My crypto journey has been a wild west and roller coaster for the entire year 2022. Nevertheless, it is important to try to build on the network you trusted.

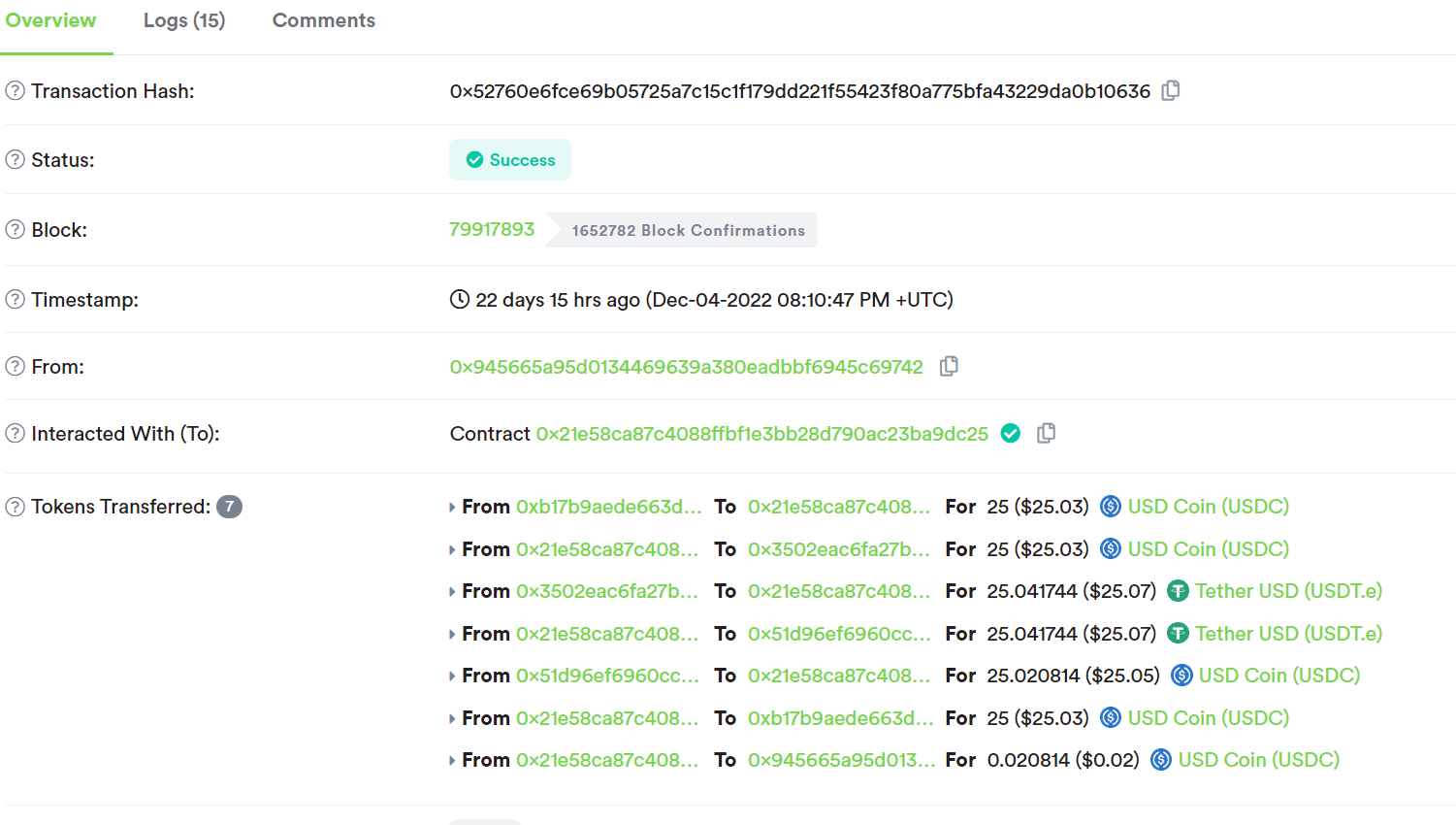

Thus, I had ventured into programming my first flashloan. The journey is wild, time and money consuming. Spent about 6 months to learn and try and error and troubleshoot most of the problem with online resource. Finally, I am able to take my first profit from flashloan execution.

The profit is about 2 Sen USDC. It is nothing much, due to the network I had selected is on Aurora Network. The reason for choosing this network is due to:

- 50 free transactions offer by Aurora Plus, which I can battle test my solidity code without wasting gas fee.

- It is a new network, the competition are fewer to compete on the same arbitrage opportunities.

After battle tested, I would like to highlight the key for deploying a successful flashloan.

- Migrate to a network with higher traded volume. This can be found in Defilama.

- Choose a low gas fee network that can mimic the successful flashloan such as on Polygon network or BSC.

- Layout the gameplan, moving up the ladder toward Ethereum network where the most of the Defi activities happens.

- Finally, continue to build until bull market return. which will increase onchain activities.

Above are the brief strategy, drop me a comment if you would like to know how I code it!

If you like this type of content, please drop a like, follow and share it out.

Our current proposal (#199) will expire end of December. May we ask you to review and support the our proposal renewal (#248) so our team can continue its work next year?

You can support it on Peakd, Ecency, or using HiveSigner.

Thank you!Dear @cklai,