Flash loans have become a popular tool in the cryptocurrency market, allowing borrowers to temporarily access large amounts of cryptocurrency without collateral. These short-term loans can be used for a variety of purposes, such as executing arbitrage trades or financing other financial transactions. While flash loans can offer a number of advantages, they also come with significant risks and require a high level of trust between borrower and lender. In this article, we will examine some real-world examples of how flash loans have been used in the cryptocurrency market.

One of the most high-profile cases of flash loans in the cryptocurrency market occurred in July 2020, when an unknown individual or group used a flash loan to manipulate the price of the stablecoin USDT. The perpetrator took out a flash loan of over $20 million in USDT, which they then used to buy up large quantities of bitcoin on various exchanges. This sudden demand caused the price of bitcoin to skyrocket, leading to significant profits for the perpetrator when they sold their bitcoin and repaid the flash loan. However, this incident also caused significant damage to the reputation of the stablecoin, which is designed to maintain a consistent value.

Another example of flash loans in the cryptocurrency market involved the use of decentralized finance (DeFi) platforms. DeFi platforms are decentralized networks that allow users to access financial services such as lending and borrowing without the need for traditional financial institutions. Some DeFi platforms, such as Aave and Compound, offer flash loans as a way for users to access large amounts of cryptocurrency quickly.

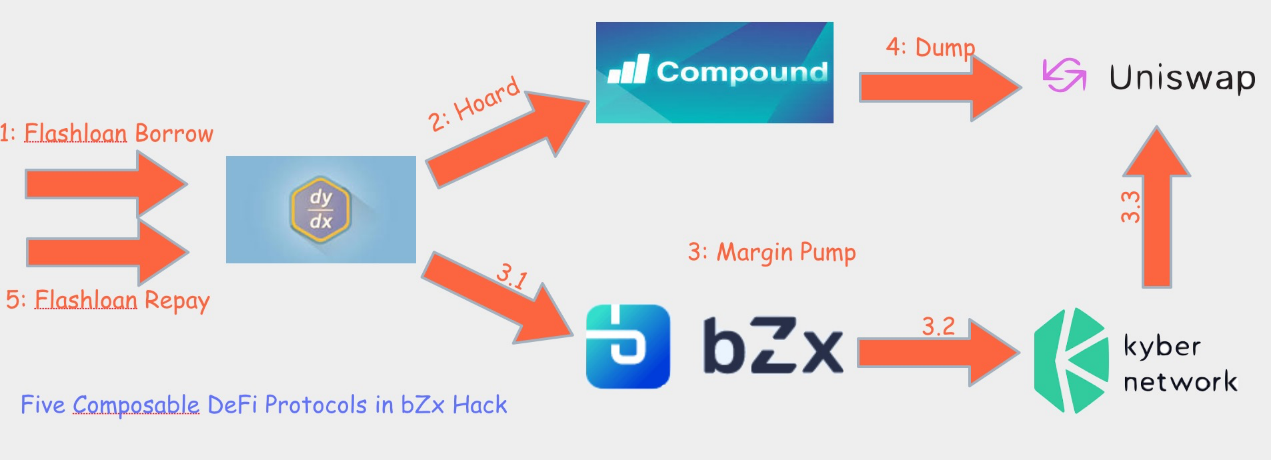

In December 2020, a hacker exploited a vulnerability in the DeFi platform bZx to take out multiple flash loans and profit from the resulting price fluctuations. This incident led to significant losses for bZx and raised concerns about the security of DeFi platforms.

While flash loans can offer a number of advantages in the cryptocurrency market, it is important for borrowers and lenders to carefully consider the risks involved. The lack of regulation in this area means that flash loans can be difficult to track and mitigate against potential fraud or misuse. It remains to be seen how flash loans will develop in the future, but it is clear that they will continue to play a significant role in the cryptocurrency market.