, but in 1980 reached a peak of $ 108 (807% increase), and in 2011 of $ 51 (333%) .

In the year 1878, when in the USA The silver-certified certificate of 100 dollars (convertible into 100 silver coins: each 8 g. = 0.26 Troy oz. X 100 = 26 ounces) was issued, the ounce of that metal cost $ 1, 25.

11/11/2015, the ounce was at $ 15.11 (average offer / dem). This means that if you had a certificate of 100 Silver Dollars of 1878 and received the corresponding silver (26 ounces), when you sold the silver you would have obtained $ 392.86: 292.8% above the value Of the original ticket.

And even better, as we mentioned and seen in the graph, as the silver reached peaks of $ 108.24 and $ 51.67, in these cases would have been obtained with the certificate of 100 dollars silver and the sale of the metal, $ 2,814 (2,714% above the nominal value) or $ 1,343 (1,243%) respectively.

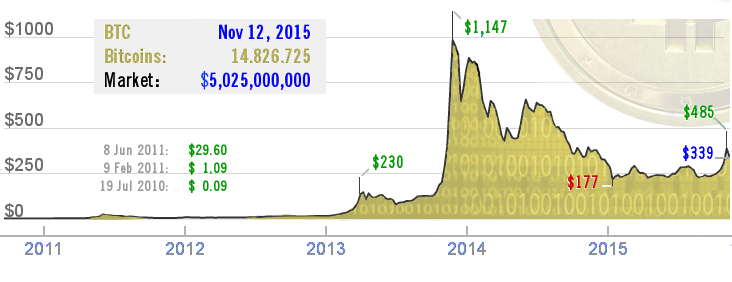

At the end of 2013 the first Cryptomoneda had a peak purchase and record price hike (December 4: 1 BTC = $ 1,147); From there it was down, first very strong, for several months to $ 177 in 2015.

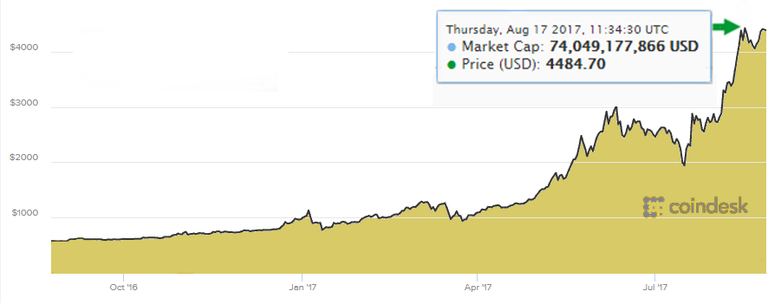

After recovering, it remained between $ 200 and $ 450, until in 2017 began a "roller coaster" of months, always with ups and downs, that surpassed $ 4,400.

It is expected that the closer you are to the number of units that will be produced (currently more than 16.5 million) and the more people will use it, Bitcoin will tend to rise rather than fall, and to stabilize its price. This aside from the risks of competition with other criptomonedas.

The truth is that as long as you continue to use paper money without backing or dubious backing, several decentralized digital coins will be more used and will be more strengthened, as was always the case with precious metals with each currency crisis and the passage of decades .

And to this is added a version with more space (8 Mb instead of 1 Mb per data block) to avoid congestion and get confirmations of transfers faster (less than 3 minutes): Bitcoin Cash; Currently with a capital of more than $ 10 billion.

thanks for your effort :) .

i will be happy if you check free courses which i post, like :

haha Life is short , we must use our time wisely

Hi. Thank you very much!. I will be watching your blog, your posts.

In general, I am interested in information regarding entrepreneurship, economics, business. I've spent quite some time there.

Now I try to apply what has been learned, to advance, to have more results in labor, economic and financial level.

But I can always learn more.

Congratulations @ecodata! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPمستقبل جل الشباب يكمن في العملة الرقمية كفا من الاستغلال مثل العمل في الشركات ياخدون منك الكثير ويعطونك القليل تحياتي .

Hi. I tried translating your Arabic text, with google translator, but the translation is not well done.

Can you repeat your comment, but on English?.