Hello guys , How are you all !

and from today i will share you the most top 100 trading Rules of all time .

Hope guys you will get some value from my post .

lets start part 1

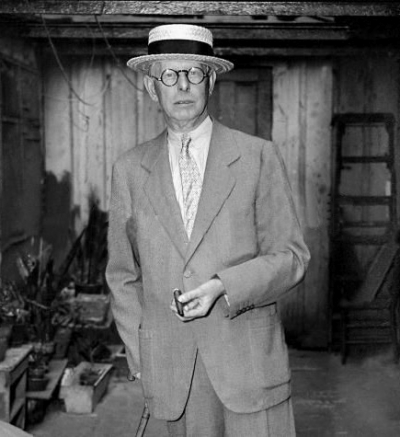

JESSE LIVERMORE

1

Watch the market leaders, the stocks that have led the charge upward in a bull market.

2

They say you never go broke taking profits. No, you don’t. But neither do you grow rich taking a four-point profit in a bull market.

3

Successful trading is always an emotional battle for the speculator, not an intelligent battle.

4

Remember that stocks are never too high for you to begin buying or too low to begin selling.

5

Losing money is the least of my troubles. A loss never troubles me after I take it. I forget it overnight. But being wrong – not taking the loss – that is what does the damage to the pocket book and to the soul.

6

When I’m bearish and I sell a stock, each sale must be at a lower level than the previous sale. When I am buying, the reverse is true. I must buy on a rising scale. I don’t buy long stocks on a scale down, I buy on a scale up.

7

The game of speculation is the most uniformly fascinating game in the world. But it is not a game for the stupid, the mentally lazy, the person of inferior emotional balance, or the get rich-quick adventurer. They will die poor.

8

Successful traders always follow the line of least resistance. Follow the trend. The trend is your friend .

9

Don’t worry about catching tops or bottoms, that’s fools play. Keep the number of stocks you own to a controllable number. It’s hard to herd cats, and it’s hard to track a lot of securities .

10

I believe that having the discipline to follow your rules is essential. Without specific, clear, and tested rules, speculators do not have any real chance of success.

11

I absolutely believe that price movement patterns are being repeated. They are recurring patterns that appear over and over, with slight variations. This is because markets are driven by humans — and human nature never changes.

12

Markets are never wrong, but opinions often are. Remember, the market is designed to fool most of the people most of the time.

13

After spending many years in Wall Street and after making and losing millions of dollars I want to tell you this: It never was my thinking that made the big money for me. It always was my sitting.

14

There are many times when I have been completely in cash, especially when I was unsure of the direction of the market and waiting for a confirmation of the next move.

15

It is foolhardy to make a second trade, if your first trade shows you a loss. Never average losses. Let this thought be written indelibly upon your mind.

16

Don’t take action with a trade until the market, itself, confirms your opinion. Being a little late in a trade is insurance that your opinion is correct. In other words, don’t be an impatient trader.

17

When you make a trade, “you should have a clear target where to sell if the market moves against you. And you must obey your rules! Never sustain a loss of more than 10% of your capital. Losses are twice as expensive to make up. I always established a stop before making a trade.

IF YOU LIKE MY POST THEN PLEASE UPVOTE , COMMENT , RESTEEM .

hey can told me how earn bitcoiin or earn from steemit and thx for all

you can earn bitcoin by doing trading ,and their a lot of free site , from there you can earn also which i do . and post good article in steemit , you will earn good money from steemit too