Gold / Silver update - flush out!

I've not been able to post for a couple of weeks as I've had a lot going on with business and personal life, but I thought I'd post an update on the gold / silver markets in the face of today's flush out.

On the face of it it looks fairly disastrous but let have a closer look at the damage.

Gold:

Let's be honest here, it's an ugly chart. If the price does not recover back to 1300 before global markets close it looks like gold is breaking down out of it's range. That's bad for the intermediate term. If it recovers to 1300 it has more or less maintained it's range.

Silver:

Silver intermediate term actually looks stronger than gold. Less damage has been done so far as the drop in price is still well within the range. The price could drop further before hitting support.

Dollar

I really don't know what's going on with the dollar. All the fundamentals suggest that the dollar should be toast, and for a while it was, but it's burst back out of it's down trend with a vengeance a strength. It feels almost too strong to me suggesting a false break out. Looking longer term it seems that we might be forming a major head and shoulders top in the dollar which would complete in the Autumn of 2018 initiating a resumption of the dollar bear market. It's a difficult call to be fair. But I don't trust this upward surge.

Dow

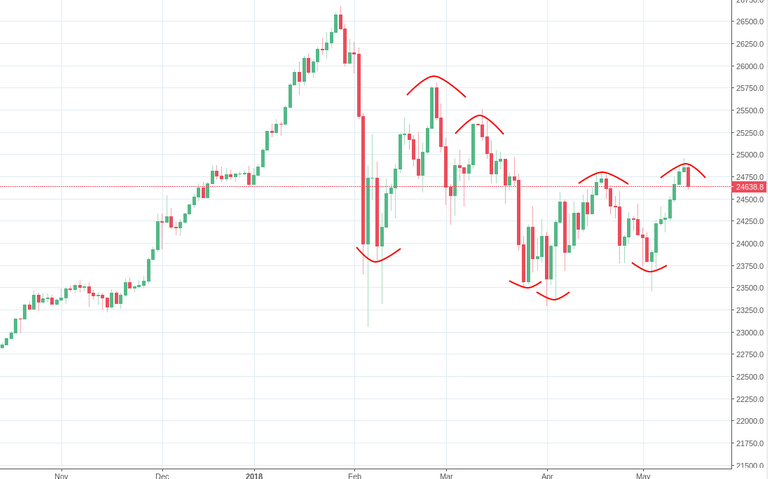

The Dow and other major markets seem to be resuming their fall today. The dow has a series of lower lows and lower highs with the exception of the last bounce. Generally it just appears to be dead cat bouncing around before resuming its fall.

Summary

There hasn't been a lot to say on the markets as the consolidation continues. It seems that major forces are pushing all markets up and then down until at some point something breaks and there will be a resolution. We are seeing false break outs (silver recently) followed by reversals making it difficult to predict when the consolidation will resolve.

It seems to me that everything is building for an Autumn shock. September / October are the ominous months that traders fear. It seems that this year we will again see an Autumn shock.

For disclosure, I'm not a professional financial advisor and this is not investment advice, merely my own observations of the market and indexes, so do your own research.

I think the high risk countries are starting to show some FIAT stress, the safe haven is the USD, the easiest and most liquid asset to sell to meet margin calls is the Precious Metals. I see the 10yr at 3.07%, another tell, but Platinum is the buy here for me at under $888.

Good point on platinum. $888 is a nice lucky figure too :)

At $400 under the Gold price, I believe the Gold/Platinum ratio has never been lower.

I'm a holder of Jubilee platinum (JLP) so here's hoping we have seen a bottom in platinum.

Sound analysis, as always.

Thanks for your comment.

Thank you for your continued support of SteemSilverGold