A pleasant day to all of us here in the crypto space industry! This is your Mr. Decentralized again wherein I am going to talk about one of the most undervalued use-cases of the cryptocurrencies and tokens but for sure will explode in value this 2021 onwards. This is about NFT. When we say NFT, it means Non-Fungible tokens. When we think about NFT as an asset there is a project out there already who are preparing for something big and that is Stater.

To give you a background on what NFTs are, we need to talk about the Ethereum blockchain first. ETH chain is where the fungible and non-fungible tokens are being made. That is why many games and NFTs are circulating around the ETH chain. Many of which are being traded in different platforms but after that, no more usage of it. Just for collections or for the sake of collecting NFTs. Fungible tokens are all the same with the same price and utility. You can interchange one with another without impacting their intrinsic quality and price. They are always been ERC-20 type of tokens. With the non-fungible ones, they are made with the ERC-721 tokens wherein each and every token has unique properties and can be distinguishable from each other. Think about of finger prints and people. We are all unique with having each individual personality.

The Stater team and company project owners saw this opportunity of a stagnant market for the NFT assets that need to be circulating so that the NFT owners can borrow assets and have the capital working by getting the borrowed assets to farm or use the ETH from the borrowing process to have a more use-case for their sleeping digital assets. That is the Stater team's vision and mission. Aside from that, on the lender's side, they are visioning of getting the NFT assets to be at work with their new owners whether these new owners are collectors or also investors in the NFT industry.

Features of STATER and competitive advantages of using Stater in the open market for NFTs

1. Stater NFTs

Of course, being the NFT lending and borrowing platform, the team doesn't want to get left behind in the spring of this amazing asset. Think of NFTs like the collectibles in real-life like old basketball cards, pokemon cards, and memorabilia, etc. This is why they do have their own collection of NFT assets as well! As you could see above, those will be unwrapped once the platform launches. The beauty of the Stater limited edition NFTs is that once you hold it, either the founders' edition or the community edition, both have features such as discounted fees on the platform whether you borrow or lend on the platform! Aside from that, once you hold it in your wallet, there would be community airdrops ongoing for life with Stater! Those partnered or integrated airdrops will go surely straight to you wallet where the Stater NFT is whether it is a founders edition or community edition.

You could go ahead and buy 1 or more! Check their collections on Rarible here: https://app.rarible.com/stater/onsale

For the Founders edition, it is currently priced at 1 ETH. While the community edition is priced at 0.2 ETH each. I am telling you guys that those 2 are worth it so give it a try!

For sure, there will be more perks to come as the roadmap of the Stater increases. NFTs will be the digital art and collectibles of the future world. https://stater.co/collectible/

2. Borrowing crypto by using your NFT assets as collateral

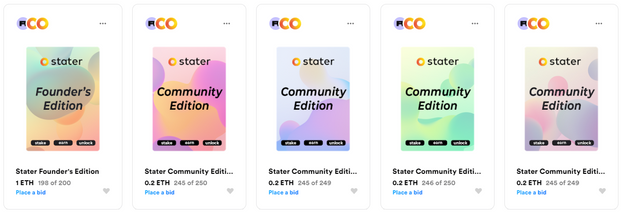

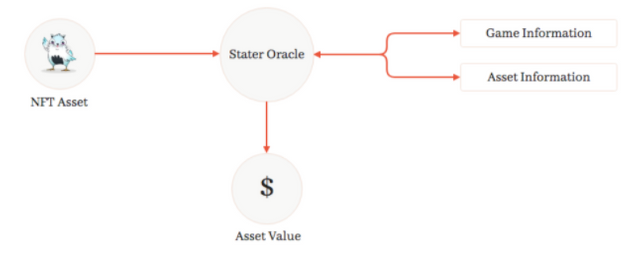

---> This is one of the newest features of the NFT asset class. With this one, you could have the power to borrow crypto assets that has value and tradeable as long as you have the NFT collateral that was being set by the Stater's oracle based on its average value and selling and buying prices in the market then with that information, the oracle will be the one to assess and appraise your NFT on the market spot price. Some of the NFT that can be traded are these assets.

3. Lend on the marketplace and be able to get yield on your lent assets

---> There is a saying that the more you lend, the richer you become. That is true. Wherefore, with Stater, you could be rich by lending the ETH needed for borrowers and have them use the ETH for other purposes because your ETH will be having collateral from the borrower which is an NFT. You as a lender could provide liquidity on the market place which will be STTR/ETH 50/50 to provide liquidity to those who need to buy and sell or borrow STTR. In turn, you will get fees. Another one is you could participate in a lending pool so that every time someone borrows, there will be the smart contracts who will automatically match the pool with the borrowers' assets to be collateralized and an instant transaction can be made in real-time already.

