Discovering Blockchain:

I stumbled upon blockchain technology in the fall of 2016 while doing research on the business operations of Deloitte & Touche LLP. in order to prepare for an upcoming interview I had for a position as an audit intern at their Detroit office location. At first, I thought it would be an interesting sort of thing to bring up during an interview in order to leave a good impression. Oddly enough, however; the conversation ended up consisting of me preaching about ALL the potential benefits of this new technology to the 3rd year associate who had been assigned to interview me. I figured her ignorance of the subject was simply due to some kind of "need-to-know-basis" type thing within the hierarchy of the firm. It wasn't until I spoke with one of the partners in charge of the Ally Financial audit engagement that I realized I was onto something big.

I asked him very pointedly when given the chance, "what can you tell me about blockchain technology"?

He responded by telling me he had heard of it before, and that the CIO of Ally was seemed pretty interested in the whole thing with his friends from New York. Other than that, he knew nothing!

*A view of the GM Renaissance Center in Detroit. Deloitte's offices are in the leftmost tower (Tower 200)*

My First Trade:

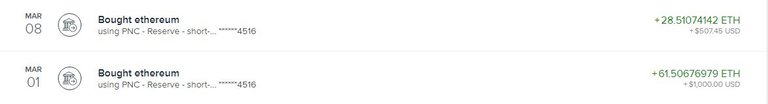

Toward the end of my time with Deloitte (late February 2017), I could tell that I probably wouldn't be receiving an offering letter for a full-time position (which is generally expected). It may have had something to do with the fact that I was too distracted soaking up as much knowledge about cryptos and blockchain, that I would often skip lunch with the rest of the audit teams in order to listen to seminars or listen to podcasts. Sensing that I would no longer have a steady stream of income at my disposal for an indefinite period of time, I thought "fuck it! Why not?" and made - what I consider to be my first real investment - in a financial market. $1,500 was used to purchase 89 Ether at $16.85 each. In the following months, as I watched the price of my investment increase exponentially, I became hooked. I was able to triple my investment in roughly one month. It became very clear to me then, that this was the career path for me.

*Pic of my first two trades made over a one week period (taken from Coinbase.com ETH wallet transaction history)*

The founding of SMPL Investment Group, LLC.:

It was very difficult to describe my vision to friends, family, and potential investors at first. In many ways, the vision of my company is still evolving and, therefore, incomplete. Although, it has become easier to explain with the proliferation of the crypto-currency asset class. You'll still encounter the occasional person that asks what a Bitcoin is though...

Simply put, it is my intention to utilize the disruptive power of this new technology as a means to circumvent the traditional barriers to entry present in the banking industry. My ultimate vision is to allow people simple access to newly generated sources of wealth. It all begins with the creation of my asset management company SMPL Investment Group, LLC. which will become a reality this September once I receive my series 7 and series 66 certifications. In the mean time, I will continue to invest my own funds in order to hit the ground running. I started this summer with a $1,500 investment which quickly turned into a diversified portfolio of blockchain assets worth nearly $40,000.

There is plenty more in store and I can't wait to share it with you all.

Thanks for reading! Follow me on Steemit to see future posts.

Be sure to upvote, and/or resteem if you liked what I had to say!

Twitter: @Jimmy_Koss

Amazing Work mate...

I gotta follow you @around-z-block also upvoted...

Thanks, I appreciate it!

Nice article. Just interested in why you invested in ether first? Also, in your opinion, which cryptos do you think are the most worthwhile to invest into and HODL? cheers :)

Thanks for reading! Ether was the only one other than BTC listed on coinbase and I hadn't found any exchanges yet. Plus, I had downloaded the ETH wallet client and explored it more than any other, so it felt more comfortable. PERSONALLY (not giving any investment advise) I am long XRP, LTC, ETH, STEEM, GNO, STORJ, FACTOM, ARDR, and many others. One way I choose the good tokens is by visiting their site, and looking to see what sort of other well established companies they are partnered with.

Zcash recently partnered with JPMorgan Chase. XRP is partnered with the Bank of England... etc.

Sorry, I totally replied in the wrong spot! lol

Thanks for reading! Ether was the only one other than BTC listed on coinbase and I hadn't found any exchanges yet. Plus, I had downloaded the ETH wallet client and explored it more than any other, so it felt more comfortable. PERSONALLY (not giving any investment advise) I am long XRP, LTC, ETH, STEEM, GNO, STORJ, FACTOM, ARDR, and many others. One way I choose the good tokens is by visiting their site, and looking to see what sort of other well established companies they are partnered with.

Zcash recently partnered with JPMorgan Chase. XRP is partnered with the Bank of England... etc.