source

Flash loans are a unique financial instrument that allow users to borrow assets without collateral for a short period of time, usually just a few seconds or minutes. These loans are often used in the cryptocurrency market to facilitate arbitrage opportunities or execute financial transactions that wouldn't be possible without the ability to borrow assets quickly. In a market with high traded volume, flash loans may be more effective for several reasons.

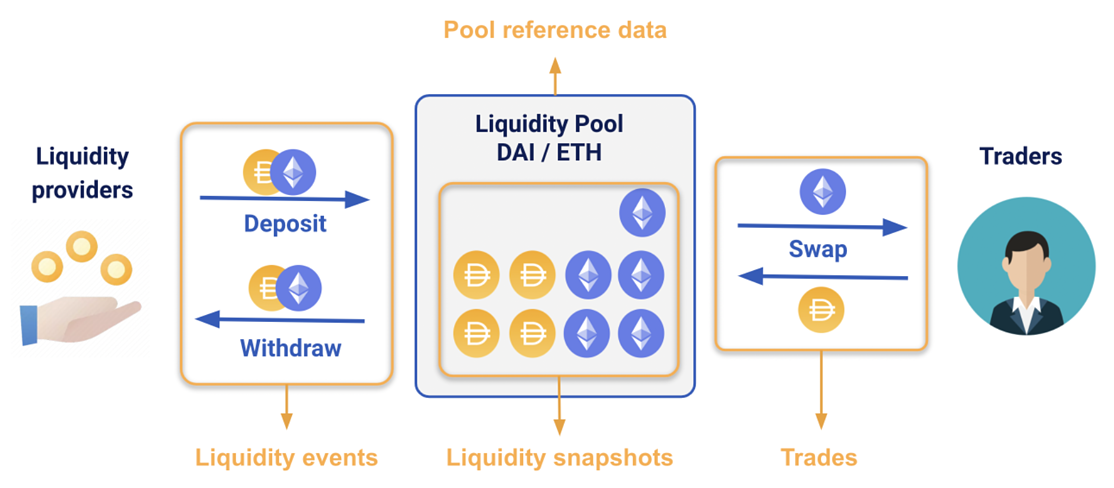

One reason is that high traded volume generally indicates increased liquidity in the market. This means that there is a larger pool of assets available to be borrowed, making it easier to find the assets needed to complete a trade or take advantage of an arbitrage opportunity. Additionally, the presence of more buyers and sellers in a market with high traded volume can lead to more efficient price discovery. This means that prices are more likely to reflect the true value of assets, making it easier to identify arbitrage opportunities and execute trades.

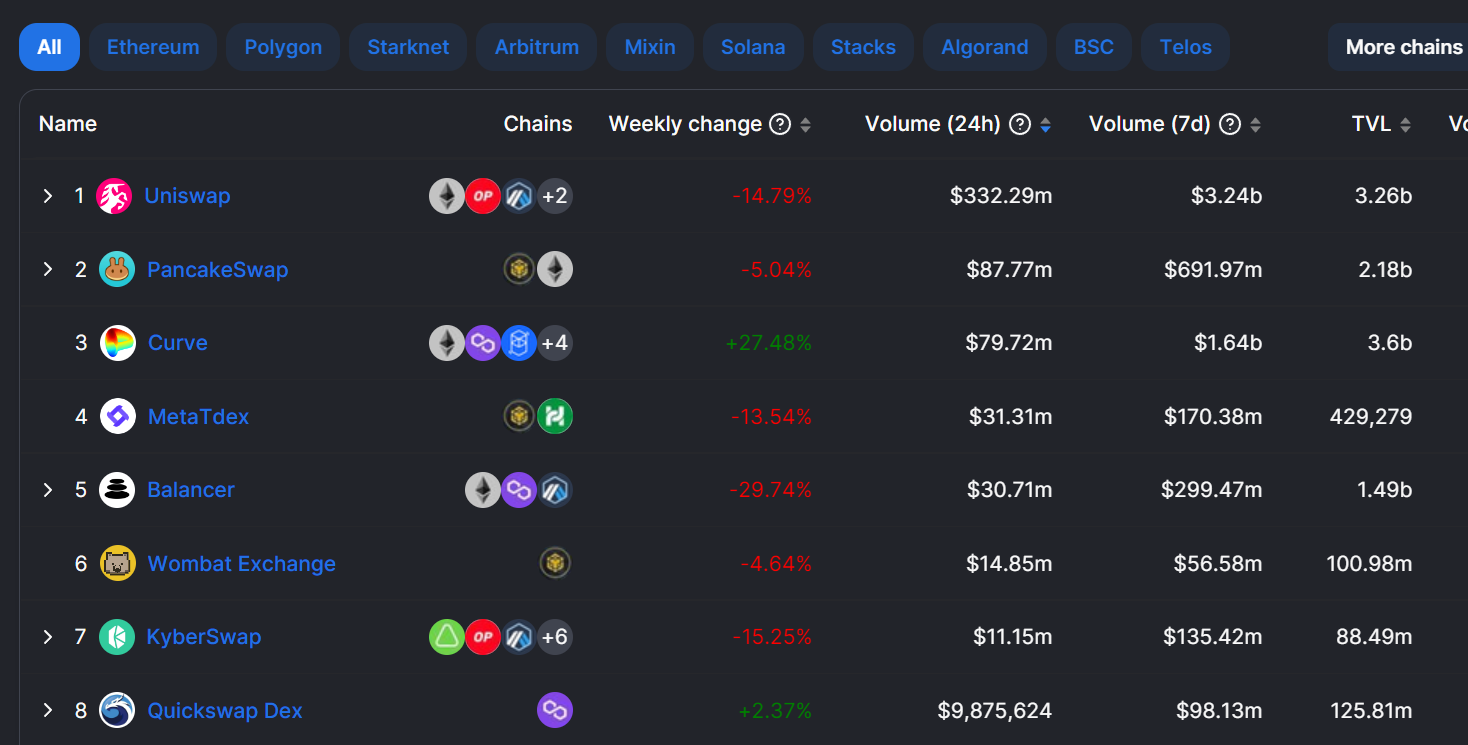

DEX traded volume by Defilama

Another factor that makes flash loans more appealing in a market with high traded volume is the stability and maturity of the market. Higher traded volumes can be a sign of a more mature and stable market, which can be attractive to traders and investors looking for safe and reliable opportunities to earn returns. In contrast, markets with lower traded volumes may be less stable and less attractive to traders due to the higher risk of price fluctuations and the difficulty in executing trades.

In conclusion, flash loans may be more effective in a market with high traded volume due to the increased liquidity, efficient price discovery, and overall market stability that such a market offers. These factors can make it easier for traders to take advantage of arbitrage opportunities and execute financial transactions using flash loans.