Why is Stater safe?

A. Open Source code

---> The code of the Stater is open-sourced and can be seen publicly by anyone. You can check them here: https://github.com/stater-co

B. Governance voting by the community

---> STTR or the Stater tokens will be the governance tokens of the Stater community. Wherein there will be a specific threshold if a proposal will pass or fail. This means the more STTR tokens you own, the larger your voice is in the community and you can also propose in the governance of the Stater platform and its community. As time passes by, there will be more token holders because of trading therefore, the Stater platform will be decentralized in the essence and will become a decentralized autonomous organization or DAO.

C. Liquidity rewards

---> Provide enough liquidity and be able to reap rewards by the Stater platform.

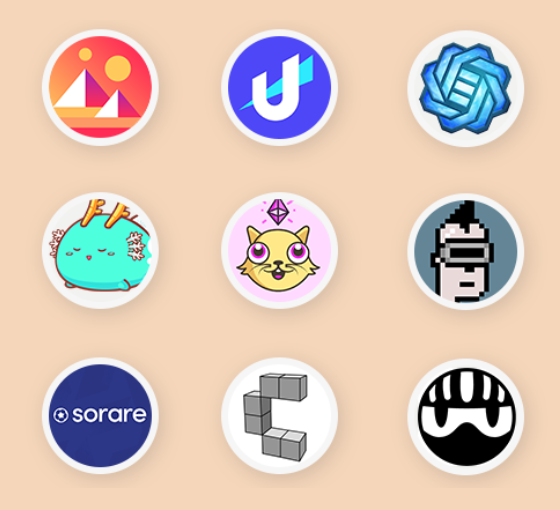

A primer and example on how borrowing and lending work

---> To the best of my understanding, I would like to explain how the Stater platform works so that you will also be able to grasp the basics.

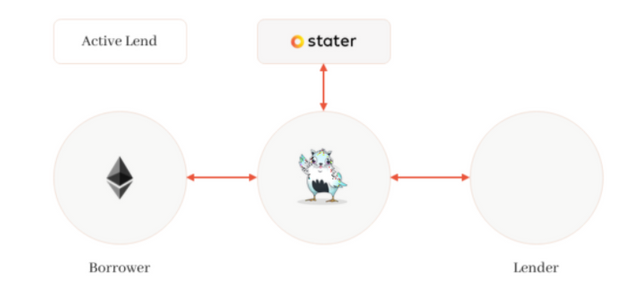

Alright, so this is where the magic happens. As you can see, the borrower has the NFT asset and the lender has the ETH part.

Next is this one:

---> This is where the NFT is now being in the decentralized custody of the Stater platform. The Stater acts as an escrow but does not hold your NFT directly because it will be in a smart contract in the platform. The ETH that you have as a lender will now go to the borrower and the lending process and repayment begins after some time.

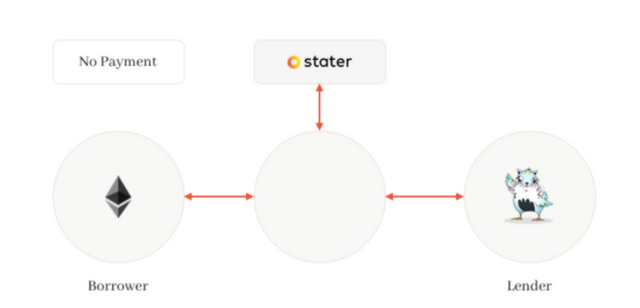

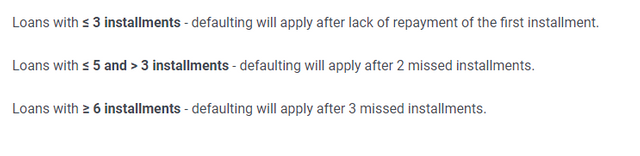

In a typical scenario, if the borrower repays the principal capital of the lender with the interest, the borrower will be able to get back their NFT asset and the contract will close. However, there could be defaults in the crypto industry that is why there will be safeguards made by the Stater team to be able to make the platform safe. Such as over-collateralization of NFT and also the callback of the loan if ever no payment or late payments was happening within the borrowing/lending contract. Take a look at this screenshot from the Stater white paper:

The picture above is when the borrower did no repayment done. The lender will still be the winner because they can sell the NFT asset for a higher price than the amount they lend to the borrower. Whereas the borrower lost their NFT asset and they got only ETH which is lower than the value of their NFT assset following the market price.

