Greetings everyone! I've been wanting to do an update post for the LPs so that we can review how the recent DAO votes have impacted the pools and consider whether or not we want to make any additional changes. Please note that there is currently a proposal to increase the DAOs position in the DEC:USDC pool that is looking very likely to pass, which will significantly bolster the liquidity in that pool.

Collectively the recent proposals have cut the LP inflation from 5,625,000 SPS per month down to 3,425,000 SPS per month, saving 26.4 million SPS in inflation per year or $330,000 at today's SPS price ($0.0125). That's a pretty solid reduction.

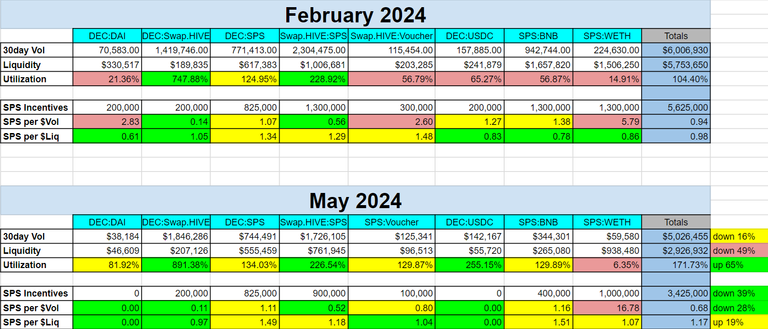

I'm attaching a comparison chart below between February this year and the most recent 30 days for each pool. The amount of SPS we're spending per dollar of volume generated by our LPs is down 28% while our overall liquidity utilization is also up 65%! Of course this comes at the cost of reducing our overall liquidity depth, but comparing to the February chart, there's a strong argument to be made that we were renting much more liquidity than our token our community required.

Looking at the most recent 30 days, it's clear that most of our pools are much healthier than they were in February before the adjustments began. The only pool that is actually performing worse is the SPS:WETH pool, which also happens to be the pool we're paying the most for that has the second lowest volume only to the DEC:DAI pool, which now has no SPS incentives.

Many people feel that it's important to keep the deep liquidity on Ethereum, but it's worth noting that 6 of our 8 pools are doing significantly more volume with significantly less liquidity and we can afford to offer lower incentives on those pools because the trading fees help to increase the pool rewards.

I think we're generally in a much better position to make informed decisions now that we have before and after data relating to the recent changes. Could things be tweaked and improved further? Sure, there's always room for improvement. The only pool that I think needs serious consideration from the DAO at this point is the SPS:WETH pool.

What options do we have with the SPS:WETH pool?

- Do nothing. Just subsidize the costs in case we suddenly get demand for buying SPS on the ETH blockchain.

- Cut inflation to reduce expense and lower liquidity in the pool.

- Have the DAO take over all or some portion of the pool.

If you have other suggestions related to the SPS:WETH pool, drop a comment below.

My Thoughts/SushiSwap Bond Update

We're pretty close to finalizing the SushiSwap bond from the proposal that passed a few months ago, which will be creating an SPS:WETH v3 pool on SushiSwap (BSC Chain). It's been a lot of back and forth and much more time consuming than either party expected, but it feels like it's finally happening. I hope to be able to provide firm details very soon.

Assuming the bond goes well, the DAO could consider using some of the inflation we've cut to create more bonds and pools on other chains. SushiSwap enables some pretty elaborate cross-chain swapping opportunities, so getting strong SPS pairs across multiple chains could soon be an option, which should help increase arbitrage opportunities.

We'll need time to see how that goes and then evaluate as a community if we want to do more bonds. Let's assume that all goes perfectly for a moment. That would provide the DAO the opportunity to turn its current expense for renting liquidity into hard assets that the DAO can perpetually earn trading fees on. This alone could help make the DAO self sustainable as long as there is demand to trade the SPS token on DeFi platforms. Currently SPS is doing over $5 million dollars a month in volume on them, so I suppose time will tell.

I tend to be very grounded with my expectations. My hope is that the bond goes well, but we really don't know what will happen. 60% APR for only a 1 month lockup could generate significant demand. Having SushiSwap to help promote the bond should be an easy win. The tech is still fairly new though, so we'll have to see how it goes.

Conclusion

I think we've made some pretty smart moves with regards to our LPs. Some token dumping was likely and with Grain LPs scheduled to release tomorrow, that should help to absorb some of the DEC oversupply. I'm hopeful that we can make our DAO self sustaining and I hope you are too. Thanks for your time and consideration! Until next time...

Id like to see the SPS per $ in volume in the WETH pool cut by at least half still. Cutting emissions to 750k here and watching another few months seems reasonable.

Cut some of it and move it to a cheaper chain like arbitrum for SPS/WETH so more people with smaller positions can jump in without paying crazy fees or needing like 10k plus to be profitable. That way we still have liquidity on eth as well as a cheaper way to access the pool as I would like to use the sps weth lp but dont want to pay the fees for eth.

The bonds is a good idea to lock up liquidity for additional rewards. Also what about a time weighted increase in rewards to give people holding longer a larger percentage kind of how they do it on beeswap right now with say the colony/sps pool gets a 1% bonus shares in the pool per day so people leaving it in get extra and people freq trading in and out do not get the extra rewards.

My suggestion: Have the DAO take over all or some portion of the pool.

Why are we paying others to do what we can do for ourselves?

You made this game worthless.