tl;dr: Using Steem is not really free. Steem Power holders are being charged a negative inflation-adjusted interest rate. Only witnesses and top contributors earn enough to offset it with rewards. Other contributors lose more than they earn, to the profit of witnesses and top contributors.

If the market cap grows fast enough, everybody using Steem can make some profit. However, if the market cap stabilizes, Steem becomes a zero-sum game, where some lose and some win.

That is because the only way to increase the value of your Steem holdings becomes increasing your share of the market cap. Conversely, this means somebody else will see their share of the market cap - and the value of their holdings - shrink.

Who loses?

Steem Power holders. When more than 90% of Steem is powered up, the inflation-adjusted interest rate becomes negative [1] (i.e.: your share of the market cap shrinks).

Steem holders. They don't even get any interest at all, so their inflation-adjusted interest rate is very negative in all cases. Therefore it is doubtful that much of the available Steem will be powered down at any given time, which in turn makes it unlikely that any Steem Power holder will ever see a positive real interest rate.

Who wins?

Witnesses, of course. Each of the 19 permanent witnesses earns at least 1371 STEEM per day (658 USD at the time of writing), for producing 1371 blocks a day [2, 3].

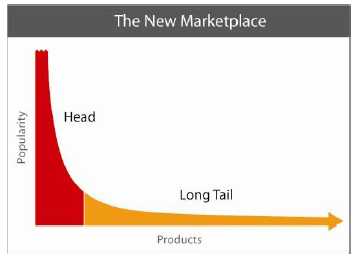

Top contributors (posters and curators). Even though all contributors are rewarded, top contributors get most of the rewards. This is because the reward distribution is heavily skewed in favor of the top contributors (rewards grow exponentially with popularity) [4]. Other contributors will only earn nominal rewards.

Conclusions

When you are holding Steem Power, you are being charged a negative real interest rate. When you vote for yourself, you recoup some of it. When you vote for someone else, you give them some of it. In all cases, you give some to the witnesses for securing the blockchain. All of this is paid with the devaluation of your holdings.

So if you decide to invest into Steem Power, remember that using Steem is not really free: you are actually taking part in a STEEM redistribution from Steem Power holders (you) to witnesses and top contributors.

It might still be profitable for you if the market cap increases fast enough, but be aware of what you are betting on: other people having reasons to buy STEEM, thereby driving the market cap up.

There ain't no such thing as a free lunch

[1] White paper, "Allocation & Supply". For every 1 STEEM created to reward contributions, 9 STEEM are distributed to Steem Power holders. If more than 90% of the existing STEEM receives 90% of the new STEEM, the inflation-adjusted rate is negative.

[2] 63 seconds per round, 1 block per round per witness

[3] White paper, "Allocation & Supply". "1 STEEM per block or 0.750% per year, whichever is greater"

[4] White paper, "Payout distribution". Units are arbitrary, but the idea is that people in the red will make enough to offset the negative interest rate, people in the orange (the majority) will not.

All cryptocurrencies are about network effect. The more people involved in the currency the more effective it is as a currency. The demand for cryptocurrencies is so strong that even with 10% or more inflation paid to miners they grow.

The effects you are concerned about here do not apply until the system reaches "peak value". The steady state involves everyone contributing new value proportional to their stake. This means that if I have $100 of Steem Power, then I must contribute $10 worth of value per year.

Steem isn't about "payments" so much as it is about "recognition of contribution". The pie of contribution is designed to grow at 10% per year. If the value of new contributions is less than 10% of the market cap, then the market cap will fall. If the value is greater then it will rise. In other words, the steady state of Steem is where 10% of the market cap equals the value of the contributions made each year.

Passive investors in Steem are betting that the value of contributions will exceed the 10% per year fee for lack of participation. Eventually most Steem will end up in the hands of active users who contribute proportional to their stake. Those who contribute more relative to their stake will profit from those who contribute less relative to their stake.

In other words, Steem prevents "rent seekers" and encourages people to provide real value to one another. Payment is made in the form of quality content and curation.

Or a plateau.

Exactly, but this also means that if I can only contribute $10 worth of value per year, I should keep $100 of Steem Power at most and sell the rest. Won't this create downward pressure?

You can hold your value in Steem Dollars. If you expect no growth in the platform then selling makes sense. But those who are active have financial incentive to grow the value, not just maintain status quo. After all, if the combined efforts of everyone involved only enables them to "break even" then there would be a large expenditure of effort and no profit. People work for the sake of profit. As a whole the community will have to produce a profit or die.

Your hypothetical plateau or steady state will never be reached. Steem will change hands until the new owners / voters / users / readers find ways to produce more value than they consume.