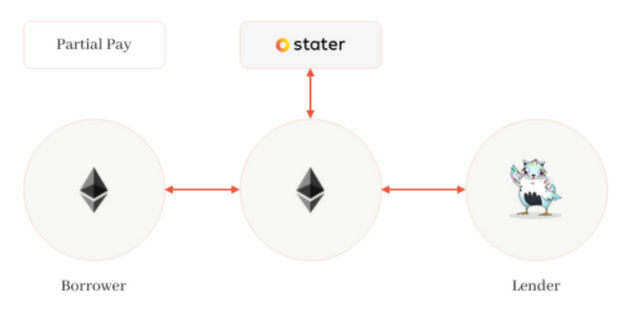

Then this will be the scenario if there will be partial payment followed by no payment for the ETH borrowed.

So for the partial payment followed by no repayments, the NFT asset can still be called and owned by the lender. In this state, liquidation happens for the NFT now and will be owned by the lender. Aside from the partial payments being kept by the lender from the borrower, the NFT will be seized. So as a borrower, it is imperative to pay your debts on time!

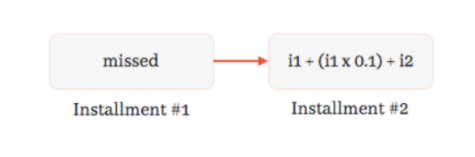

There are also penalties if the borrower is having late payments. Here are the scenarios and formula computation for you to understand it easier. All credits belong to: Stater white paper

10% penalty

20% penalty

And these are the total number of repayments needed and the defaulting or liquidation scenarios

As I am talking about the Oracle awhile ago, here is their flowchart about it:

The Stater platform earns revenue through loan amount fees, interest from the loans, and 1% liquidity fee if someone is withdrawing from the liquidity pool. Quite amazing for this platform!

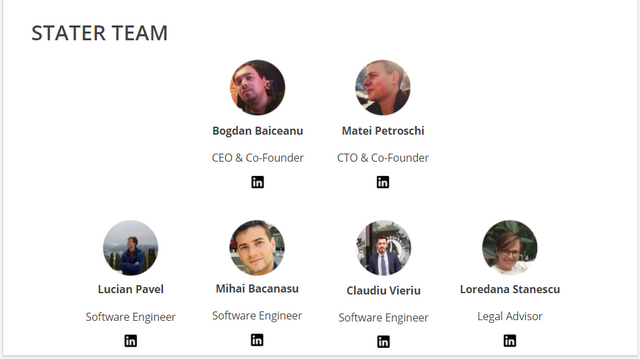

Stater's Bigtime team

Thank you so much everyone for reading about Stater. This is the first one that offers lending and borrowing for your NFTs! All platforms are so much focused on buying and selling. This Stater team is one step ahead!

For more information and details, you may go ahead and check their website and read also their white paper and go to their social media channels here:

Website: https://stater.co/

White paper: https://drive.google.com/file/d/1m9FpIUrsCnkYsI1s5ltKPBO-sKaKJsAO/view

Documentation: https://docs.stater.co/

Presentation: https://docs.google.com/presentation/d/1APnhZWZMnIHEeV1CCSXQnq4PdS74RgUOM_8S1pHbLtc/edit#slide=id.g8f60d68bd9_0_146

Twitter: https://twitter.com/StaterFinance

Discord: https://discord.com/invite/hBGgjhe

Telegram: https://t.me/staterlending

Github: https://github.com/stater-co

Try and have early access today to the platform! Go here: https://stater.co/early-access/

About the author: POA: https://bitcointalk.org/index.php?topic=5295616.msg55758513#msg55758513

Do you like my advocacy? Support Mr. Decentralized by giving some crypto here:

Donate BTC: 19udCJXqMVcAPgK3tNC7VdVjJirSAsanDK

Donate Ethereum: 0xDFD2144eb8CC1212551d50b00b18a2fEfcf6762b

Donate Dash: XkrQAsEgxMkZSrDkgoQhgoAWSVPhfs5Lyd

Donate Doge: DC6pGognFVU4wrt6AJtkmD7mXRKFepnMZQ

Donate Litecoin: LNKorfrjR12h7Ykx3Ros8kZF5UiUqmotav

Here are other of my blogging profiles:

You may also earn cryptocurrencies from here guys!

Publish0x:https://www.publish0x.com/?a=gl9avlrdG1

Hive: https://hive.blog/@frankydoodle

Congratulations @frankydoodle! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOP