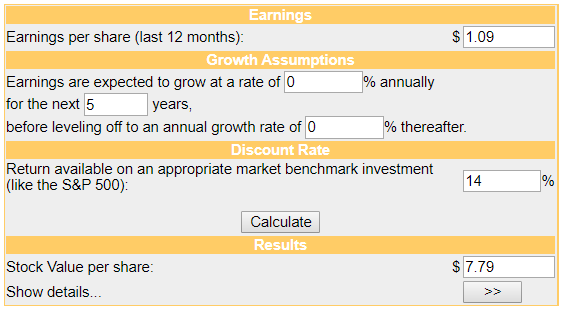

2018 DCF Value:

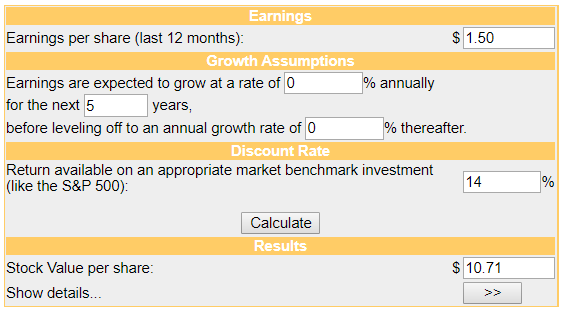

My very conservative assumption for 2019 DCF value:

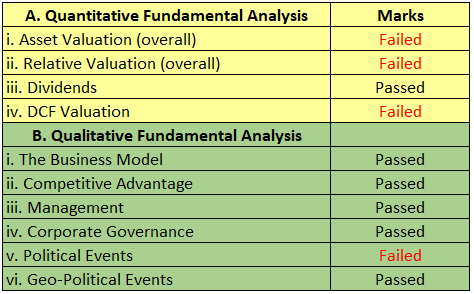

My takeaways:

What are the commonalities for DMCI Holdings, Inc. (DMC), Metro Pacific Investments Corporation (MPI), and Manila Water Company, Inc. (MWC)? They’re all water concessionaires.

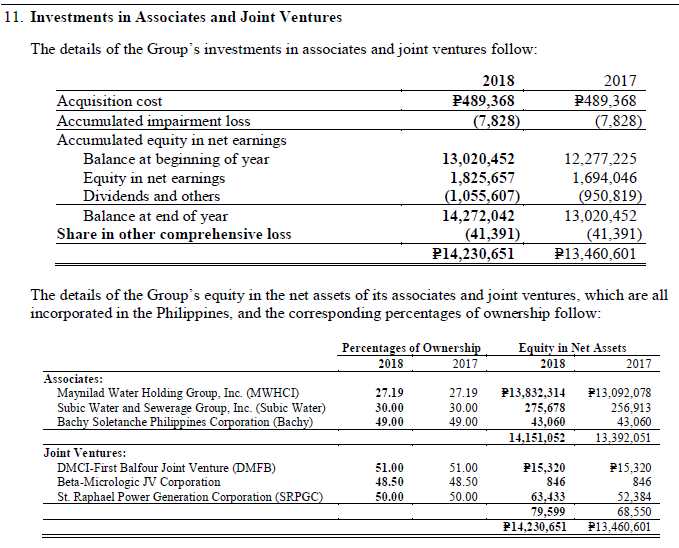

The DMC has a 27% indirect ownership in Maynilad Water Services, Inc. through Maynilad Water Holding Company, Inc., a consortium with MPI and Marubeni Philippines Corp., who won the competitive bidding and acquired 93% of Maynilad's shares. Maynilad handles the water distribution and sewer services for the western side of Metro Manila and parts of Cavite (West Zone). On the other hand, MWC holds the right to provide water and used water services to the eastern side of Metro Manila (“East Zone”).

Overall, they’re all under current political woes by no less than the President of the Republic of the Philippines. If the concession agreement will be canceled MWC is the 100% affected.

