This post assumes you've read the Steem White Paper

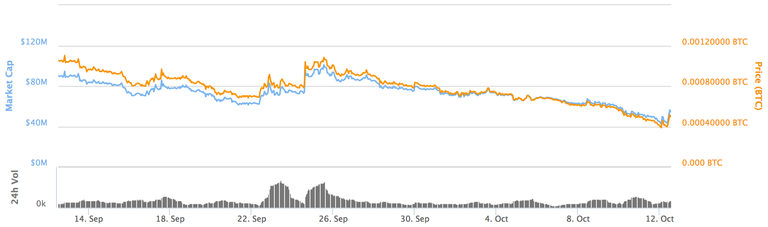

Like anyone else interested in Steem and Steemit, I watch the price of STEEM closely. Over the past month, the value of STEEM has dropped by about 50%, and that's including a large uptick in the price within the last 24 hours. Most people have an intuitive sense that monotonically decreasing price is bad, but the implications of such market behavior aren't always clear. This post will focus on the Steem Dollar (SBD) and what SBD means for the financial health of Steem and the Steemit community.

The problem with SBD

Steem Dollars are essentially convertible bonds, meaning they are a debt liability to Steem. In order to maintain a reasonable dept ratio, Steem issues the equivalent of $19 in STEEM whenever a single SBD is created. If the price of STEEM were constant, this would result in a 5% debt ratio. In reality, the price has continually decreased, so what was worth $19 one month ago is now worth $9.50. Thus, if all SBD were issued a month ago, Steem would currently have a 10% debt ratio. Given that the price is falling without bound, the debt ratio must always be increasing. SBD issued at the peak STEEM price requires more STEEM than the $19 of STEEM created in tandem. If the current trend continues, Steem will eventually become insolvent, unable to honor the convertible bonds.

More evidence something is amiss with SBD

Before proposing a solution to the problem, I wanted to provide additional evidence that something is wrong with SBD. The most compelling of which is the fact that SBD trades at about $0.94. Think about that for a second: A contract for $1 of STEEM that also pays 10% interest is only worth $0.94. If Steem inspired trust, such a situation would be impossible. For example, imagine the U.S. government were to sell bonds with a nominal amount of $1 for a face value of $0.94 and a term of 7 days. People would snatch up as many of these bonds as possible.

What to do about it?

Trading currencies and bonds on an open market is far from a new concept, and there are many things that can be done to solve the current crisis. Two things in particular would make a huge impact. First, creating exchanges that allow short positions on STEEM would help stabilize the price. Second, SBD can be moved closer to $1 by removing the 7-day delay on conversion.

Allowing short positions would greatly increase demand for STEEM. Right now, there is no reason to buy STEEM unless powering up your Steemit account. Clearly this is not generating enough demand for the currency. Allowing short sales would increase demand because short positions would have very good payoffs given the current state of STEEM. Allowing short positions also makes long positions more attractive because there are possible profits to be made by betting against short sellers. Edit: After thinking about it more, the only increase in demand for STEEM due to short selling would be interest paid on loans, and that's assuming anyone would lend STEEM in the first place.

Allowing instantaneous conversion from SBD to STEEM would solve the ridiculously discounted SBD price. The current 7-day delay prevents arbitrage, which is absolutely necessary in any currency or bond market. Removing the delay would allow anyone to make quick and easy money whenever the price of SBD fell below $1, thus keeping the price pegged.

Disclaimer: I have no position in the STEEM or SBD markets

I have not memorized the language of finance & market trading. So the comments here are a great opportunity to chisel my way into those dark arts - lol.

FWIW: I just bought steem yesterday to power up my account. Hopefully more people are thinking along these lines. The way I see it, Steem is so new, hoping to make a significant amount of money from participating, is the furthest thought in my mind. It seems logical to me to address steem as a long term investment. If the majority of people earning from posts, cash out, well it seems obvious the result. If people go long, it gives the currency and the system time to grow large enough to handle activity that includes a lot more withdrawals.

However, markets, valuating, yeah, not my strong point. Perhaps reaching out for new participants could feature less "Make $$$ Posting!!!" and more "Enjoy creating and reading quality content?"

