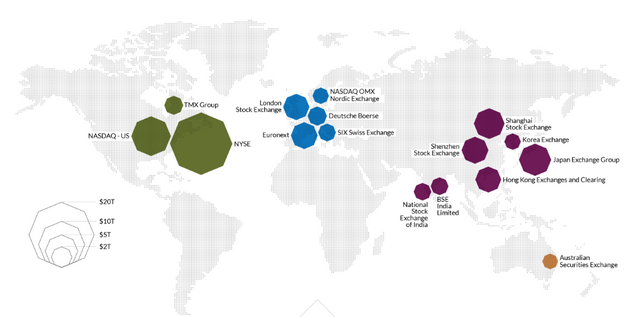

The Standard & Poor's 500 Index (known commonly as the S&P 500) is an index with 500 of the top companies in the U.S. Stocks. Because the S&P 500 Index represents approximately 80% of the total value of the U.S. stock market, it’s the bellwether index for the U.S. stock market. In addition, the U.S. stock market is the largest stock market in the world, it’s also the bellweather for equity markets around the world. The S&P 500 is arguably the most important stock market index on the planet.

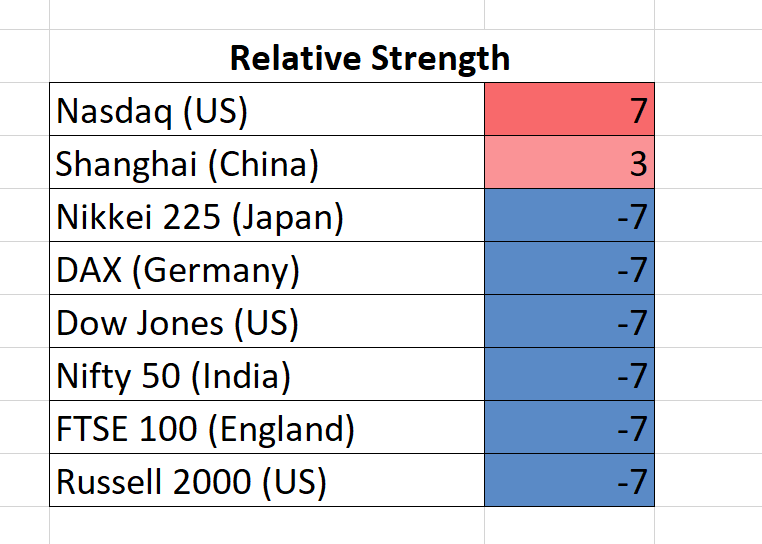

Because we live in a global economy, the global equity markets interconnected and highly correlated. However, some will outperformance other in the short term and long term. When constructing an equity portfolio, for the best returns one needs to have the ability and the capacity to assess all the major equity markets around to asset allocation purposes. However, the first step is to determine the relative strength of the major equity markets, relative to the bellweather, the S&P 500.

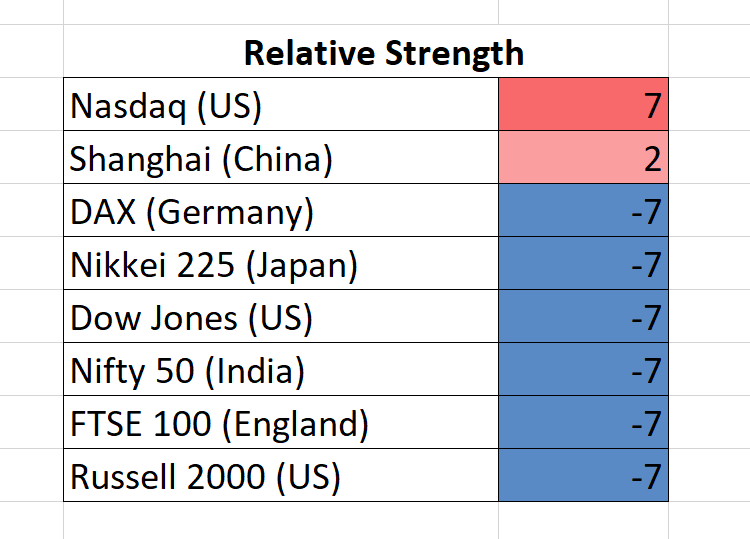

DAX (Germany)

Dow Jones (US)

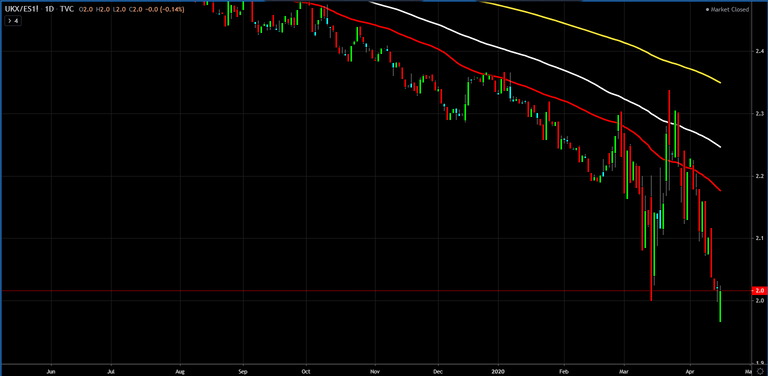

FTSE 100 (England)

Nasdaq (US)

Nifty 50 (India)

Nikkei 225 (Japan)

Shanghai (China)

Russell 2000 (US)

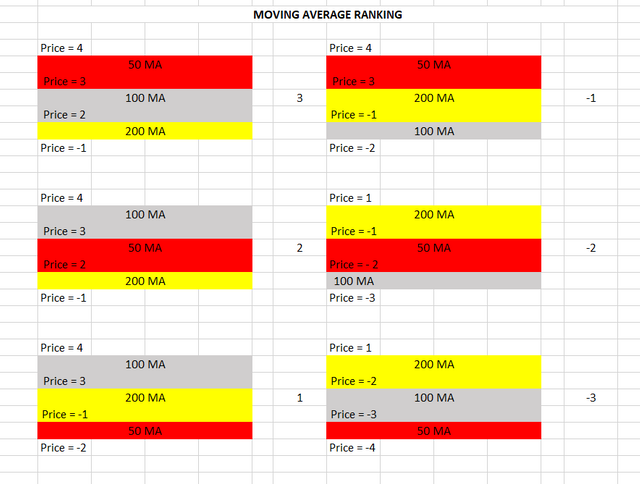

Based on the moving averages and the last daily closing price, relative to the moving averages,

the world equity markets' relative strength, relative to the S&P 500 are the following:

Two Weeks Ago

This post is my personal opinion. I’m not a financial advisor, this isn't financial advise. Do your own research before making investment decisions.

Wow the Nasdaq and Shanghai look ready to pop off. Those sitting on fiat right now must be going nuts wondering when to jump back in. There will be some money to be made for sure and educated folks must be seeing some really neat anomalies in the regular patterns right now.

Awesome intelligence!

The tech sector is the only thing holding up the equity markets, but once and if this sector rolls over, look out.

I see more downward pressure on the DJIA as it approaches resistance this week.

Agree, watch the DOW and Russell 2000 to reverse first.

Been meaning to buy some SP500 ETF, not sure which, there aren't many available in Europe, at least not in the app that I'm using which is one of the major ones...

I might way a few more months, even with the Fed printing lots of money, not sure how many more months they can sustain the stock market, and Covid is probably not going to disappear any time soon...

Agree, there is a lot of uncertainty that will become certain over the coming months.