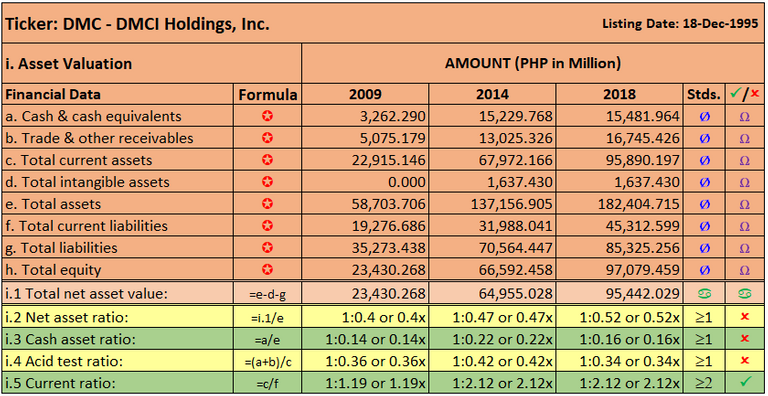

DMC water contributed only 13.832 million or 0.07% of 19,849.085 million net income in 2018, and it has a very minimal impact. So, what’s wrong with DMC?

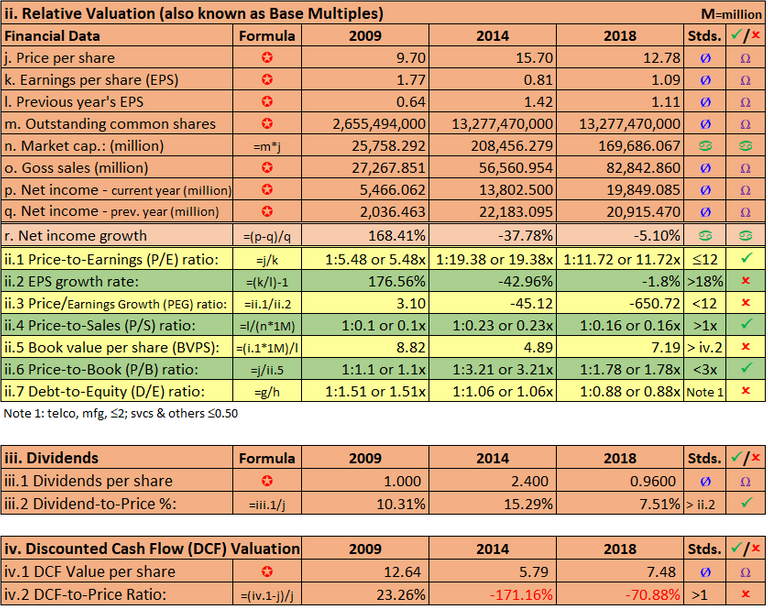

All-time low support at 1.86 on 28-Oct-2008 before it zoomed up to PHP 82.50 on 09-Sep-2014, both payouts a regular dividend of 1.20, a special dividend of 1.20 on 30-Jun-2014 and a huge 400% stock dividends on 07-Nov-2014. The main reason I sold my holdings and run away as I knew the supermajority of the stakeholders cash-in and passed the burdens to the minority that caused this stock to dragged into the cesspit.

On Friday’s closed price at 6.05, its 23.64% premium from my DCF at 7.48 per share in 2018. If I have to set at my very conservative assumption EPS at 1.50 for 2019 and revisited the price at that triggered higher high on 04-Nov-2008 at 3.00 per share before that all-time ceiling, my DCF calculation per-share value is 10.71, its price premium increased to 257%.

Therefore, a no brainer if you do not all-in at this level. However, the questions remain, are these 1.50 EPS, 3.00 market price attainable? and is the concession can be canceled? If so, and as I said, it has a very minimal impact.

Well, it’s worth to include this ticker in my watchlist as only time can tell. If my assumptions materialized, it’s about time to buyback.

For complete narratives for:-

MWC – click this link --> https://steemit.com/steemph/@php-ph/manila-water-company-inc-mwc

MPI – click this link --> https://steemit.com/steemph/@php-ph/metro-pacific-investments-corporation-mpi

DISCLAIMER: I'm not a Certified Financial Planner. Published herein is my personal opinion and should not be construed as a recommendation, an offer, or solicitation for the subscription, purchase or sale of this security.

Please upvote and follow me on https://steemit.com/@php-ph