Argentina has recently suffered a new wave of economic crisis. Let's just take a look at brief economic history of Argentina:

During the 1930’s Argentina has been considered as one of the richest countries in the world. Due to populist government management and military dictatorship Argentina has become every time poorer. In 1980’s Argentina has suffered a strong hyperinflation which has ended by President Menem’s pegged exchange rate 1 Argentinian peso = 1 US dollar. This unsustainable parity for over a decade has brought big troubles for that country, in 2001 Argentina has suffered another economic crisis. During that crisis Argentinians weren’t allowed to pull out cash from banks. These government moves caused massive slump of Argentinian economy and mass emigration of thousands of Argentinians looking for better life in other countries, mainly going to US, Spain and Mexico. During the government of President Nestor Kirchner, the country emerged; its strong ties with European Union and China have proven temporary success.

However after Greek’s failure in 2012, Argentina’s economy started to suffer again. If you observe Argentinian currency (Argentinian peso – ARS), it increased from 9 ARS in January 2015 to 44 ARS in August 2019. During the second week in August in 2019, dollar rose 14 ARS. Since then the exchange rate has remained within the range of 58 and 60 ARS. The inflation rate has been over 50% during 2019 according government stats, the real inflation might have been even much higher because latinamerican governments tend not to recognize the real inflation rate. They do so, because if they recognized the real inflation, the real GDP would be lower.

As you can see, devaluation and high inflation have been affecting Argentinian economy during last 40 years with only a decade of economic fake stability.

How about Bitcoin?

Argentinian citizens used to have a limit to buy US dollars of 10,000 USD per month. After the crisis got worse, the limit was subjected to 200 USD per month as of August 2019.

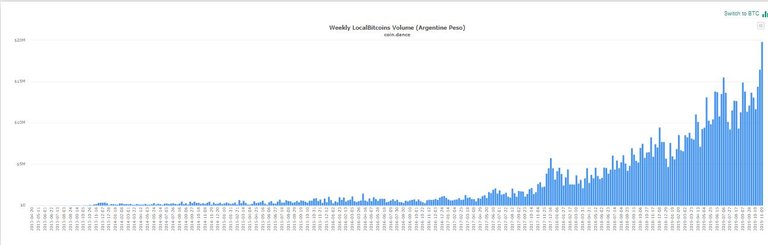

At the beginning of 2019, Argentinian bought less than 6 million dollars in Bitcoin weekly, coming to the max number on November 9th to almost 20 million. However Argentina turned to be a good crypto adopter, you can pay for the subway, utilities and Uber credits with cryptocurrency through the largest e-commerce provider Mercadolibre which is Latinamerican Ebay.

Argentinians started to use Bitcoin as a protection against the mass devaluation. Even if the crypto consciousness in Argentina isn’t high, Argentinians put a lot of faith into Bitcoin.

What drew my attention was the fact that Bitcoin’s price in Argentina was between 10-20% more expensive than in other countries. Argentinians were willing to pay between 1,000 to 2,000 USD more for Bitcoin than in other countries.

Argentinian government has been famous for restricting their citizen’s money. At the beginning of November, it was issued that Bitcoin couldn’t be purchased by credit cards in Argentina.

What was the result?

Bitcoin’s bids dramatically increased. The bids reached their highs even the days after this unpopular announcement. It proves the fact when you try to censor or ban something, people will want it even more.

There are some countries where cryptos are being censored or even banned; however people will always find their way and that’s where also black market appears. Talking about USD/ARS exchange the black market has existed for many years in Argentina. I personally have lived this situation when I was living in communist Czechoslovakia; black market has existed there in 1970’s and 1980’s. This “Unofficial” exchange market also exists in many countries of Middle East, Africa and other countries and it brings the desired liquidity into the market. And people are used to pay higher exchange rate for hard currencies.

Another latinamerican country where cryptos have been adopted is Venezuela. Their local currency - Bolivar every single minute suffers devaluation which have brought quality of life to record lows in Venezuela. Venezuela has recorded one of the highest hyperinflation on Earth. Their economic crisis has two roots: First of all, their socialist government made it difficult for small companies and their economy is dependent on oil. After the oil prices plummeted, so did economy of Venezuela. Some people of Venezuela have started to earn online income in cryptos and they find their way how to exchange crypto. Some of my friends from Venezuela have told me that they manage to exchange their cryptos in Colombia.

What has astonished me about Venezuela?

Venezuela is country No. 4 in BTC adoption according to the website LocalBitcoins. Their volume is 707 million (11% worldwide) while the volume of Mexico, Brazil, Colombia and Argentina goes around 140 million USD. As citizens of Venezuela know that there is no remedy about their national fiat, they are saving in cryptos, USD and Euros.

The socialist government of Venezuela tries to impose their Petro – an alternative digital currency backed by oil, while citizens of Venezuela prefer instead the descentralized Bitcoin. There are emerging crypto ATM where citizens can collect their BTC or Dash, and even some businesses started to accept cryptos.

The share of BTC trade is the largest in Venezuela from all Latin America.

BTC trading volume is highest in Asia, US, Europe. Africa and Latin America are unfortunately lagging (except of Venezuela, Nigeria and South Africa). If Bitcoin and cryptos want to gain more real customers in Latin America, it’s important to do better coverage of market of Brazil and Mexico which are the most important economies of Latin America.

As you can see, if a new economic crisis emerges in world’s economies we can conclude the following from case of Argentina and Venezuela:

People will start massively adopt Bitcoins and other cryptocurrencies for receiving payments.

If a national fiat defaults, then people will start using cryptos in their daily life.

If governments tried to ban or censor crypto payments, people would likely find their way to get Bitcoin.

And people would be even willing to pay higher premium fee for cryptocurrencies in their local fiat.

Citizens will prefer decentralized prestigious cryptos instead of local fiat which would be going nowhere.

So are you staking your cryptos and getting ready for any rainy day? Because I do, I completely accept the fact that we are getting into a real hard test – a strong economic crisis whose signs have started being felt worldwide.

Some have called me crypto maximalist but I strongly believe it’s the way how to protect your family’s wealth.

#Bitcoin #BTC #BTCUSD #crypto #cryptoadoption #earnfreecrypto #massadoption

Sources:

https://cryptopurview.com/argentina-imposes-more-restrictions-on-u-s-dollar-purchase/

https://www.criptomonedaseico.com/noticias/bitcoin-precio-argentina/

https://www.criptonoticias.com/opinion/donde-gobierno-dice-petro-venezolanos-dicen-bitcoin/

https://www.bitcoinmarketjournal.com/bitcoin-trading-volume-by-country/

Join Uptrennd: https://www.uptrennd.com/signup/NDQwMg

Twitter: @cryptovato1