Steem is mostly driven by speculative value. This means that any impacts from dilution are insignificant next to changing speculative perceptions in the market. To put all of this in perspective, imagine a company that decided to stop paying for employees, inventory, and advertising. It cuts its expenses to the bone, but will slowly starve to death.

If you are worried about 10% per year issuance then you are short sighted. All living organisms consume energy and must find a way to replenish their energy. Two approaches are to reduce consumption or increase production. Reduction in consumption can only get you so far before you are dead.

So you expect Steem to generate gains mostly through market cap growth. Fair enough. But is there anything that ties market cap and value creation on the platform, aside from speculation?

Would you compare investing into STEEM to investing into start-up shares, with no dividends but a high potential for growth?

That's a fair assessment. They're just like startup shares. Most early stage startups dilute to bring more resources to a company. The goal is for the dilution to bring more value overall than the amount that is diluted. Older investors get a smaller % of a bigger pie, but the value of their share increases. If you look at Steve Jobs or any early founder they have significant stake early on, but over time they have a much smaller percentage. Jobs had less than 1% when he passed away. He did sell a significant share before leading Apple to a comeback so his stake is a bit skewed. Nevertheless the Jobs example does illustrate the nature of early stakeholder dilution. When you're in a garage with a few co-founders you start with 100% shared amongst the team. Overtime you dilute and if you get really big that percentage is probably going to be far less. Early on for STEEM it's all about the network effect just like it was for Facebook & Twitter. Revenue can validate the value a platform, but it's not necessary especially early on. Advertisers will eventually want to buy STEEM to advertise and what they will pay will be an indirect representation of revenue.

@officialbitcash: sorry, it seems we reached maximal comment depth, so I can't reply to your comment directly.

I am not so convinced that advertisers will be interested in Steem. Obvious ad posts will likely be downvoted (by regular users or by competitors).

Regarding the startup analogy, I realized there is something that startups have and Steem does not, though: the eventual promise of (real) dividends, in the long term. I suspect this is a part of what drives the valuations of startups up, even though they often do not pay dividends in early stages.

I agree, I don't see this model being successful in the long term.

It is undesirable to hold SP and even more so STEEM. What about SBD you say? Well, to me it looks a lot like current fiat systems, handing out candy that you don't have. But debt-to-ownership in a stable market can not exceed 1:19 you say? Well I'm not sure that's as great as it sounds. Let's look at the numbers:

Do you think the market would be able to absorb ~$1M sellpressure in STEEM? The extremely poor distribution and the locking of STEEM artificially pumps the market cap to levels where 1:19 debt-to-ownership is just a joke, imo.

I guess the conclusion that BM drew from the last 2+ years is that artificial pumping and free stuff for everyone is just a lot easier to market than a platform like BitShares.

This is why external revenue sources being fed into Steem (e.g. from Steemit) are important in the long term:

https://steemit.com/steem/@aem/steem-long-term-incentives-and-growth-slack-chat

Great post and conversation thanks to you all ..

Just learning and just learned a bunch more now to assimilate all lol

me too, and I only understood about 25% of it!

As you said: if the marketcap stabilize. This is why steem dollars are there and that the marketcap has to grow with user adoption. Otherwise: Contribute or die.

^

My current rough plan is to keep 15% of payouts in SBD, ~5% in STEEM depending on how its looking on the exchanges, and dump the rest into SP and keep on contributing ;)

I've had similar concerns about the model in the long term due to the way influence naturally consolidates up in it without any real penalty mechanism outside of influence inflation (sort of what's wrong with the world at large so that could be less than ideal depending on how it plays out.. we'll see), but if we see it being an issue some time after launch there's no reason we couldn't look into a hard fork to remedy it then.

well... you just cut the hypothetical Gordian knot!

lol not to toot my own horn (too much), but lateral thinking is what I do best ;)

Most people see straight lines... to me its always just a bunch of squiggly shortcuts. Rarely do you need to throw the baby out with the bathwater even though it often seems like the only option on the surface. Just step back, cross your eyes, and you can almost always figure something better out :P

I think it is bound to happen sooner or later. The userbase can only grow so much.

This is true for Steem but not for SBD, since you will be getting an asset which is worth the equivalent of 1 usd and will also give you a 10% annual interest.

I am not convinced about the ability of SMD to track USD and give 10% real interest: would you sell me 100 SMD for 100 USD, if they were going to be worth 110 USD in a year?

Where is the interest coming from? I could not find anything suggesting it was anything else but inflation.

If you never invest a penny, you aren't at least losing any money. You are maybe losing some time, which you might spend in a less positive forum where you get no money.

..just something to counter your arguments :)