Or does that defeat the whole purpose? I also think that drawing in less young people, seeking to get rich quick with their untapped awesomeness (now that they dropped out of high school), in favor of seasoned participants would add major value. I wasted way too much time trying to hold an actual discussion with some kid who couldn't hold a conversation without swinging wildly out into all sorts of half-baked certainties of his ... My fault that I didn't clue in faster.

So take heart that there are some of us out here buying in.

Cheers, and thanks for the post and discussion

I think shorts would help in a lot of places

https://steemit.com/steemit/@dennygalindo/why-short-sellers-can-improve-curation

No sure I fully understand but it sounds like you might be a trader and clearly do. Thanks for the analysis.

So your solution is:

A: allow short selling

B: convert steem more quickly

Is A not something that exchanges can do aldeady?

Short positions are much different than long positions. Building an exchange for long positions is simple. User A wants to buy for price P, User B wants to sell for price P. Done.

Short selling in currencies is done in one of two ways, both of which are more complicated. For normal securities like stocks, short selling is done by loaning the security. For obvious reasons, loans between anonymous cryptocurrency users is problematic. Bitfinex is one of the only exchanges supporting lending features, but it's complicated and and doesn't support STEEM. You can short BTC, but you need to borrow BTC, convert it to USD, wait some time, and then convert it back, returning the borrowed sum in BTC + interest.

The other way of shorting a currency is via a currency pair. Which involves the implicit buying and selling of currencies as the pairs are traded. Again, way more complicated then a simple long position.

Bullcrap.

It's not complicated at all.

You have a market of lenders that want to hedge and so they offer their steem for loans at say 1% daily interest. Then you have the short seller fund a margin account to cover the interest due and let them borrow whatever they can cover as an interest payment. Then let them short to their hearts content, but force a margin call before they run completely out of funds. This means you prioritize margin calls over all other orders including market orders.

This is how margin works and you can use it to go long or short.

Since it's all cleared on the exchange, nothing is needed on our end and poloniex has a dozen currencies or more you can lend or borrow and go long or short.

Short selling steem is not a good idea for the price, period point blank.

Holding SBD is already a short position. You want to short steem just buy SBD.

If you mean shorting currency you don't actually have, then all that will do is add even more liquidity to the market. The market already has WAY too much liquidity. They need a way of burning liquidity, possibly the same way we do promoted posts right now. Promoted posts help to mop up the SBD liquidity and is the primary reason SBD is $0.94 instead of $0.75 like it was a little while back.

Do the same thing for steem and the price will rise. Otherwise promote the uses of the coin by helping to build the ecosystem.

No currency has ever been made more attractive by naked shorting, except to those who want to crash the price.

I do agree on lifting the 7 day limit and I would take it a step further and say that the price avg point used should be 3 day avg instead of 7 day.

I agree with you on this williambanks

Yep... his arguments about allowing short selling somehow helping the current price didn't hold much water...

Yea, thinking about it more, I agree with you that short selling would be unlikely to help the demand for STEEM, other than to pay the interest on the loans.

good post

Good post, in my opinion the key is steem devs must create an ad market payable with btc and use this for support the coin, we have too much capital flowing out we need some going inside to be sustainables

Interesting thoughts. I like the idea of removing the 7 day delay and allowing arbitrage to happen. Great post.

I think that the payout for posts changing from 50/50 Steem Dollars and the other half in Steem should help. People are less likely to sell Steem at the lower price that it is now. They'll either hold or power up which helps the overall economy of Steemit. The whitepaper reads that:

Steem Dollar added Stability -

"When Steem Dollars become 2% of the market cap, a portion of content rewards will be awarded as Steem instead of Steem Dollars. Steem Dollars are awarded at a rate of 50% of the reward at 2% or less market cap and 0% at 5% or more market cap. Example, at 3.5% market cap content rewards will be 25% Steem Dollars, 25% Steem, and 50% Steem Power."

I think this was their intended fix....or am I just confused?

Congratulations @dimes! You have received a personal award!

Click on the badge to view your own Board of Honor on SteemitBoard.

For more information about this award, click here

Congratulations @dimes! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!