Earlier this month, the NASDAQ website reported on the new wave of Bitcoin ETF's there were in front of the SEC in America.

The most likely of these funds to succeed was the fund being offered by VanEck, called the VAnEck SolidX Bitcoin Trust (XBTC) The difference with this ETF compared to the previous wave that were rejected by the SEC earlier in the year, is that these funds are being based on held BTC rather than holding futures contracts that appear to be easily manipulated.

Also, this fund will be buying Bitcoin Over the Counter rather than through traditional exchanged that you and I can access. This should help to alleviate further manipulation of the whole Crypto environment.

The fund initially will not be open to retail investors. The opening unit price for the XBTC fund will be $200,000. This will help protect investors as it will limit the number of small investors and allow for large amounts if institutional capital to flood the Crypto market.

According to John Hyland, who is the head of Bitwise Asset Management, he beleives that the SEC granting approval for Crypto ETF's is likely to come "Sooner rather than later". He also states that he beleives that if the SEC doesn't approve Crypto ETF's within the next 2 months, then we wont see any positive news from the SEC until at least 2019. This he says is due to the midterm elections in the US. If the SEC were to change their decision in the middle of elections, it would look bad for them.

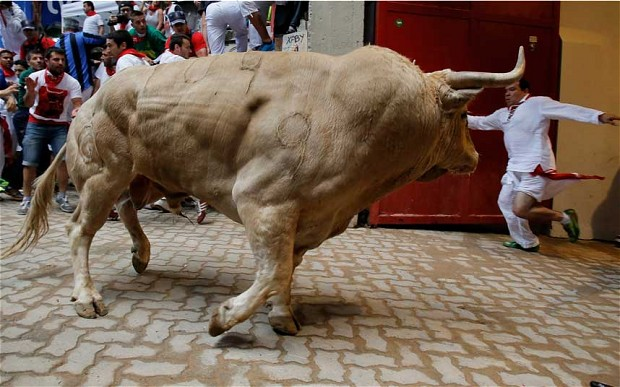

So fingers crossed, within the next few months, we could not only see a new bull run, it could be a full blown stampede by a herd of profit hungry mega bulls. Latest predictions for the price of Bitcoin if it were to get SEC approval, has been quoted as saying a very rapid rise to $35K upon instituional take over.

https://steemit.com/iq/@noorsamad/never-loses-trading-strategy-on-iq-option